Free Daily Analysis

Free Daily Analysis

Stock Trend Analysis Report

Prepared for you on Sunday, February 1, 2026.

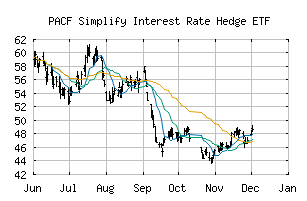

Simplify Interest Rate Hedge ETF (PACF:PFIX)

Sidelines Mode (-55) - PFIX is moving in a sideways pattern and is unable to gain momentum in either direction. Beware of choppy movement and consider a sidelines position until a stronger trend is identified.

Is it time to buy, sell, or avoid PFIX?

MarketClub looks at technical strength and momentum to determine if the timing is right for PFIX.

Learn more about the Trade Triangles and how we make technical analysis as easy as buy and sell.

|

|||||||||||||||

|

|||||||||||||||

MarketClub’s Trade Triangles for PFIX

![]() The long-term trend has been DOWN since Sep 8th, 2025 at 52.30

The long-term trend has been DOWN since Sep 8th, 2025 at 52.30

![]() The intermediate-term trend has been DOWN since Dec 23rd, 2025 at 47.93

The intermediate-term trend has been DOWN since Dec 23rd, 2025 at 47.93

![]() The short-term trend has been UP since Jan 29th, 2026 at 46.49

The short-term trend has been UP since Jan 29th, 2026 at 46.49

Smart Scan Analysis for PFIX

Based on our trend formula, PFIX is rated as a -55 on a scale from -100 (Strong Downtrend) to +100 (Strong Uptrend).

| Open | High | Low | Price | Change |

|---|---|---|---|---|

| 46.72 | 47.47 | 46.47 | 47.47 | +0.89 |

| Prev. Close | Volume | Bid | Ask | Time |

| 47.47 | 198625 | 2026-01-30 15:59:59 |

| 52wk High | 65.1521 | 52wk High Date | 2025-05-22 |

| 52wk Low | 43.65 | 52wk Low Date | 2025-10-28 |

| Average Volume | 558,370 |