Free Daily Analysis

Free Daily Analysis

Stock Trend Analysis Report

Prepared for you on Friday, December 26, 2025.

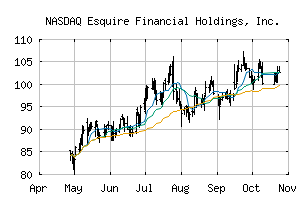

Esquire Financial Holdings, Inc. (NASDAQ:ESQ)

Bull Market Weakness (+75) - ESQ is showing signs of short-term weakness, but still remains in the confines of a long-term uptrend. Keep an eye on ESQ as it may be in the beginning stages of a reversal.

Is it time to buy, sell, or avoid ESQ?

MarketClub looks at technical strength and momentum to determine if the timing is right for ESQ.

Learn more about the Trade Triangles and how we make technical analysis as easy as buy and sell.

|

|||||||||||||||

|

|||||||||||||||

MarketClub’s Trade Triangles for ESQ

![]() The long-term trend has been UP since May 6th, 2025 at 88.07

The long-term trend has been UP since May 6th, 2025 at 88.07

![]() The intermediate-term trend has been UP since Nov 25th, 2025 at 100.35

The intermediate-term trend has been UP since Nov 25th, 2025 at 100.35

![]() The short-term trend has been DOWN since Dec 24th, 2025 at 105.78

The short-term trend has been DOWN since Dec 24th, 2025 at 105.78

Smart Scan Analysis for ESQ

Based on our trend formula, ESQ is rated as a +75 on a scale from -100 (Strong Downtrend) to +100 (Strong Uptrend).

| Open | High | Low | Price | Change |

|---|---|---|---|---|

| 105.600 | 107.880 | 105.630 | 105.740 | -0.355 |

| Prev. Close | Volume | Bid | Ask | Time |

| 106.095 | 7573 | 2025-12-26 13:28:31 |

| Year High | 29.45 | Year High Date | 2018-06-13 |

| Year Low | 17.34 | Year Low Date | 2018-01-29 |

| 52wk High | 110.7086 | 52wk High Date | 2025-12-22 |

| 52wk Low | 68.9 | 52wk Low Date | 2025-03-10 |

| Average Volume | 64,245 | Shares Outstanding | 8,565 |

| Market Cap | 178M | Assets | 218,431,100M |

| Liabilities | 190,508,400M | P/E Ratio | 18.6459 |

| Volatility | 26.46 |