Free Daily Analysis

Free Daily Analysis

Index Trend Analysis Report

Prepared for you on Sunday, December 14, 2025.

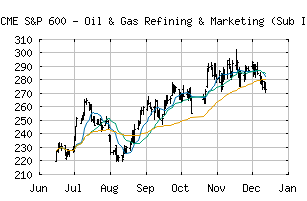

S&P 600 - Oil & Gas Refining & Marketing (Sub Ind) (CME:SP600-10102030)

Weak Downtrend (-65) - SP600-10102030 is showing signs of a strengthening downtrend. Monitor SP600-10102030 as it may be building momentum to the downside.

Is it time to buy, sell, or avoid SP600-10102030?

MarketClub looks at technical strength and momentum to determine if the timing is right for SP600-10102030.

Learn more about the Trade Triangles and how we make technical analysis as easy as buy and sell.

|

|||||||||||||||

|

|||||||||||||||

MarketClub’s Trade Triangles for SP600-10102030

![]() The long-term trend has been UP since May 13th, 2025 at 196.19

The long-term trend has been UP since May 13th, 2025 at 196.19

![]() The intermediate-term trend has been DOWN since Dec 10th, 2025 at 274.85

The intermediate-term trend has been DOWN since Dec 10th, 2025 at 274.85

![]() The short-term trend has been DOWN since Dec 8th, 2025 at 281.68

The short-term trend has been DOWN since Dec 8th, 2025 at 281.68

Smart Scan Analysis for SP600-10102030

Based on our trend formula, SP600-10102030 is rated as a -70 on a scale from -100 (Strong Downtrend) to +100 (Strong Uptrend).

| Open | High | Low | Price | Change |

|---|---|---|---|---|

| 276.75 | 278.00 | 270.59 | 272.65 | -2.73 |

| Prev. Close | Volume | Bid | Ask | Time |

| 272.65 | 3655983 | 2025-12-12 16:53:00 |

| 52wk High | 139.4 | 52wk High Date | 2018-10-18 |

| 52wk Low | 99.14 | 52wk Low Date | 2018-04-02 |