Free Daily Analysis

Free Daily Analysis

Index Trend Analysis Report

Prepared for you on Friday, February 6, 2026.

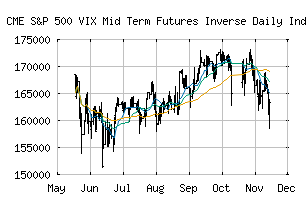

S&P 500 VIX Mid Term Futures Inverse Daily Index ER (CME:SPVXMPI)

Crossroads (-60) - SPVXMPI is struggling to move into a solid trend. Beware of choppy markets and consider a sidelines position until a stronger trend is identified.

Is it time to buy, sell, or avoid SPVXMPI?

MarketClub looks at technical strength and momentum to determine if the timing is right for SPVXMPI.

Learn more about the Trade Triangles and how we make technical analysis as easy as buy and sell.

|

|||||||||||||||

|

|||||||||||||||

MarketClub’s Trade Triangles for SPVXMPI

![]() The long-term trend has been UP since Dec 10th, 2025 at 173220

The long-term trend has been UP since Dec 10th, 2025 at 173220

![]() The intermediate-term trend has been DOWN since Jan 29th, 2026 at 175481

The intermediate-term trend has been DOWN since Jan 29th, 2026 at 175481

![]() The short-term trend has been DOWN since Feb 2nd, 2026 at 173538

The short-term trend has been DOWN since Feb 2nd, 2026 at 173538

Smart Scan Analysis for SPVXMPI

Based on our trend formula, SPVXMPI is rated as a -60 on a scale from -100 (Strong Downtrend) to +100 (Strong Uptrend).

| Open | High | Low | Price | Change |

|---|---|---|---|---|

| 172573 | 177351 | 172573 | 177018 | +4131 |

| Prev. Close | Volume | Bid | Ask | Time |

| 172887 | 0 | 2026-02-06 15:38:33 |