Investor sentiment is improving, and the stock market reflects this new positive attitude with higher closing prices and bullish momentum.

The S&P 500 has rebounded from the coronavirus pandemic and overtook earlier year-to-date highs two weeks ago. With momentum back in the driver’s seat, investors are gearing up for a potential long-term post-pandemic rally.

With an impressive Q2 earnings beat and an oversold stock price, investors could jump on this insurance stock with massive upside potential.

A Staple in the Insurance Industry and Value Play for Investors

The Allstate Corporation (ALL) is a $29.8 billion property and casualty insurance powerhouse with operations in the United States and Canada. It also owns and operates 19 other companies under the Allstate umbrella, with additional market operations in the United Kingdom and India.

The company reported a phenomenal earnings beat for the second quarter at $2.46 per share. This earnings surprise smashed the analysts’ estimate of $1.55 per share.

Revenues came in less than expected at $10.49 billion. This drop was largely attributed to muted investment income. However, management reiterated a positive forward outlook.

Insurance companies, particularly life insurers, are sensitive to changes in interest rates. When interest rates fell in March, ALL’s stock also dropped when investors sold off anything that derived profits from higher interest rates. The impact may have been overblown for the property and casualty insurance subsector.

Despite the revenue drop due to lower investment returns, an increase in premiums and fewer-than-expected claims means that the company already has the bad news priced into the stock price. Now, there is a lot of upside potential that is going unnoticed.

The stock was upgraded by Credit Suisse in late June from an “underperform” recommendation to “neutral.” They also bumped the price target to $101 per share.

The Fundamental Case

The stock trades cheaply at only 8 times earnings compared to the property and casualty insurance industry’s average of 23 times earnings.

The long-term EPS growth rate projection of 6% gives the stock a PEG ratio of less than 2, indicating that it may be trading under its intrinsic value.

The stock carries a 2.30% dividend yield helping to protect investors from downside movements and provide additional income.

The Technical Case

The chart for Allstate shows somewhat of a sideways trading trend right now. The stock price is bouncing up and down within a narrow range.

The RSI rating of 49 is almost perfectly balanced, while volumes and other metrics are lukewarm. But there are signs of bullish momentum beginning to build up in the stock. The 20-day SMA crossed over the 50-day SMA last week, indicating that the stock price should head higher.

The Bottom Line

Based on Allstate’s full-year EPS estimates, this stock should be fairly valued at around $120 per share – a gain of nearly 27% from its current trade price.

Investors looking for a defensive play, but aren’t willing to sacrifice overall returns, should take a closer look at this solid value stock.

The above analysis of ALL was provided to MarketClub by Daniel Cross, professional trader and financial writer.

MarketClub’s Analysis of ALL

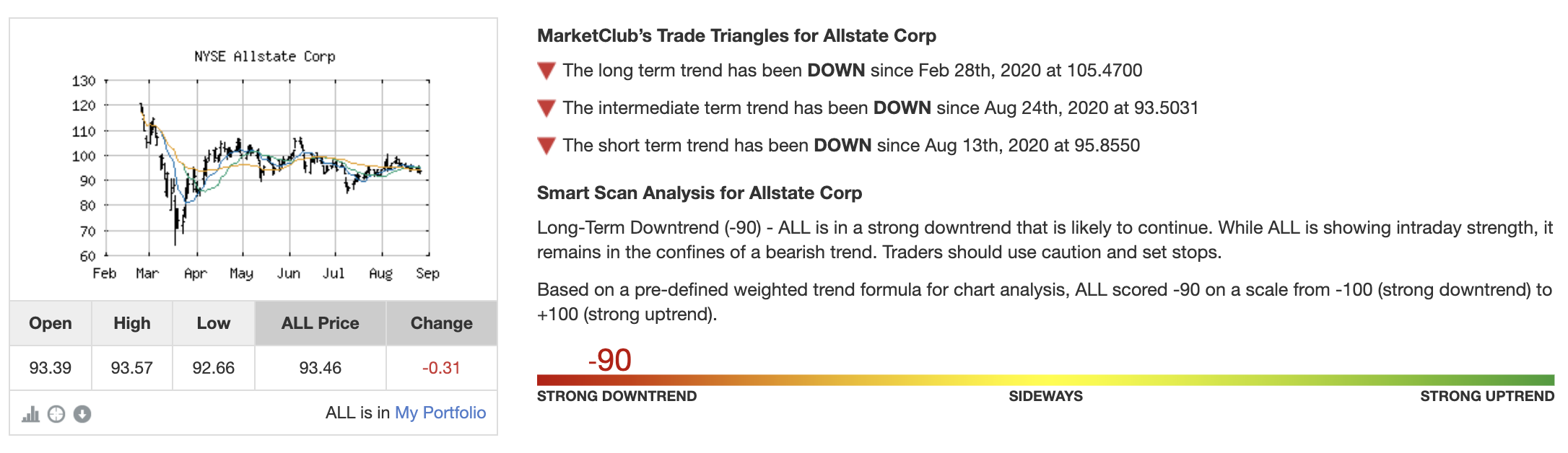

While ALL has the potential to rebound to $120/share, a level not seen since late February, the technical trend is still pointing in a bearish direction.

More than just pointing bearish, a Chart Analysis Score of -90 suggests that ALL will continue its downward trajectory.

MarketClub members received a monthly, red Trade Triangle on February 24, 2020, at $105.47 before the stock plunged 33% to a low of $71.74 on March 23, 2020.

The stock has made a move back to the $90/share level. However, this move has not been enough to shift the trend into a bullish direction.

MarketClub members will wait to see an increase in ALL’s trend strength before considering a long position.

Want the Trade Triangle signal for ALL?

Start your 30-day MarketClub trial right now!