Earnings season is a chance for investors to take a moment to see how each sector of the economy has been faring. It is also a time to look for possibilities that might lie ahead.

One of the newest revelations is that consumers are beginning to return to a pre-pandemic lifestyle. Many businesses are reopening their doors and consumers are venturing out.

With consumer travel beginning to recover, industries that cater to this demand are in an ideal position to deliver.

One company, set to report earnings next week, is going relatively unnoticed. This play gives value investors a prime opportunity to buy now before that stock takes off.

A Best-In-Breed Oil and Gas Refining Conglomerate

Valero Energy Corporation (VLO) is a $23.5 billion oil and gas refining and marketing company for transportation fuels. It operates 15 refineries, including one in Wales, 11 ethanol plants, and a 50-megawatt wind farm.

The company reported a significant earnings beat for the first quarter at $0.34 per share compared to the analysts’ estimates of a net loss of -$0.15 per share. Analysts have upgraded EPS expectations several times for the upcoming July 30th report. These revisions indicate that many on Wall Street believe Valero is a stock on the rise.

Jefferies Group upgraded the stock in late July from a “hold” recommendation to “buy.” They gave a price target of $62 per share. The price target estimate seems to be a rather conservative one but still represents a modest upside of around 7%.

Interestingly, the downgrade by Morgan Stanley in early July still quotes a price target of $70 per share – significantly higher than the upgrade by Jefferies.

The Fundamental Case

The stock trades incredibly cheaply at just 11 times earnings compared to the oil refining and marketing industry average of 65 times earnings.

While the stock currently shows a massive dividend yield of 6.76%, we’ll likely see a reduced dividend moving forward. However, the expected cut is priced into the stock and shouldn’t negatively impact it when management finally slashes the dividend.

The Technical Case

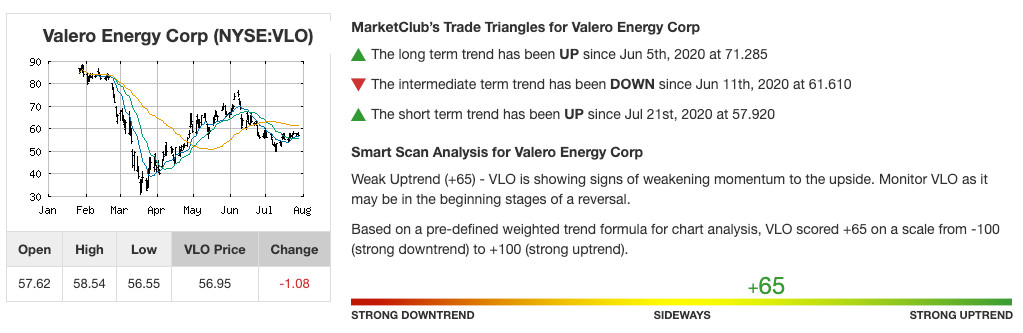

Valero’s chart doesn’t reveal much to investors.

The shorter 20-day SMA crossed below the 50-day SMA in early July, followed by a small dip in the stock price. However, the stock has been trading sideways on lower-than-average volume – likely suggesting that investors are holding off buying or selling activity until Valero reports 2nd quarter earnings results.

The Bottom Line

Based on Valero’s full-year EPS estimates, this stock should be fairly valued at around $72 per share – a gain of more than 24% from its current trading range. This valuation does not count the additional boost from any dividend payments.

Value investors, in particular, should consider adding Valero Energy to their portfolio.

The above analysis of VLO was provided to MarketClub by Daniel Cross, professional trader and financial writer.

MarketClub’s Analysis of VLO

The analysis for Valero Energy Corp. (VLO) is mixed. With a Chart Analysis Score of +65, VLO has yet to turn on the gas and rocket up the chart.

MarketClub members will look for the trend to strengthen before entering VLO.

Want to know when the trend strengthens for Valero?

Start your MarketClub trial to get a daily analysis, alerts, premium charts, and long-term outlook for VLO.