The technology sector is one of the most volatile economic sectors in the market. Competition is fierce, and companies that don’t grow fast enough find themselves either acquired by another larger entity or out of business altogether.

As technological innovation requires more and more automation, this company is primed to give investors long-term stability and growth in an otherwise volatile sector.

A Best-In-Breed Global Robotics and Semiconductor Conglomerate

NVIDIA (NVDA) is a $118 billion niche semiconductor company. Their impressive product portfolio includes graphics processing units (GPUs), mobile and automotive computing chips, and robotics and artificial intelligence.

The company reported earnings of $1.24 per share for the 2nd quarter of FY 2020, beating the analysts’ estimate of $1.15 per share. Revenue similarly beat estimates coming in at $2.58 billion versus $2.54 billion.

NVIDIA is a global innovator in the growing field of machine learning, artificial intelligence, and IoT. The primary catalyst for NVIDIA’s growth story is the rising demand for artificial intelligence applications and more sophisticated machine learning products for all market segments.

Another catalyst for the stock is the boost in gaming notebook demand that is expected to steadily climb through 2022. NVIDIA’s gaming segment could see 15% or more growth over the next couple of years.

The stock has been given a “buy” or “outperform” reiteration three times in the past month by Goldman, RBC Capital Markets, and BofA/Merrill with price target ranges between $179 to $250 per share.

A Fundamental Look at the Numbers

The stock trades at 40 times earnings, earning the label of a growth play.

While seemingly high compared to the industry average of 27 times earnings, the stock carries a long-term projected EPS growth rate of around 37%. That gives NVIDIA a PEG ratio of roughly 1 – a sign that the stock may be undervalued right now.

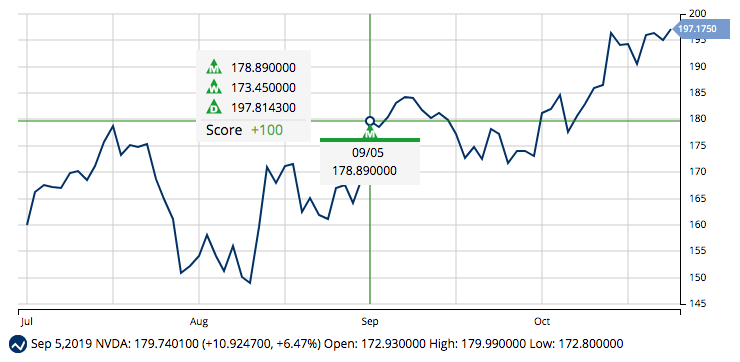

A Technical Look at the Charts

NVIDIA’s chart has been steadily climbing since the beginning of September when the 50-day SMA crossed over the 100-day SMA. This technical signal is colloquially known as the “golden crossover” and usually marks the start of a long-term bullish trend in the stock.

The stock is currently up around 46% year-to-date and looks primed to continue moving higher into 2020.

The Bottom Line

Based on NVIDIA’s full-year EPS estimates, this stock should be conservatively valued at around $230 per share – a gain of nearly 18% from its current trading range.

Investors looking for the next “big thing” may want to give NVIDIA another look. Strong global demand for robotics and AI combined with strong technical and fundamental indicators, make NVIDIA a can’t-miss opportunity.

The above analysis of NVDA was provided by Daniel Cross, professional trader and financial writer.

What Does MarketClub Say

MarketClub agrees that NVDA is a hot stock right now.

With a +100 Chart Analysis Score and a new monthly Trade Triangle issued on 9/5/19, this stock is up more than 10% since and is not showing signs of stopping.

Right now, MarketClub members would be holding a long position until the signals or score suggested weakness or a reversal.

Want the next signal for NVDA? What about signals for 350K other stock, futures, forex or ETF markets?

Click the button above to learn more about MarketClub and how thousands of traders are using our technology to power their portfolios with signals and scores not available anywhere else.