August 2021

My name is Wayne Burritt and I’m CEO of Burritt Research and a MarketClub analyst.

I research and write about investments, cryptocurrencies, and data science.

Earlier in my career, I worked for companies like Bank of America and Morgan Stanley doing a bunch of stuff with numbers and investments. But lately, I spend most of my time making arcane topics like stock analysis easy to understand. You can read more about me at burrittresearch.com.

I’ve written for INO.com and MarketClub since 2014. I couldn’t be happier to bring you my new report – 3 Hot Stocks to Buy Now.

I hope you find the reading interesting and useful!

Sponsor Message

The One Company on the Cusp a Potential 20,300% Market Surge

Tesla recently announced the “One Million Mile Battery.” But a former Tesla employee has already beat them to the punch. His energy innovation is so strong, it can send a Tesla cross country without charging — FOUR TIMES. Imagine a “superbattery” that, charges in eight minutes, lasts 9,200 miles between charges, and has a lifespan of 12 MILLION miles.

This tech already exists. And it’s rolling out to manufacturers at this moment.

Check Out MarketClub’s Trading Tools

I’ve used the trading tools at MarketClub to help me pick the stocks in this report.

You can try those same tools with a 30-day trial to MarketClub.

The two I used the most were the Trade Triangles and the Chart Analysis Score.

The Trade Triangles produce binary signals – either green or red – based on a variety of time frames using proprietary algorithms. They use weighted factors including price change, percentage change, moving averages, and new highs/lows. They’ll tell you when to get in and out of trades based on your trading style.

Chart Analysis Scores tell you about the strength of a trend. The scale runs from -100 for a very strong downtrend to +100 for a very strong uptrend. All told, they give you details on 20 different scores and how you can play them.

The thing I like about these tools is that they give me another way of looking at a trade. I don’t follow them blindly. And I wouldn’t recommend you do either. But once you get some practice using them – and they are pretty easy to use – you’ll find that they are really intuitive. Start your MarketClub trial now.

Now, if you need or like a bit more hand-holding, MarketClub will take you step-by-step through how to use their tools and make successful trades. I actually found the documentation and videos about their tools really helpful. And I’ve been doing this for a while!

Full Disclosure: MarketClub may pay me a small commission if you end up using these tools. But the fact is I would use them even if they didn’t. They’re that good.

So, let’s get started.

3 Hot Stock to Buy Now

Stock #1: Caterpillar (CAT)

No matter where you go if people are building something, they’re likely using Caterpillar (CAT) products. The brand’s profile stands heads and shoulders above competitors. And right now there are a ton of factors pointing to more upside for the stock.

Caterpillar is a global leader in making construction and mining equipment, diesel and natural gas engines, diesel-electric locomotives, and industrial gas turbines. And when it comes to far reach in the equipment business, you can’t do much better than CAT.

The company operates in just about every industry that touches heavy equipment, including construction, resources, energy, and transportation. So, if there’s money to be made in machinery, CAT is going to take a big cut.

Here’s what I really like. CAT generates 61% of its sales outside the U.S. That means the company is exposed to a broad variety of markets which smooths out global differences in supply and demand. And that makes it easier for a company to strategize and go to where the profits are.

During the most recent quarter, sales were up a solid 12% to $12 billion. Operating profits – a good metric of profits from day-to-day operations – were 15%, up from the year-ago quarter. Profits were also up.

But here’s something you have to read between the lines to get.

During the most recent quarter, dealers of CAT equipment made significant increases in their inventories. In a dealership business model, this is just what you want to see.

Why? Because it means that your dealers – your on-the-ground sales force – know the outlook is positive. And they’re willing to plunk down some cash and buy the product to prove it.

According to Caterpillar Chairman and CEO Jim Umpleby…

“I’m proud of our global team’s strong performance as they continue to serve our customers… We’re encouraged by improving conditions in our end markets and are proactively managing supply chain risks. Our dedicated team continues to execute our strategy for long-term profitable growth.”

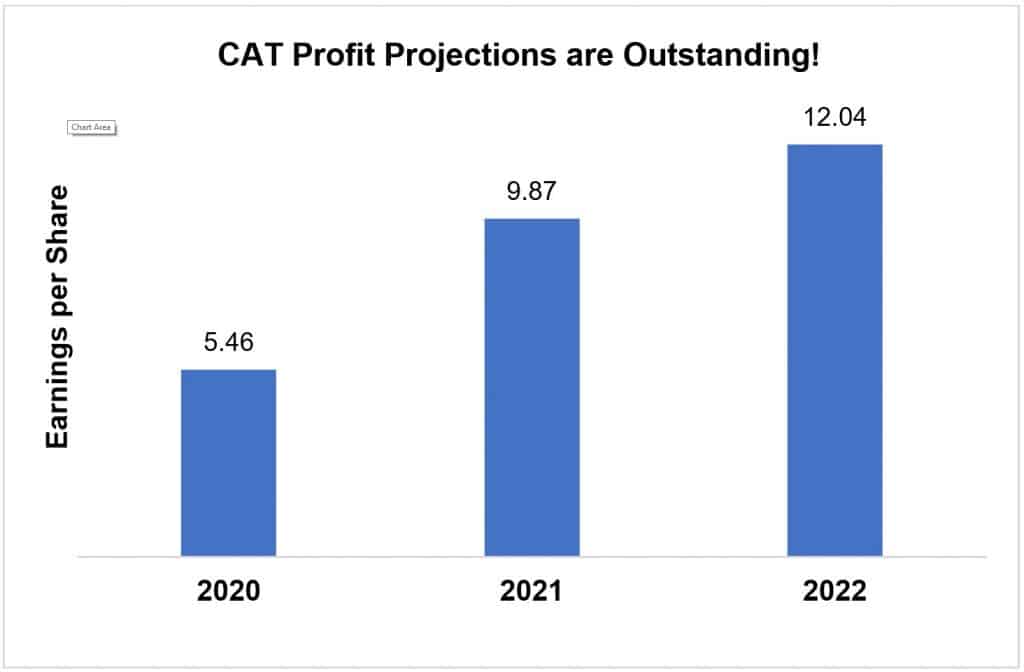

Earnings Outlook is Outstanding for CAT

These factors tell me that CAT is headed higher. The company’s dominance in the marketplace and capabilities to drive sales and profits during a pandemic are without parallel. But the fact is I almost fell out of my chair when I saw the latest long-term projections on CAT profits.

As you can see from this graph, estimates are calling for CAT to bring home an EPS (earnings per share) of $9.87 in 2021 and $12.04 in 2022. That translates to an increase of 81% and 22% respectively over this year’s numbers – no small feat in a recovering economy.

It gets even better. If you dig a bit deeper into those estimates, you’ll find that they’ve been going up over the last three months. That tells me that as good as these estimates are, they are likely headed even higher down the road.

Infrastructure and Construction Spending Bullish for Cat

Squabbles in Washington seem to be a common way of doing business. And as much as that is an anathema to most investors – myself included – it looks like an infrastructure bill of some kind will get done.

Now, it could be the $1 trillion that the administration is looking for in new infrastructure spending. Or it could be $300 billion from the Republicans. But no matter how you slice it, it’s going to happen.

That is a bullish sign for CAT because with their dominance, they’ll be the one to turn to when the spigots open from Washington. That’s where the company’s broad reach really pays off.

But a push from more infrastructure spending isn’t alone. The housing market is also headed up. In fact, the construction industry recently added 110,000 jobs during a single month. Unemployment is also decreasing, spending is headed up, and consumer sentiment is positive.

Here’s the kicker…

Housing giant Freddie Mac says that about 4 million new homes are needed just to meet existing demand. As the economy continues to recover, that number is likely headed even higher. That’s bullish for CAT shares.

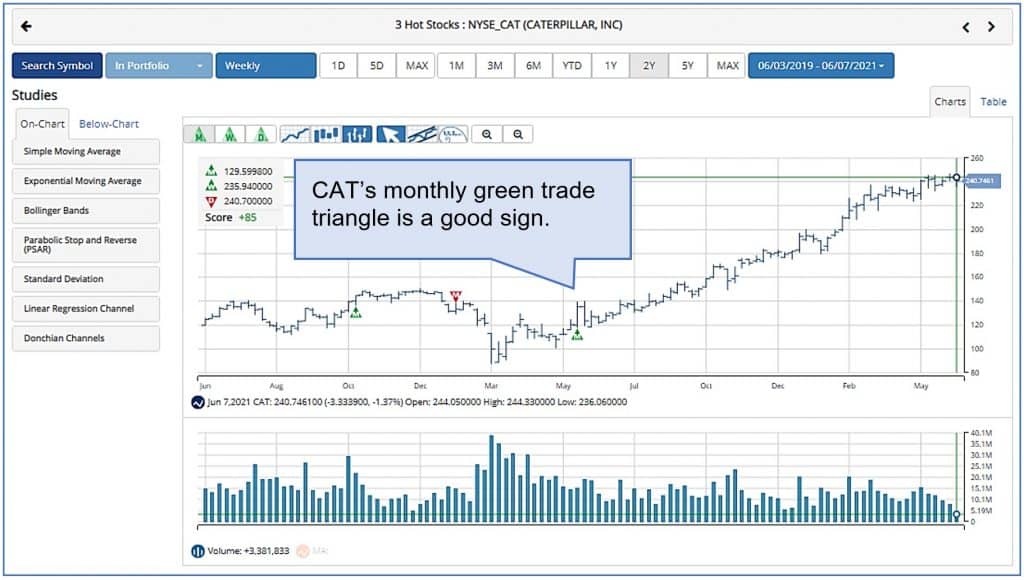

MarketClub Outlook is Bullish

CAT has a monthly green Trade Triangle that has been there since June 5, 2020, when the stock traded at $129.60. In addition, the Chart Analysis Score is at +85. That tells me the stock is in a strong uptrend with intermediate and long-term strength.

Taken together, both CAT’s Trade Triangles and Chart Analysis Score are bullish on the stock. See for yourself…

Stock #2: CVS Health (CVS)

It’s hard to drive around the U.S. and not eventually run into a CVS pharmacy. And that’s no surprise. CVS is a pharmacy giant.

It has over 10,000 locations and engages a mind-boggling one in three Americans every year. It also fills a staggering 2.9 billion prescriptions every year.

17,000,000 Doses and Counting

CVS has administered well over 17 million COVID vaccines through its retail and long-term care settings. The company is offering vaccinations at more than 9,600 CVS pharmacy locations across 50 states, Puerto Rico, and Washington, D.C.

In and of itself, that’s a great job for all of us. But with nearly 85% of the U.S. population within 10 miles of a CVS pharmacy, those numbers are likely headed much, much higher.

CVS isn’t sitting on its laurels.

The company has launched a sweepstake to encourage vaccinations. According to the most recent CDC household pulse survey COVID-19 vaccination tracker, 17.6% of adults 18 years plus are hesitant about getting the vaccine. According to Dr. Kyu Rhee, Senior Vice President and a Chief Medical Officer of CVS Health…

“We’re grateful for the millions of people who’ve received one of the well over 17 million doses we’ve administered at CVS Health, but we have a long way to go … Getting as much of the population fully vaccinated will bring us one step closer to all the things we’ve missed during the past 14 months, and keep our country moving in the right direction.”

The sweepstakes will include prizes, trips, products, gift cards, festivals, and hotel getaways.

But it’s also good for business. With more and more people coming into CVS, footfall (a useful measurement of traffic in retail stores) is likely to head higher. And that means more sales of just about everything in a CVS.

Earnings Outlook is Strong

Despite the pandemic, in 2020 CVS grew its topline sales by 5% to $269 billion. That translated to earnings per share (EPS) of $5.47.

No doubt about it, that’s a heck of a result. But from what I’m digging up, it gets even better.

Current estimates are calling for CVS to book EPS of $7.65 this year. And next year that bottom-line number increases to $8.23 a share. Compared to a recent price of $85.76, that makes CVS a bargain compared to the broader market.

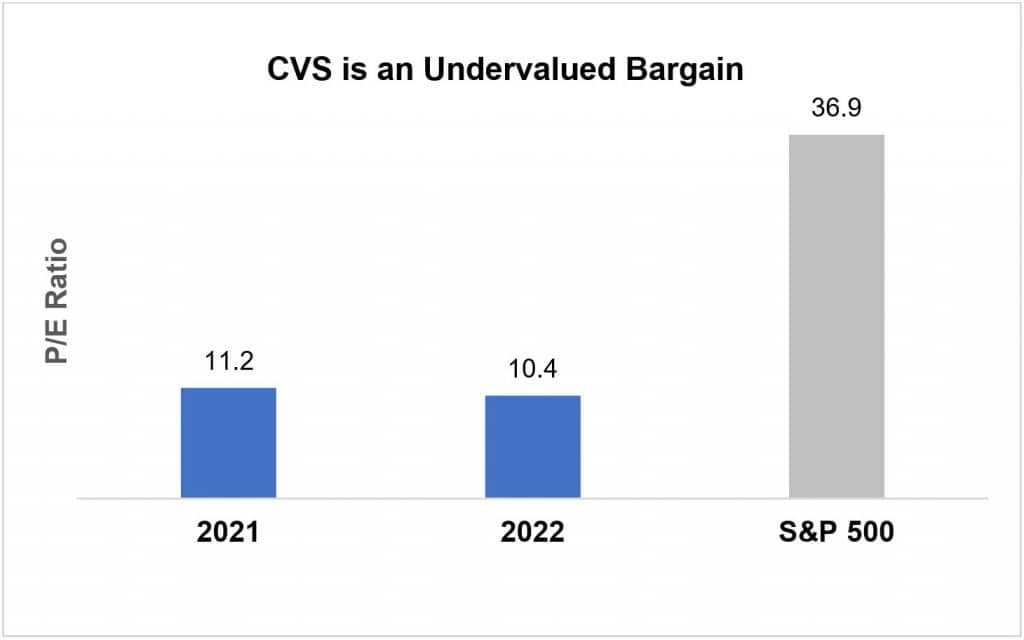

Here’s what I mean…

With P/Es of 11.2 this year and 10.4 next, CVS is an undervalued bargain compared to the broader market.

Investors – especially value investors who tend to focus on P/E ratios – will take a long hard look at the stock. And that means more upside for the shares.

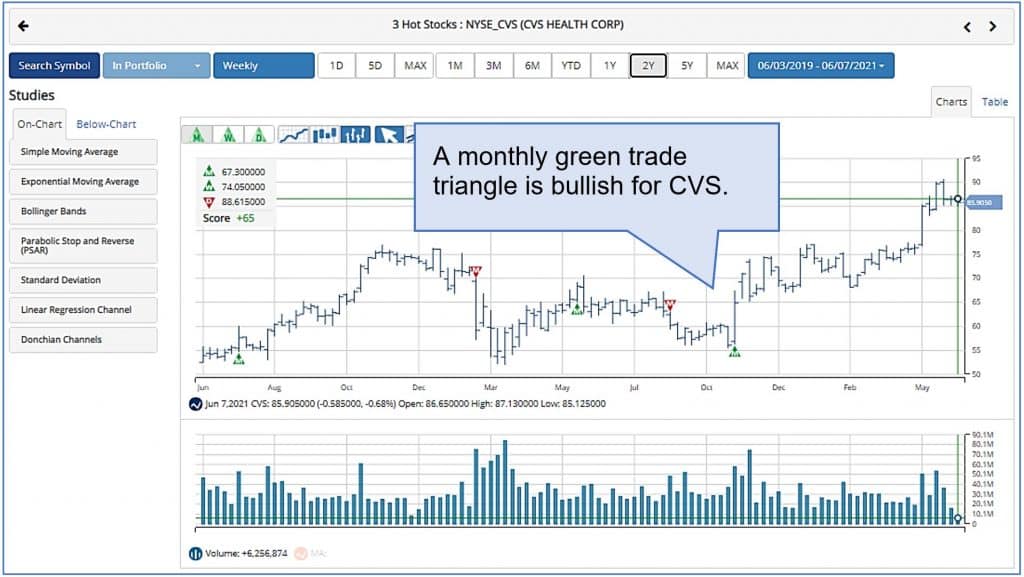

MarketClub Outlook is Mixed

CVS triggered a monthly green Trade Triangle on November 6, 2020, at $67.30. The long-term trend is still bullish for the stock. However, the Chart Analysis Score comes in at +65. This indicates that there might be some sideways chop for a while. A quick glance at the chart confirms this.

But when you add the two together, CVS has good signals and gets the green light from me.

Stock #3: Walt Disney World (DIS)

First off, the bad news.

Walt Disney World’s operations were clobbered last year due to COVID. And all you have to do is take a look at their annual report to see that – theme parks closed or operated at reduced capacity, cruise ship sailings canceled, suspension of film or TV content. You get the picture.

All told, the company’s top and bottom lines were hammered.

So, why in the world would I recommend a company like this?

Well, that answer is easy. It would be impossible to find any other media and entertainment company like Disney that didn’t get clobbered last year. And so as business gets back to normal and COVID slips into the rearview mirror, Disney is positioned to deliver like never before.

Now, the Good News

When it comes to one of the most recognizable brands on the planet, you don’t have to look much further than Walt Disney World (DIS). Its portfolio of media assets, theme parks, and outstanding management track record make it one of the most popular destinations on the planet. And that’s true whether you’re sitting at home or traveling about.

So, while we just listed all the things that went wrong last year to Disney, take a look at the arsenal it has today:

- Networks like ABC, Disney, ESPN, FX, National Geographic.

- Vacation destinations like Walt Disney World, Disneyland; Disneyland Paris; Hong Kong Disneyland, Disney Cruise Line, Disney Vacation Club, and National Geographic Expeditions.

- Motion picture producers like Walt Disney Pictures, Twentieth Century Studios, Marvel, Lucasfilm, Pixar, and Searchlight Pictures.

- Direct-to-Consumer streaming services like Disney+, Hotstar, ESPN+, and Hulu.

Are these assets important? You bet. They mean power to drive sales and profits as business gets back to normal. And we’re already seeing that take place. Take a look at what’s happening right now to DIS:

- Most of the company’s theme parks are open and running.

- Movie theatres will continue to reopen, which boosts the prospects for movie-goers.

- “Black Widow” and the “Jungle Cruise” are slated for hybrid release in July on Disney+ Premier Access and theaters.

- By 2024, the company expects to have between 230 million and 260 million Disney + subscribers. And around the globe, projections are called for subs in the 300 million to 350 million range.

Here’s what I also like… in spite of the bad news last year, the company’s sales for the most recent quarter were only off a modest 13%. In the world of COVID and for an entertainment company, this is something of a miracle. And even better, many of the net income metrics that I like to follow – such as net income from continuing operations – showed nice pops compared to the year-ago period.

DIS Outperforms SPX

When compared to the S&P 500 – a good proxy for the broader stock market – Disney is doing a nice job outperforming the average stock. Take a look…

As you can see from this chart, over the past year the stock market is up 38% while Disney stock is up about 50%. That’s not a bad performance, especially considering the factors we discussed before.

From a longer-term technical perspective, the shares will likely find support in the $160 to $170 area. They made a nice bounce from that level at the beginning of the year. From there, they took off for an all-time high of $203. With the fundamental factors looking better and better by the day, I’m looking for the shares to take a new run at that level and this time take it out. From there, it’s pretty much off to the races.

So, where will the shares likely top out? No one knows for sure. But if they can outpace the broader market in a COVID-recovery year, $203 could likely be the gateway to $250 and even more.

MarketClub Outlook is Cautious

DIS’s Trade Triangles issued a red monthly signal in May of 2021, at 168.03. Prior to that, the stock had a green monthly signal for over a year, beginning at $123.78.

While the red monthly signal gives me a pause, for this stock fundamental and macro factors should get more weight. So, DIS still gets a green light from me.

But, if you’re super-cautious, sit on the sidelines until another monthly green signal shows up. I would look for that to happen once DIS gets above $203.

Summing Up

I hope you enjoyed reading about the picks I think could outpace the broader market in the weeks and months ahead, but don’t wait. Make sure to act on these ideas as soon as you can.

Always remember, investing is risky. And with stocks like these – stocks with lots of upside potential – it can be even riskier. So, don’t budget more than 1% to 2% of your portfolio for any of these picks.

And don’t forget to check out the MarketClub tools I’ve used to pick these stocks. I found them to be a great way to generate ideas based on sound analysis.

Take care!

Wayne Burritt

Burritt Research, Inc.

MarketClub Analyst

Disclosure: Wayne Burritt may own positions in securities mentioned in this report.