The markets have been experiencing high volatility as we approach the end of the year. Stock charts over the past few months have looked more like a roller coaster ride than a stable investment option. But in the midst of the chaos, there are always certain stocks and sectors that remain relatively immune.

Non-cyclical sectors perform about the same regardless of whether the economy is doing well or not. Consumers’ need for healthcare services, medicines, household goods, electricity, and other items doesn’t disappear just because the economy is in a contraction.

For one utility company, a bear market is precisely where it shines brightest for investors seeking shelter.

This Week’s Stock Pick is Duke Energy Corporation (NYSE_DUK)

Duke Energy Corporation (DUK) is a $65 billion electric utility giant based out of North Carolina. It provides utility services across multiple U.S. states including parts of Latin America totaling more than 104,000 square miles.

The company reported a third-quarter earnings beat of $1.65 per share compared to the $1.52 analysts had expected. It beat slightly on revenues as well reporting $6.63 billion compared to $6.6 billion. Looking forward, the company could beat earnings again for the fourth quarter.

As an electric utility company, this stock is a classic defensive play for investors seeking a dividend and shelter from market volatility. But there’s also a rare opportunity for growth in a utility stock with management’s $37 billion growth capital plan scheduled to take place between 2018 and 2022 that is expected to generate an additional 4% to 6% in annual earnings.

The stock was upgraded several times this summer by JP Morgan, Citigroup, and BofA/Merrill while coverage was initiated by Scotia Howard Weil. Ratings ranged from a bullish to neutral outlook for the company which could mean that investors still have a chance to take part in the stock’s growth story.

Generating Solid Numbers

The stock trades cheaply at just 19 times earnings compared to the industry average of 29 times earnings. But the most interesting feature is the stock’s beta ratio of -0.06. That means that, for the most part, the stock trades independently of the broader averages with a very slight inverse correlation. In a bear market, this disconnection can make the stock a valuable addition to a portfolio.

As with any utility stock, the dividend is one of its most attractive features. Currently yielding a competitive 3.70% with a payout ratio of 87% and a steady payment history spanning nearly a century, investors can be confident in a reliable dividend stream going forward. In a bear market, the yield should help mitigate downside stock movements as well.

Based on Duke Energy’s full-year EPS estimates, this stock should be fairly valued at around $95 per share – a gain of about 11.5% with the dividend reinvested as well. While it’s not a large growth play, this stock should hold consistent regardless of whether it’s a bull market or bear market. Investors looking for a way to preserve wealth without bailing out of a volatile market should consider adding Duke Energy to their portfolio.

The above analysis provided by Daniel Cross, professional trader and financial writer.

What Does MarketClub Say?

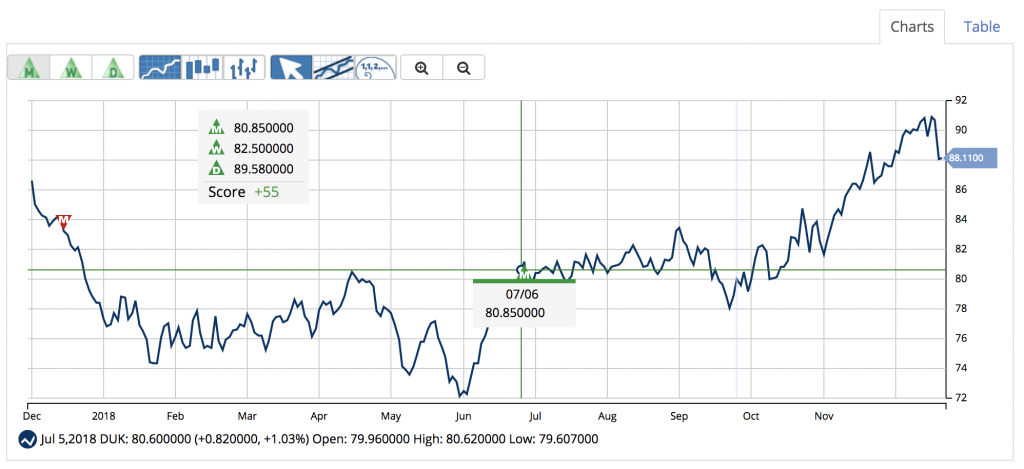

MarketClub’s technology is detecting that a counter-trend rally is underway. It also indicates that the current downtrend could be changing and that DUK may be moving into a trading range, putting members into a sidelines mode.

While a Weekly Trade Triangle has confirmed the long-term upward trend originally detected in July 2018, the Chart Analysis Score would suggest that the strength of this trend is weakening and that this stock is moving in a sideways direction.

Members will be the first to know when this trend strengthens when they set their MarketClub Trade Alert. Join MarketClub now with a 30-day trial to get the next signal for DUK!