After several months of the COVID-19 pandemic, it appears as if every industry has felt its impact in some form or another. But one market segment has seemingly escaped the financial stress of the coronavirus outbreak – defense contractors.

For one aerospace and defense company, profits continue to pour in heedless of any pandemic, giving investors a solid defensive position in the current economic environment.

A Best-In-Breed Aerospace Giant and Value Play

Lockheed Martin Corporation (LMT) is a $102 billion aerospace and defense conglomerate with operations around the globe. The company’s operations fall into four segments: Aeronautics, Missile and Fire Control, Rotary and Mission Systems, and Space. As of FY2014, it was listed as the largest defense contractor in the world by revenue.

See if LMT made our 50 Top Stocks List

The company reported a first-quarter earnings beat of $6.08 per share compared to the analysts’ estimates of $5.80 per share. Revenues improved by 9.4% to $15.69 billion, with management announcing total EPS estimates for 2020 to be $24.11 per share.

Despite the pandemic, Lockheed Martin has a number of positive catalysts working for it. The company has a backlog worth more than $140 billion and an expected U.S. annual defense budget increase from $676 billion as of 2019 to $906 billion by 2030. That gives it plenty of maneuvering room in any economic environment. Additionally, the creation of the Space Force in 2019 should open up the company to even more lucrative contracts over the next decade.

Fundamentally Sound

The stock trades at 16 times earnings – slightly under the defense industry average of 17 times earnings. However, it comes with a long-term EPS growth rate estimate of 12%. That gives that stock a PEG ratio of less than 2, indicating that the stock may be undervalued.

LMT also comes with a hefty 2.60% dividend yield, giving investors some protection against downside movements and boosting overall returns. The relatively low payout ratio of just 41.50% ensures that the company will be able to pay out a dividend without any liquidity concerns.

Technically Strong

Taking a look at Lockheed Martin’s chart, I don’t see a lot of support for a bearish or a bullish position. The sideways trend is marked by a moderate RSI reading of 50.

The 20-day SMA is currently below the 50-day SMA but does show some signs of accelerating. Strong buying activity could initiate a long term upward trend after the company reports earnings.

Did LMT make it onto our top stocks list?

The Bottom Line

Based on Lockheed Martin’s full-year EPS estimates, this stock should be fairly valued at around $430 per share – a gain of more than 16% from its current trading range.

Investors looking for a strong defensive stock play with long term growth potential need look no further than Lockheed Martin.

The above analysis of LMT was provided to MarketClub by Daniel Cross, professional trader and financial writer.

MarketClub’s Analysis of LMT

The force is strong with this one.

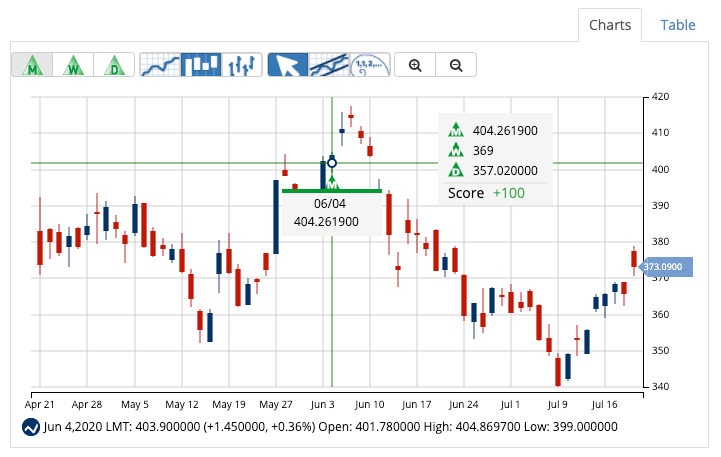

LMT has earned MarketClub’s coveted +100 Chart Analysis score. With a red hot bullish trend and major momentum, LMT looks like it will continue its move higher.

Lockheed’s stock fell since the last monthly Trade Triangle triggered in early June. However, intermediate and short-term trends still point up.

MarketClub members currently holding a position in LMT should protect their gains and look for a change in score to suggest a slow down in momentum.

Be sure to set an alert for LMT to warn you of a drop in the Chart Analysis Score. Also, if you’ve added LMT to your portfolio or watch list, our nightly portfolio recap email will show any changes in momentum.

Not a member? You can change that right now.

Start your 30-day trial to MarketClub and we’ll start watching LMT (and 350K+ markets) for you!