Free Daily Analysis

Free Daily Analysis

Index Trend Analysis Report

Prepared for you on Wednesday, February 5, 2025.

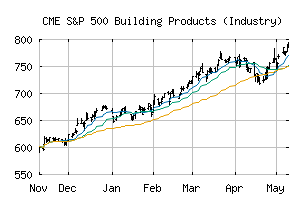

S&P 500 Building Products (Industry) (CME:SP500-201020)

Bear Market Rally (-75) - SP500-201020 is showing some rallying power, but still remains in the confines of a long-term downtrend. Keep an eye on SP500-201020 as it may be in the beginning of a reversal.

Is it time to buy, sell, or avoid SP500-201020?

MarketClub looks at technical strength and momentum to determine if the timing is right for SP500-201020.

Learn more about the Trade Triangles and how we make technical analysis as easy as buy and sell.

|

|||||||||||||||

|

|||||||||||||||

MarketClub’s Trade Triangles for SP500-201020

![]() The long-term trend has been DOWN since Jan 13th, 2025 at 830.21

The long-term trend has been DOWN since Jan 13th, 2025 at 830.21

![]() The intermediate-term trend has been DOWN since Feb 3rd, 2025 at 821.95

The intermediate-term trend has been DOWN since Feb 3rd, 2025 at 821.95

![]() The short-term trend has been UP since Feb 5th, 2025 at 847.97

The short-term trend has been UP since Feb 5th, 2025 at 847.97

Smart Scan Analysis for SP500-201020

Based on our trend formula, SP500-201020 is rated as a -75 on a scale from -100 (Strong Downtrend) to +100 (Strong Uptrend).

| Open | High | Low | Price | Change |

|---|---|---|---|---|

| 845.91 | 849.48 | 836.75 | 845.07 | +26.02 |

| Prev. Close | Volume | Bid | Ask | Time |

| 819.05 | 10396829 | 2025-02-05 12:47:08 |

| 52wk High | 390.27 | 52wk High Date | 2018-01-26 |

| 52wk Low | 272.55 | 52wk Low Date | 2018-10-29 |