Cineworld (CNNWF) is closing its US and UK theaters for the foreseeable future. Could this closure turn up the heat for the already competitive streaming industry?

Companies like Disney (DIS) for example, have attempted to bypass the traditional theatrical release and pandemic restrictions. In September, the company released its live-action remake Mulan. Subscribers could access the new release on their streaming platform, Disney+, for an additional fee. This release is just one of the many new releases scheduled to skip the theaters.

A strong move from traditional in-theater releases to in-home streaming could change the content-consumption paradigm forever. While companies live-theater companies like AMC Entertainment Holdings Inc. (AMC) and Cinemark Holdings Inc. (CNK) would suffer, at-home streaming companies could continue to add to subscriber growth. Big streaming companies are already in a position to capitalize.

Here are four companies leading the streaming industry and ones that you may want in your portfolio watchlist as content-consumption trends continue to shift.

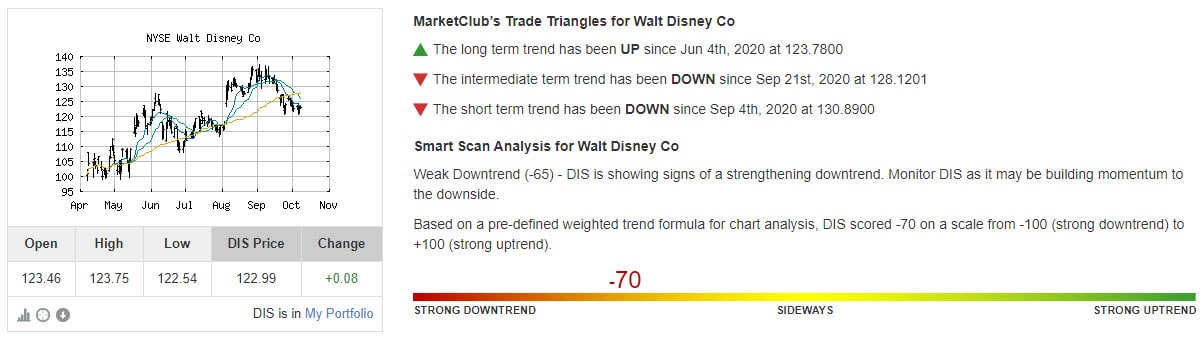

Walt Disney Co (DIS)

Avg. Volume: 9,039,557

Market Cap: 245,329 M

Monthly Green Trade Triangle: 6/48/2020 – $123.78

Smart Scan Score: -70

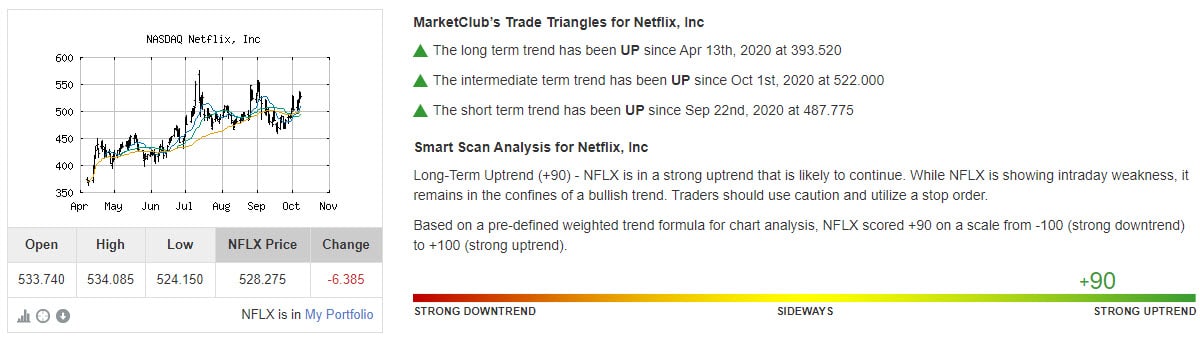

Netflix, Inc (NFLX)

Avg. Volume: 6,705,335

Market Cap: 126,214 M

Monthly Green Trade Triangle: 4/13/2020 – $393.52

Smart Scan Score: +90

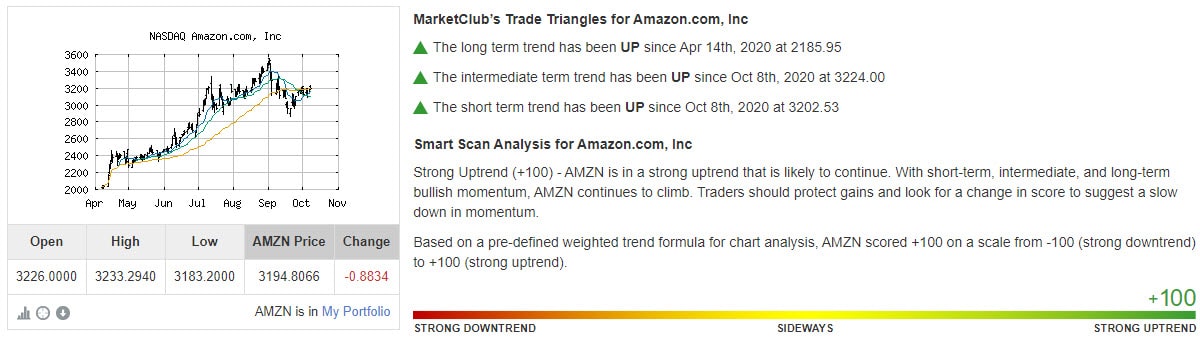

Amazon.com, Inc (AMZN)

Avg. Volume: 4,868,129

Market Cap: 901,752 M

Monthly Green Trade Triangle: 4/14/2020

Smart Scan Score: +100

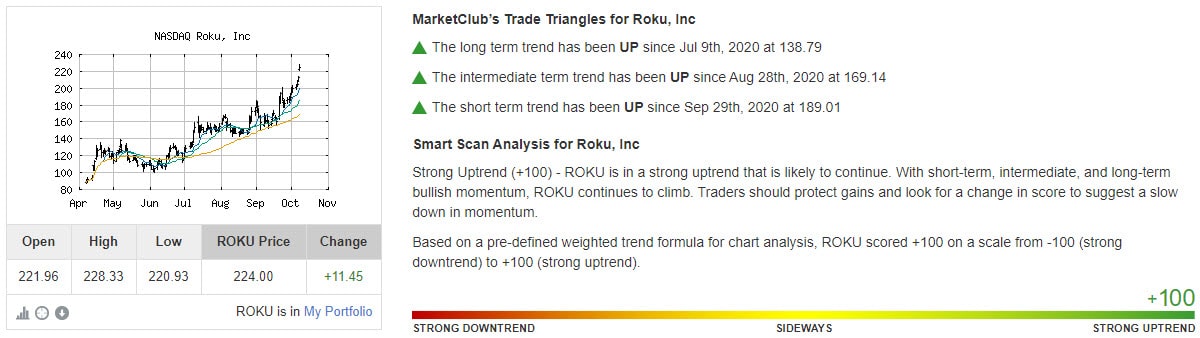

Roku, Inc (ROKU)

Avg. Volume: 8,271,795

Market Cap: 17,407 M

Monthly Green Trade Triangle: 7/9/2020 – $138.79

Smart Scan Score: +100

Let MarketClub carefully monitor the trends, momentum, and potential warning signs for these four streaming stocks.

Begin your 30-day MarketClub trial now to get the signals for these stocks and access analysis for over 350K more symbols.