The secret is out – Wall Street is booming once again. This is the market’s best performance for August in the past 30 years and investors are itching for new opportunities.

As businesses continue to adapt to the post-coronavirus global paradigm, new methods for banking and payment transactions become the new standard.

For one technology-based credit services company, a booming market means more payment transactions and more profit opportunities for investors.

Payment Processing Shift Creates Big Opportunity

PayPal Holdings (PYPL) is a $239 billion credit services conglomerate and one of the early pioneers of online payment services. The company acts as a payment processor for online vendors, auction sites, and other commercial users and offers a digital alternative to traditional paper-based monetary transactions.

The company reported an impressive earnings beat for the second quarter at $1.07 per share compared to the analysts’ estimates of $0.88 per share.

PayPal has demonstrated impressive money management, with annual net operating cash flows doubling from $1.2 billion in the second quarter of 2019 to $2.4 billion for the second quarter of 2020.

The business of online payment transactions is fast-paced and growing quickly. The global shift from traditional banking to online transactions is a strong trend that’s still only in the beginning stages. According to Allied Market Research, there are now 1.3 billion active debit and credit accounts compared to 5.3 billion active mobile phone accounts – that’s huge market potential for PayPal.

Analytic firm Mizuho initiated coverage on the stock in August with a “buy” recommendation and a $285 price target.

The Fundamental Basis

The stock trades at 63 times earnings, identifying it as a growth stock play. But this earnings multiplier is slightly higher than the transaction processing services industry average of 57 times earnings.

See the latest signal, momentum rating, and more – Get Your Free Report on PYPL

The long-term estimated EPS growth rate of 29% gives the stock a PEG ratio of around 2 – not an undervalued signal, but certainly not overvalued by any means.

The Technical Basis

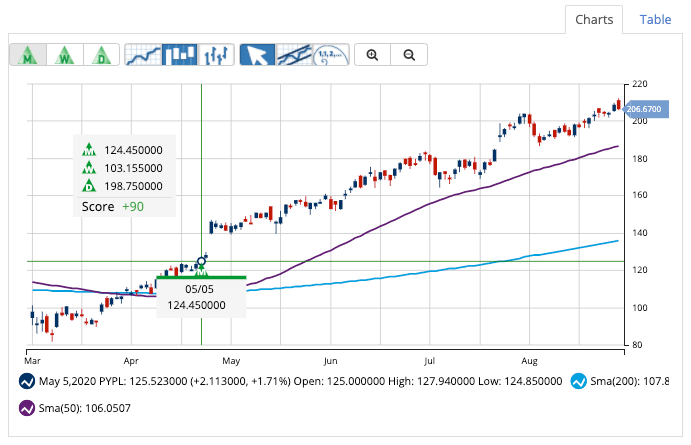

The stock chart for PayPal isn’t hard to interpret. There’s a very clear upward trend with the 20-day SMA moving well above both the 50-day SMA and the 200-day SMA.

The RSI reading of 62 indicates that the stock may be slightly overbought, but the steady rise in the stock price could also mean that the RSI is merely reflecting investors’ bullish sentiment right now.

The Bottom Line

Based on PayPal’s full-year EPS estimates, this stock should be fairly valued at around $240 per share – a gain of 17% from its current trading range.

Investors looking for a high-growth stock to bolster their portfolio may want to add PayPal to their watchlist.

The above analysis of PYPL was provided to MarketClub by Daniel Cross, professional trader and financial writer.

MarketClub’s Analysis of PYPL

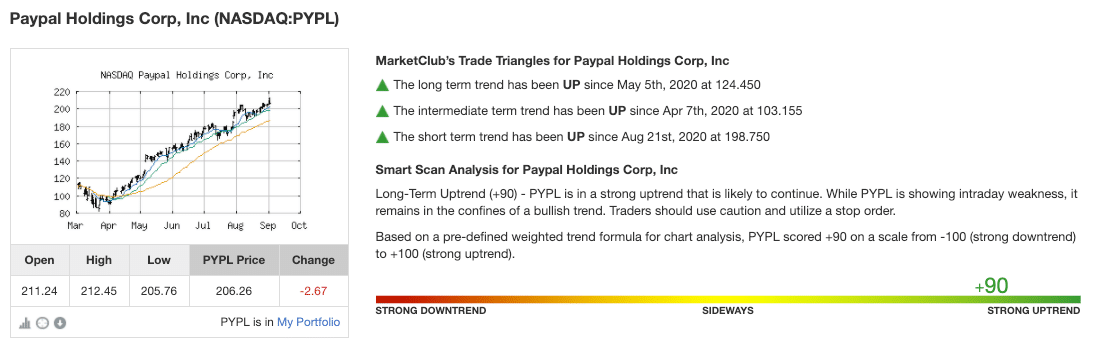

MarketClub agrees with Mr. Cross’ analysis of PayPal. With a +90 Chart Analysis Score of +90, the bullish trend is strong for this payment-processing powerhouse!

Members received a long-term Trade Triangle on May 5, 2020, at $124.45. The stock continued to climb to all-time highs, even breaking through the $200/share mark on August 5th.

Since the monthly green Trade Triangle, PYPL is up 66%.

Have you missed the move?

The momentum is still strong for PYPL and the analysis suggests that there is still more room to run.

MarketClub members will keep an eye out for a new red exit signal or for the Chart Analysis Score to weaken. Our Alert tools will wave the flag if and when PayPal’s trend begins to weaken.

Want the next alert for PYPL? Join us!

Start your 30-day MarketClub trial right now.