Free Daily Analysis

Free Daily Analysis

Index Trend Analysis Report

Prepared for you on Thursday, March 12, 2026.

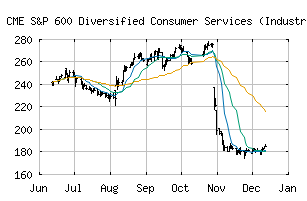

S&P 600 Diversified Consumer Services (Industry) (CME:SP600-253020)

Bear Market Rally (-75) - SP600-253020 is showing some rallying power, but still remains in the confines of a long-term downtrend. Keep an eye on SP600-253020 as it may be in the beginning of a reversal.

Is it time to buy, sell, or avoid SP600-253020?

MarketClub looks at technical strength and momentum to determine if the timing is right for SP600-253020.

Learn more about the Trade Triangles and how we make technical analysis as easy as buy and sell.

|

|||||||||||||||

|

|||||||||||||||

MarketClub’s Trade Triangles for SP600-253020

![]() The long-term trend has been DOWN since Oct 29th, 2025 at 221.22

The long-term trend has been DOWN since Oct 29th, 2025 at 221.22

![]() The intermediate-term trend has been UP since Feb 26th, 2026 at 212.92

The intermediate-term trend has been UP since Feb 26th, 2026 at 212.92

![]() The short-term trend has been DOWN since Mar 3rd, 2026 at 205.35

The short-term trend has been DOWN since Mar 3rd, 2026 at 205.35

Smart Scan Analysis for SP600-253020

Based on our trend formula, SP600-253020 is rated as a -75 on a scale from -100 (Strong Downtrend) to +100 (Strong Uptrend).

| Open | High | Low | Price | Change |

|---|---|---|---|---|

| 201.67 | 204.69 | 200.09 | 201.93 | -1.20 |

| Prev. Close | Volume | Bid | Ask | Time |

| 203.13 | 21897961 | 2026-03-12 16:19:56 |

| 52wk High | 177.66 | 52wk High Date | 2018-08-22 |

| 52wk Low | 115.32 | 52wk Low Date | 2018-02-06 |