Free Daily Analysis

Free Daily Analysis

Index Trend Analysis Report

Prepared for you on Tuesday, December 16, 2025.

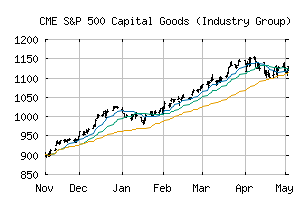

S&P 500 Capital Goods (Industry Group) (CME:SP500-2010)

Long-Term Uptrend (+90) - SP500-2010 is in a strong uptrend that is likely to continue. While SP500-2010 is showing intraday weakness, it remains in the confines of a bullish trend. Traders should use caution and utilize a stop order.

Is it time to buy, sell, or avoid SP500-2010?

MarketClub looks at technical strength and momentum to determine if the timing is right for SP500-2010.

Learn more about the Trade Triangles and how we make technical analysis as easy as buy and sell.

|

|||||||||||||||

|

|||||||||||||||

MarketClub’s Trade Triangles for SP500-2010

![]() The long-term trend has been UP since May 12th, 2025 at 1296.49

The long-term trend has been UP since May 12th, 2025 at 1296.49

![]() The intermediate-term trend has been UP since Dec 10th, 2025 at 1533.70

The intermediate-term trend has been UP since Dec 10th, 2025 at 1533.70

![]() The short-term trend has been UP since Dec 10th, 2025 at 1529.35

The short-term trend has been UP since Dec 10th, 2025 at 1529.35

Smart Scan Analysis for SP500-2010

Based on our trend formula, SP500-2010 is rated as a +90 on a scale from -100 (Strong Downtrend) to +100 (Strong Uptrend).

| Open | High | Low | Price | Change |

|---|---|---|---|---|

| 1556.28 | 1559.89 | 1548.37 | 1552.94 | +5.90 |

| Prev. Close | Volume | Bid | Ask | Time |

| 1552.94 | 109973790 | 2025-12-15 16:19:38 |

| 52wk High | 739.39 | 52wk High Date | 2018-01-29 |

| 52wk Low | 587.07 | 52wk Low Date | 2018-10-29 |