The Trade Triangle technology just issued new buy signals for 3 high volume, well-known stocks.

Our technology has alerted members of these major trend shifts which propel these stocks into levels of great trend strength.

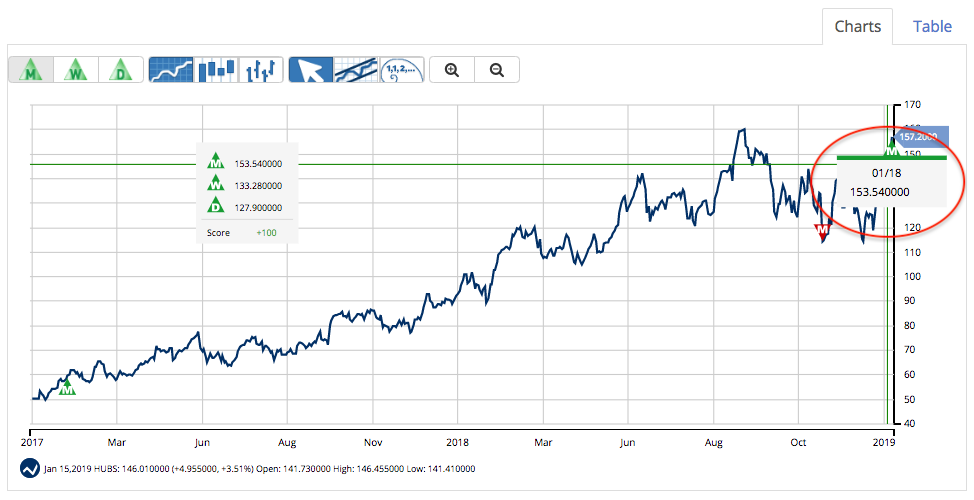

Buy Signal for HubSpot, Inc. (NYSE_HUBS)

HubSpot is a developer and marketer of software products for inbound marketing and sales headquartered in Cambridge, Massachusetts.

Symbol: HUBS

Avg. Volume: 509,550

Market Cap: 6.112B

2Y MarketClub Return*: $25.34/share (65.4%)

A new monthly Trade Triangle was issued for HUBS on 1/18/19 at $153.54 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. This Chart Analysis Score of +100 confirms that the uptrend is strong.

Buy Signal for DexCom, Inc. (NASDAQ_DXCM)

Dexcom develops, manufactures and distributes continuous glucose monitoring systems for diabetes management.

Symbol: DXCM

Avg. Volume: 1,566,870

Market Cap: 13.4B

2Y MarketClub Return*: $63.45/share (87.3%)

A new monthly Trade Triangle was issued for DXCM on 1/18/19 at $152.14 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. While the intra-day term is flopping around, the Smart Scan Scores sits at a +90 suggesting that this stock is in a firm uptrend.

Buy Signal for Vipshop Holdings (NYSE_VIPS)

Vipshop Holdings Limited operates as an online discount retailer for various brands in the People’s Republic of China.

Symbol: VIPS

Avg. Volume: 6,585,212

Market Cap: 4.57B

2Y MarketClub Return*: $12.43/share (90.07%)

A new monthly Trade Triangle was issued for VIPS on 1/17/19 at $16.31 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. This stock is rated as a +100 with all trends strongly moving in the same upward direction.

Join MarketClub to get up-to-date lists with new buy signals for stocks, ETFs, futures, Forex, and ETFs!

*Results calculated using the long-term method with both long and short positions.