Options trading is usually the next step for investors once they get comfortable trading stocks. Adding options to your portfolio gives you more opportunities to generate profits and reduce your portfolio’s risk.

If the thought of boosting your returns or reducing your risk exposure sounds appealing, keep reading!

Options Trading Basics

Options are financial derivatives of an underlying stock. In other words, they are contracts to buy or sell a specific amount of a company’s stock. An option is also executed or expires worthless when it reaches its expiration date.

|

Learn how to use options to supersize your portfolio returns |

An option contract gives you the ability to control 100 shares (or more) of stock for just a fraction of the cost it takes to purchase the stock itself. This leverage can boost your returns significantly. Or conversely, you can use options defensively and reduce your risk exposure in the markets by lowering your break-even price on a stock you own.

Unlike stock investments, options are only valid for a certain amount of time and are listed by the month of expiration– generally one year or less. Options contracts are always settled on the third Friday of each month. For example, if you bought a 3-month option contract on November 23rd, 2021 then the expiration date for that contract would be February 18th, 2022.

Before we jump into how to trade options, let’s go over some basic terminology.

What Is a Strike Price?

The “strike price” is the established price of the underlying stock that the option contract represents. For example, if you buy a call on JPM at $100 per share, the strike price is $100. Note that the strike price is not the same as the price quoted to buy or sell the option – this a separate category called the “premium.”

Options contracts come in two forms: “calls” and “puts.”

What Is a Call?

Buying a call gives you the right, but not the obligation, to purchase 100 shares of the underlying stock at the strike price. That means that you have option of exercising the contract at any point up until its expiration date.

Selling a call means you are obligated to sell 100 shares of the underlying stock if the option is exercised. That means that the buyer of the call is the one who may or may not choose to exercise the option contract and determines the seller’s actions.

What Is a Put?

Buying a put gives you the right, but not the obligation, to sell 100 shares at the strike price. As is the case in buying a call, a put may be exercised at any time up to its expiration date.

Selling a put gives you an obligation to purchase 100 shares of the underlying stock if it is exercised.

How to Read an Options Chain

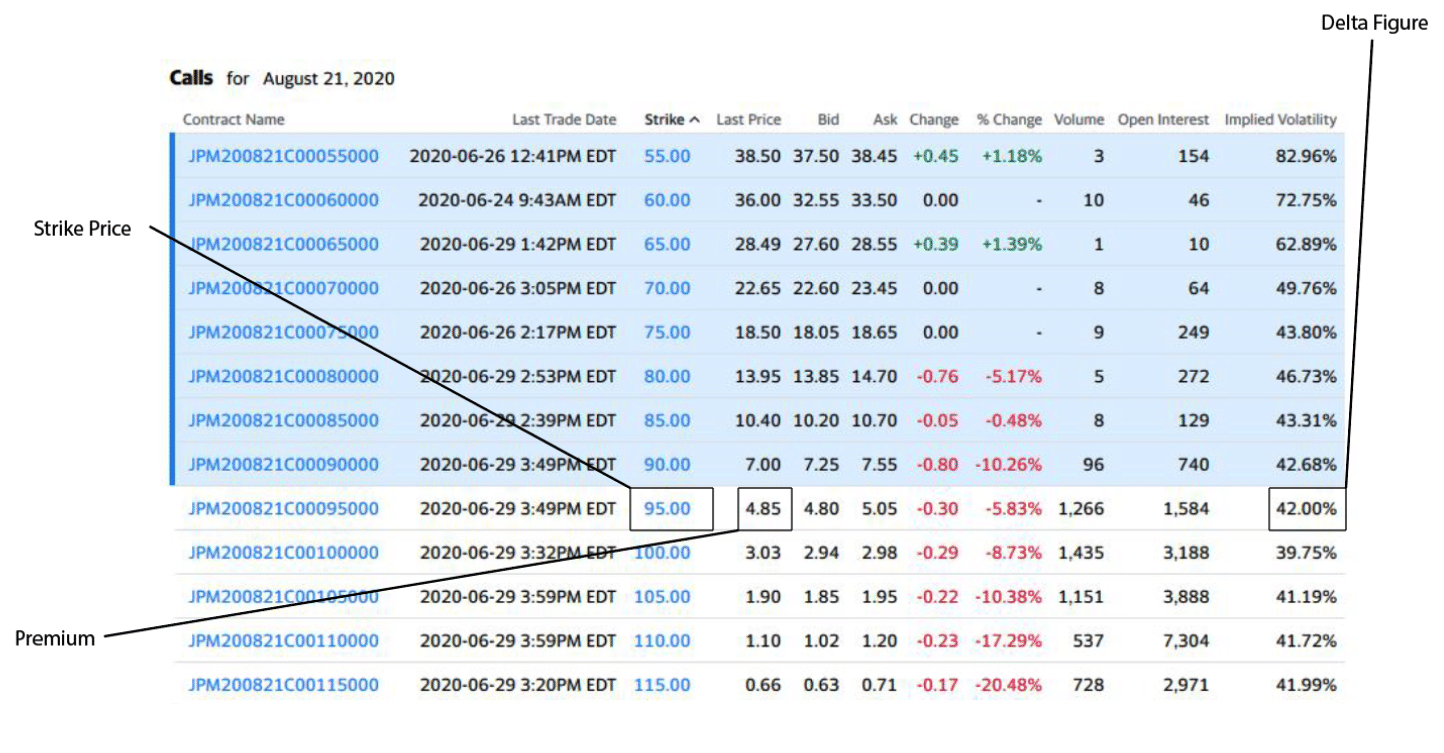

Options are valued differently than stocks because they have a time element associated with them known as “delta.” This is reflected in the option’s premium and will decrease as the option approaches its expiration date. The graphic below illustrates the key numbers of an option chain using JPM as an example:

Note the strike price and the premium in the image above. These will be the two figures you’ll want to identify right away.

What Is Implied Volatility (IV)?

The implied volatility figure, shown here as a percentage, impacts the delta value in addition to the time value of the option.

Implied volatility is the market’s prediction of how volatile the stock will be in the future.

- The higher the IV rank, the wider the expected range of the underlying stock movement becomes

- As IV rank rises, the expectations of share price movement rise and demand for the options increase

- When IV rank increases, options increase in value

- When IV rank decreases, options decrease in value

Since option pricing is determined by IV, the option itself will rise and fall as IV or the expectation of volatility changes. IV largely determines whether or not options are relatively cheap or expensive. Historically, this predicted volatility always overestimates actual volatility, and it’s this overestimation that can be exploited to the benefit to option sellers

A Brief Guide Regarding Option Strategies

Now that you understand what an option is, let’s go over how they can benefit your portfolio.

Here are a few basic ideas for utilizing simple options contracts to get you started.

Buying a Call

Options are a great way to speculate on a stock without having to expose your portfolio to as much risk as you would if you simply bought the stock. Buying a call on a stock you think could breakout higher in a few months but has higher volatility than you are willing to accept is a great way to safely speculate in the market. Leveraging 100 shares of a stock for just a fraction of the cost it would otherwise be if you bought the stock outright gives you more room for participating in “hot” trends or risky plays without compromising your long-term investment goals or adding unnecessary risk to your portfolio.

Selling a Put

Value investors may find selling put options on discounted stocks to be an appealing strategy. The upfront profit from selling can be used to lower the break-even price of the stock making an already cheap stock even cheaper to own. The key to this type of options trade is finding a stock that has upside value at the right price. For example, if you think JPM could rise to $100 per share and is worth owning at $90 per share, you might consider selling a put at $90. Even if the option is exercised and falls below that price, the stock still has the same upside value as before making it a good pickup regardless of the buy-in price.

What Is a Covered Call?

One of the most common option trading strategies is known as a “covered call.” In this type of trade, you sell a call on a stock you already own. This generates an up-front profit, thereby reducing your break-even price point at the cost of potentially having the option exercised if the stock rises to a price higher than the strike price of the call by its expiration date.

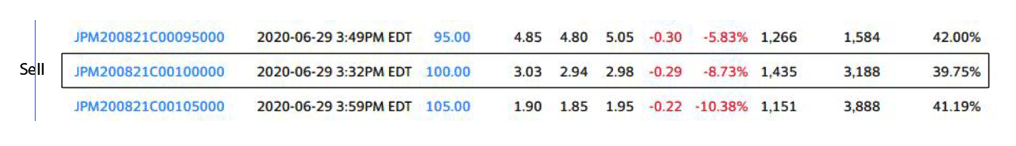

We’ll use an example to illustrate how this works. Let’s say you own 100 shares of JPM stock that you bought when it was trading at $90 per share. To initiate the covered call, you decide to sell the August 21st call at $100 per share for $303 (shown below).

You immediately earn a profit from the premium of $303 (minus brokerage fees) that’s yours to keep regardless of whether the option is exercised or not. Your new break-even cost for the stock is now the $9000 you paid for 100 shares minus the $303 option premium – or $86.97 per share. If the stock doesn’t hit $100 by August 21st, the call will expire worthless.

The downside occurs if JPM suddenly rises more than you expected. If JPM suddenly breaks out to the upside and ends up being quoted at $110 per share by August 21st, your call will be exercised and you’ll have to sell JPM at the agreed-upon strike price of $100. You still achieve the profit you wanted, but you would have missed out on any upside beyond $100.

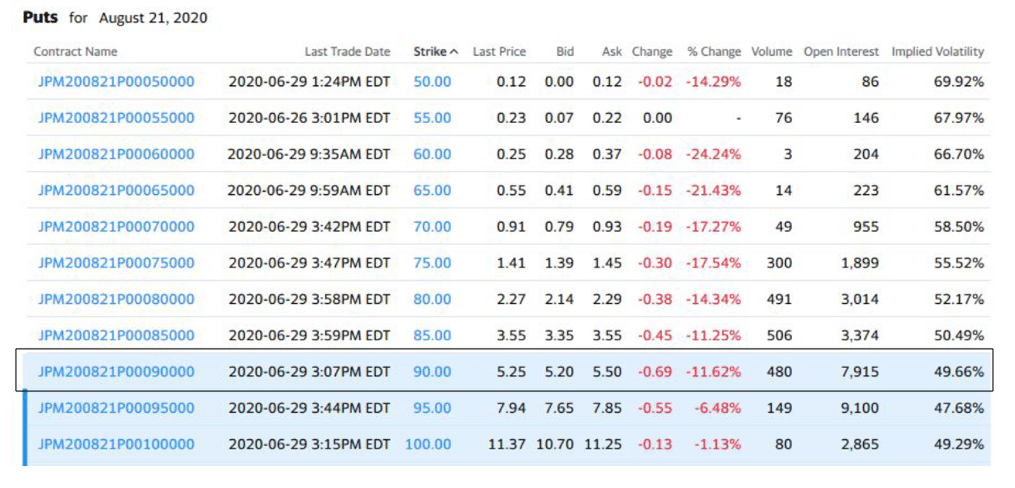

Another useful strategy is to sell a put on a stock that you are interested in purchasing if it drops to a certain price. For example, let’s say you determine that the intrinsic value price of JPM stock is $90. However, JPM it’s currently trading at $93 per share. You decide to sell an August 21st put for $525 at a strike price of $90 (shown below).

If the stock does fall below the strike price, the put will be exercised and you will be obligated to buy 100 shares of JPM at $90 per share. However, if the stock doesn’t drop below $90 in three months, the put option will expire. Note that in both cases, the $525 profit you received from selling the put option is yours to keep.

The downside risk for this strategy happens if the stock falls more than anticipated. If August 21st comes around and JPM stock is trading at $80 per share, you’ll be obligated to buy it at $90 per share. The premium you received for selling the put lowers your break-even cost. Unless the stock rebounds, you’ll have a net loss if you sell the stock.

What Is a Bull Spread and Bear Spread?

You can also use options without having to worry about owning the underlying stock. This can be useful if you want to speculate on a stock, but aren’t willing or don’t have the free cash flow actually to purchase 100 block shares of stock. The most common trade type using just options is a “bull spread” or “bear spread.”

Let’s go back to our previous example using JPM stock. This time, however, let’s assume that you don’t own the stock but think there’s a good chance for it to break out higher in the next three months.

You buy the August 21st call at $90 per share for $700. You sell the August 21st call at $100 per share for $303. Your total cost to initiate the trade is $397 (minus brokerage fees).

To break even, JPM needs to be worth at least $93.97 per share. Anything above $93.97 per share becomes profit up to $100 when the sell option is triggered. The upside here is $603. The maximum downside is the cost paid to set up the trade – $397.

Final Thoughts for New Options Traders

Adding options to your portfolio can add a new level of excitement and sophistication to your trading habits. Once you start trading options, you’ll discover many other strategies and combinations that you can utilize.

Before long, you’ll be able to trade along with Wall Street professionals – and have the portfolio returns to prove it.

Start our Free Options Basics Boot Camp – free course will walk you through the basics of options and share an easy-to-follow strategy.

About the Author

Daniel Cross has been in the industry as an investment writer and financial advisor since 2005. His experience includes being editor-in-chief of a corporate newsletter aimed at employee education regarding investing and retirement planning and crafting thought-provoking white papers for financial service firms.

Post updated December 14, 2021.