Free Daily Analysis

Free Daily Analysis

Stock Trend Analysis Report

Prepared for you on Saturday, December 20, 2025.

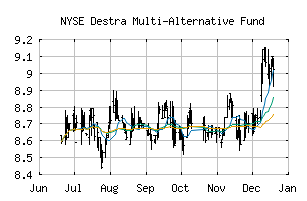

Destra Multi-Alternative Fund (NYSE:DMA)

Bull Market Weakness (+75) - DMA is showing signs of short-term weakness, but still remains in the confines of a long-term uptrend. Keep an eye on DMA as it may be in the beginning stages of a reversal.

Is it time to buy, sell, or avoid DMA?

MarketClub looks at technical strength and momentum to determine if the timing is right for DMA.

Learn more about the Trade Triangles and how we make technical analysis as easy as buy and sell.

|

|||||||||||||||

|

|||||||||||||||

MarketClub’s Trade Triangles for DMA

![]() The long-term trend has been UP since May 19th, 2025 at 8.91

The long-term trend has been UP since May 19th, 2025 at 8.91

![]() The intermediate-term trend has been UP since Dec 9th, 2025 at 8.79

The intermediate-term trend has been UP since Dec 9th, 2025 at 8.79

![]() The short-term trend has been DOWN since Dec 16th, 2025 at 8.97

The short-term trend has been DOWN since Dec 16th, 2025 at 8.97

Smart Scan Analysis for DMA

Based on our trend formula, DMA is rated as a +75 on a scale from -100 (Strong Downtrend) to +100 (Strong Uptrend).

| Open | High | Low | Price | Change |

|---|---|---|---|---|

| 8.9900 | 9.0900 | 8.9201 | 9.0200 | +0.0325 |

| Prev. Close | Volume | Bid | Ask | Time |

| 9.0300 | 24814 | 2025-12-19 15:58:01 |

| 52wk High | 9.15 | 52wk High Date | 2025-12-12 |

| 52wk Low | 7.17 | 52wk Low Date | 2025-04-08 |

| Average Volume | 31,822 |