Without a doubt, one industry that’s been benefiting from COVID-19 is pharmaceuticals. The demand for medical research and drug treatments aimed at the coronavirus has helped fuel a biopharmaceutical boom.

In the case of one biopharmaceutical company, the completion of a major acquisition and rising consumer demand could mean big profits for investors.

A Best-In-Class Pharmaceutical Company With an Undervalued Stock Price

AbbVie (ABBV) is a $172 billion biopharmaceutical and drug manufacturing conglomerate. While best known for its Humira drug, AbbVie also provides several other products ranging from age-related disease to HIV/AIDS treatments. The company’s products are available in more than 170 countries around the globe.

The company reported a first-quarter earnings beat of $2.42 per share compared to the analysts’ estimates of $2.25 per share. Revenues jumped 10.1% year-over-year to $8.619 billion. Management reiterated guidance of adjusted EPS between $9.61 and $9.71.

|

This list ranks the top optionable stocks based on trend, volume, price and our proprietary algorithm. |

The merger with Allergan gave AbbVie more drug portfolio diversification and provided access to the cosmetic treatments and neurology market segment. Allergan’s brands such as Botox, Juvederm, and CoolSculpting, along with the promising antipsychotic drug Vraylar, are now under AbbVie’s umbrella and should pay off dividends for years to come.

In June, Argus, Wolfe Research, and Atlantic Equities all raised guidance on the stock from a “neutral” or “market-weight” recommendation to “buy” or “over-weight. Argus and Atlantic Equities both provided a $115 price target as well.

The Fundamental Story

The stock appears to trade cheaply at just 10 times earnings compared to the pharmaceutical industry average of 34 times earnings.

The long-term estimated EPS growth rate of 10.50% gives the stock a PEG ratio of just under 1 – a secure sign that the stock is currently undervalued. The stock also comes with a hefty 4.85% dividend yield, giving investors protection against sharp downside movements and providing an income stream to help boost overall portfolio returns.

The Technical Story

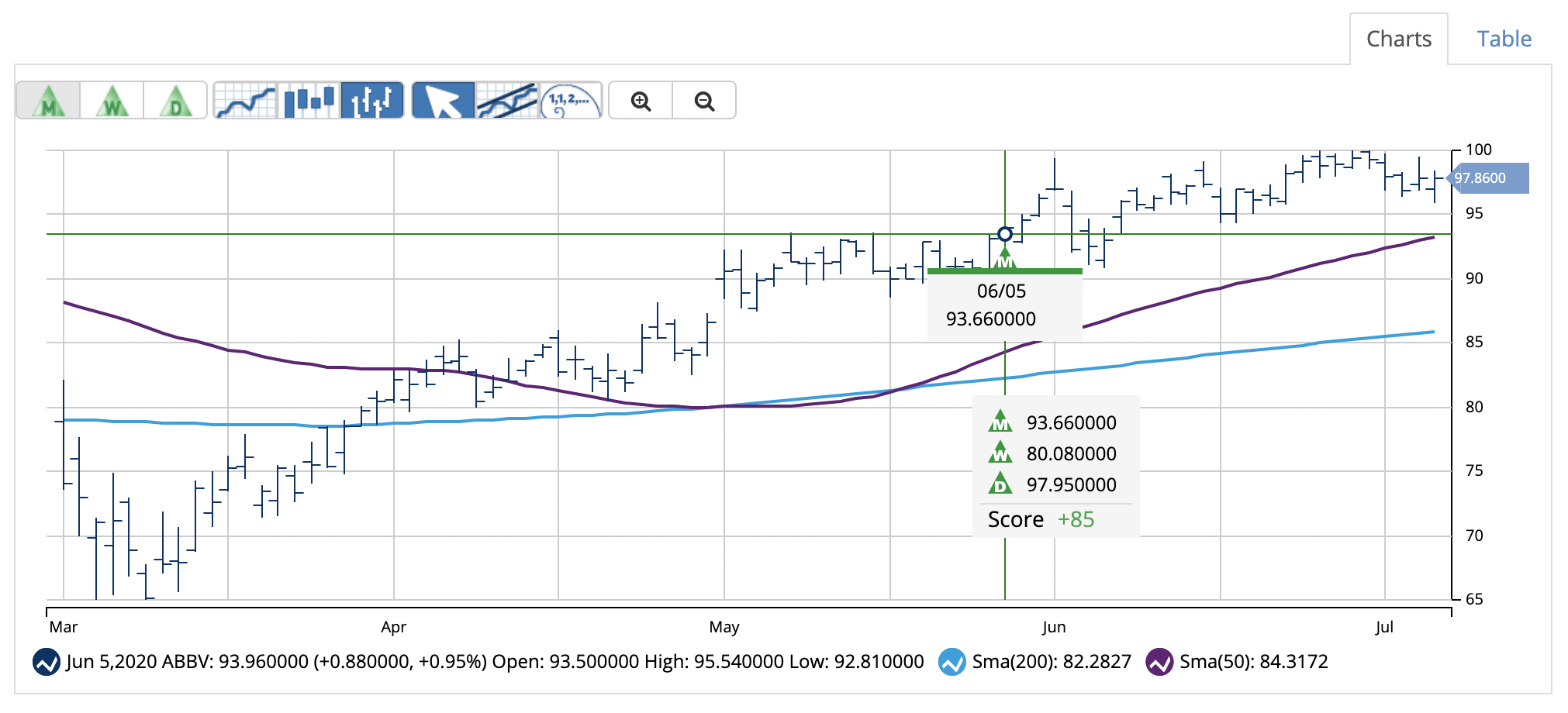

The chart for AbbVie has several bullish indicators beginning with a clear upward trend accompanied by steady trading volumes. The 20-day SMA trend line is well above both the 50-day and 200-day SMA and appears to be steadily climbing along with the stock price.

The one potentially negative takeaway is the high RSI reading of 60. While it isn’t signaling an overbought status yet, the stock could experience some pullback from profit-taking activity.

The Bottom Line

Based on AbbVie’s full-year EPS estimates, this stock should be fairly valued at around $115 per share. This value would be a gain of nearly 20% from its current trading price.

The stock is a great addition for a value investor or income investor, giving them a discounted stock with a steady income stream to balance out their portfolio.

The above analysis of ABBV was provided to MarketClub by Daniel Cross, a professional trader and financial writer.

MarketClub’s Analysis of ABBV

MarketClub is tracking strengthening momentum for this biopharma bigwig.

With a +85 Chart Analysis Score, MarketClub is detecting a countertrend pattern for ABBV. Short-term momentum has stalled, but longer-term trends should push the stock higher.

Short-Term Strategy

Members can continue to hold a long position while utilizing stops to capture any gains made from the last Trade Triangle signal.

Intermediate-Term Strategy

Members can continue to hold a long position while the daily and weekly Trade Triangles are in agreement.

Long-Term Strategy

Members can continue to hold a long position that was established on June 5, 2020, with a new Trade Triangle.

MarketClub members can consider a number of strategies depending on their unique trading profile.

Want to add ABBV to a watch list and know when the short-term momentum picks up?

Join MarketClub and we’ll start watching this stock (and over 350K markets) for you!