It may be counter-intuitive to declare a stock near its 52-week low as an opportunity, but some of the best value stocks are found this way. But having a low stock price alone isn’t enough of a reason to buy – it needs to have the right combination of technical and fundamental signals to tell investors it may be a bargain.

One mining company appears to have hit bottom multiple times now and could be a steal for value investors willing to be patient.

A Deep Value Play and Best-In-Breed Quality Company

Freeport-McMoRan (FCX) is a $2.5 billion copper mining conglomerate with numerous mining operations in Africa, Europe, North America, South America, and Indonesia. It’s the largest producer of molybdenum in the world and the second largest for copper. In addition to these, the company also has segments for gold and petroleum.

The company reported an earnings miss in January of $0.11 per share – short of the $0.18 per share analysts had expected. One of the biggest headwinds for the company is the value of the US dollar. A strong dollar means poor commodity prices and lower margins for Freeport. But the dollar has been showing some signs of weakening lately with the Fed changing to a more dovish stance. That could spell higher profits for Freeport down the road.

As costs across all sectors rise, squeezing corporate margins and bringing down net earnings, Freeport could still see volatility in its stock price. Investors should be prepared to hold the stock for a long term investment instead of a quick flip for a profit.

Digging Deeper for Fundamental Riches

The stock trades at just 8 times earnings, less than the industry average of 12 times earnings and far under the S&P 500’s average P/E of 26. The stock carries a small dividend as well, currently yielding 1.7% and helping protect the stock from large downside movements.

Like most mining stocks, Freeport can’t be valued based purely on earnings numbers. The price of copper and molybdenum play a large part in how its stock price is determined along with the amount of mineral reserves available. The best way for investors to analyze Freeport right now is by looking at the technical side.

The Technical Aspect

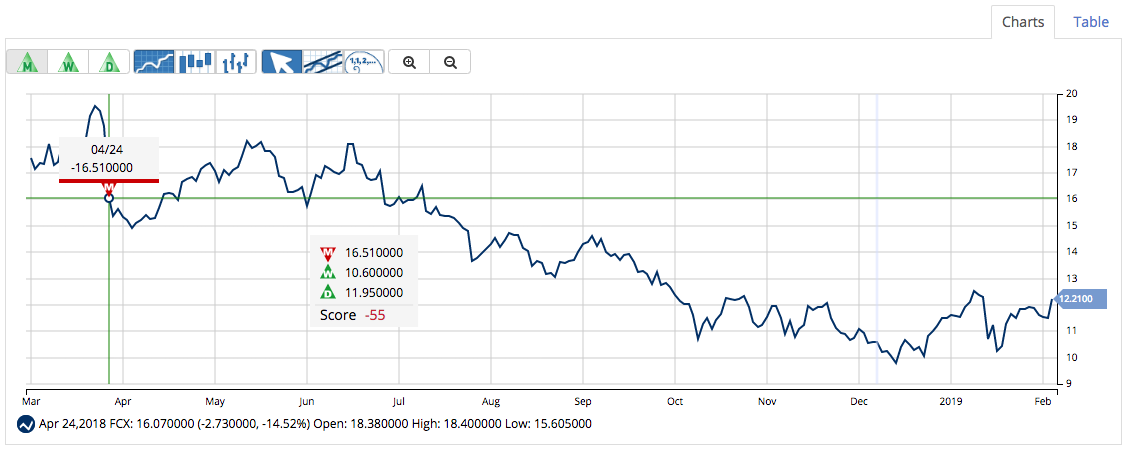

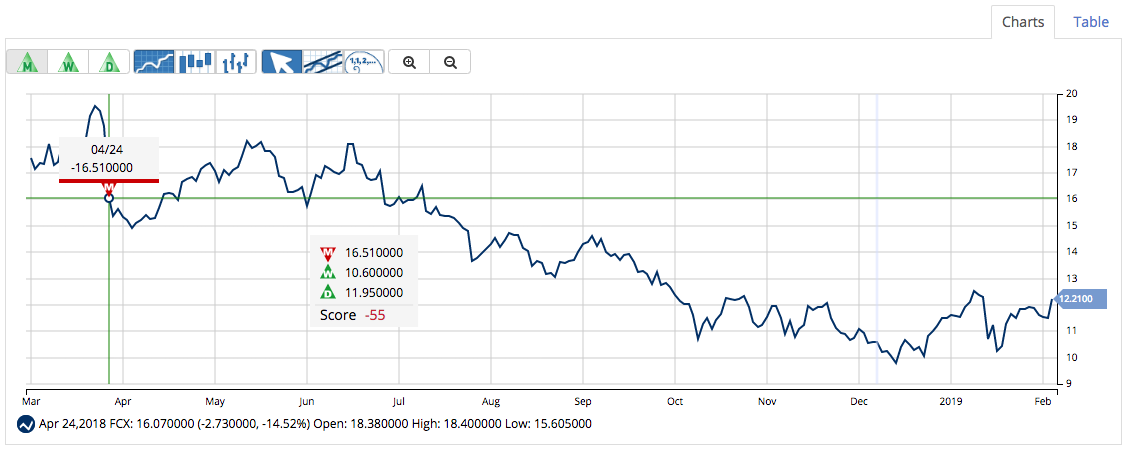

A quick look at Freeport’s chart shows a stock far off its highs. Investigating a little further reveals another pattern – a double bottom. The stock touched a low in late December under $10 per share before climbing for a month and then crashing back to nearly the same level. The stock appears to have established a lower limit on its stock price giving investors some reassurance that it shouldn’t drop below $10 for any extended period of time.

The stock price has moved ahead of the 20-day and 90-day SMA signaling to investors a possible new bullish momentum. Only time will tell if the stock remains in the trading band it’s been in bottoming out at $10 per share or if it finally breaks higher.

The Bottom Line

Based on Freeport’s past performance and general economic direction, this stock should be fairly valued at around $17 per share – a gain of more than 46% from its current price point. For value-minded investors with patience and a long term time horizon, Freeport-McMoRan should produce high enough returns to make up for the wait.

What Does MarketClub Say?

MarketClub’s technology suggests that FCX has moved into a trading range with a score of only +55.

Long-term members would be holding a short position after following a red monthly Trade Triangle on April 24, 2018 at $16.51. As of the close on February 12, 2019, members would be seeing an unrealized gain of +30%.

Members, you can add FCX to your watchlist and set your alert so you’ll know the second our technology detects any upward strength for this stock.

Not a member? Get exclusive analysis and signals for Freeport-McMoRan (FCX) or over 320K symbols when you try MarketClub for 30 days.