Free Daily Analysis

Free Daily Analysis

Stock Trend Analysis Report

Prepared for you on Tuesday, January 20, 2026.

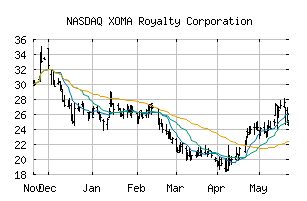

XOMA Corporation (NASDAQ:XOMA)

Strong Downtrend (-100) - XOMA is in a strong downtrend that is likely to continue. With short-term, intermediate, and long-term bearish momentum, XOMA continues to fall. Traders should use caution and set stops.

Is it time to buy, sell, or avoid XOMA?

MarketClub looks at technical strength and momentum to determine if the timing is right for XOMA.

Learn more about the Trade Triangles and how we make technical analysis as easy as buy and sell.

|

|||||||||||||||

|

|||||||||||||||

MarketClub’s Trade Triangles for XOMA

![]() The long-term trend has been DOWN since Dec 1st, 2025 at 31.1800

The long-term trend has been DOWN since Dec 1st, 2025 at 31.1800

![]() The intermediate-term trend has been DOWN since Jan 12th, 2026 at 25.0375

The intermediate-term trend has been DOWN since Jan 12th, 2026 at 25.0375

![]() The short-term trend has been DOWN since Jan 12th, 2026 at 26.2875

The short-term trend has been DOWN since Jan 12th, 2026 at 26.2875

Smart Scan Analysis for XOMA

Based on our trend formula, XOMA is rated as a -100 on a scale from -100 (Strong Downtrend) to +100 (Strong Uptrend).

| Open | High | Low | Price | Change |

|---|---|---|---|---|

| 28.4700 | 29.4600 | 26.3200 | 26.3885 | -2.4015 |

| Prev. Close | Volume | Bid | Ask | Time |

| 26.3700 | 1198329 | 2026-01-16 15:59:51 |

| Year High | 36.86 | Year High Date | 2018-01-02 |

| Year Low | 11.88 | Year Low Date | 2018-10-30 |

| 52wk High | 39.92 | 52wk High Date | 2025-10-03 |

| 52wk Low | 18.352 | 52wk Low Date | 2025-04-07 |

| Year End Close | 2.4 | Average Volume | 622,690 |

| Shares Outstanding | 12,383 | Short Interest | 8,049,026 |

| % Institutional | 68.3 | Market Cap | 168M |

| Assets | 223,456,000M | Liabilities | 131,002,000M |

| Beta | 2.81 | Volatility | 89.2 |