The markets have been unsteady, with geopolitical tensions mixing in with renewed coronavirus fears.

The return of volatility, coupled with low yields on fixed-income products, limits options for investors seeking safe haven. But there’s one segment of the market that’s known for protecting wealth – particularly during times of low-interest rates and rising inflation.

One gold mining company appears to be the ideal haven for investors. Low all-in costs for gold production and healthy reserves should keep profits flowing steadily.

A Best-in-Class Gold Mining Company and Investor Safe Haven

Barrick Gold Corporation (GOLD) is a $51 billion gold mining company based in Canada. While the company primarily mines gold, it also mines copper and has 16 operating sites in 13 countries.

The company reported an earnings beat for the second quarter of $0.23 per share compared to the analysts’ estimates of $0.18 per share. But for mining companies, all-in costs of operations are a more critical metric. For 2019, the company saw all-in gold costs of $894 per ounce.

Gold prices have been climbing all year long with year-to-date gains of 26% – one of the few 2020 bull markets. In stark contrast, the 10-year treasury yield has fallen sharply – down around 60% year-to-date. With such low interest rates, some investors may receive yields that are less than the inflation rate. That could translate into high demand for gold stocks, sending Barrick’s stock price soaring higher.

The stock was upgraded by Canaccord Genuity in late August from a “hold” recommendation” to “buy” as well.

The Fundamental Case

Barrick had all-in operating costs for gold of $894 per ounce as of 2019 and all-in costs for copper of $2.52 per pound. With gold prices trading near all-time highs, the company has room to maneuver in the current environment.

GOLD also comes with a small 1.10% dividend yield helping to mitigate sharp downward movement in the stock.

The Technical Case

Barrick’s stock chart doesn’t have a lot of action at first glance. GOLD traded mostly sideways in a $4 range from peak to trough. However, the trend does appear to be on a slight upward trajectory.

Get a free technical trend report for GOLD

The 20-day SMA is tracking along the 50-day SMA with no clear sign of whether it will break out above or below. Notably, the stock has pulled back some over the past couple of weeks, allowing investors to buy at a discounted stock price.

The Bottom Line

Based on Barrick’s all-in cost, dividend yield, and market potential, this stock should be fairly valued at around $34 per share – a gain of nearly 20% from its current trading level.

For investors that want a solid safe-haven play that still offers strong returns, Barrick is an easy choice.

The above analysis of GOLD was provided to MarketClub by Daniel Cross, professional trader and financial writer.

MarketClub’s Analysis of GOLD

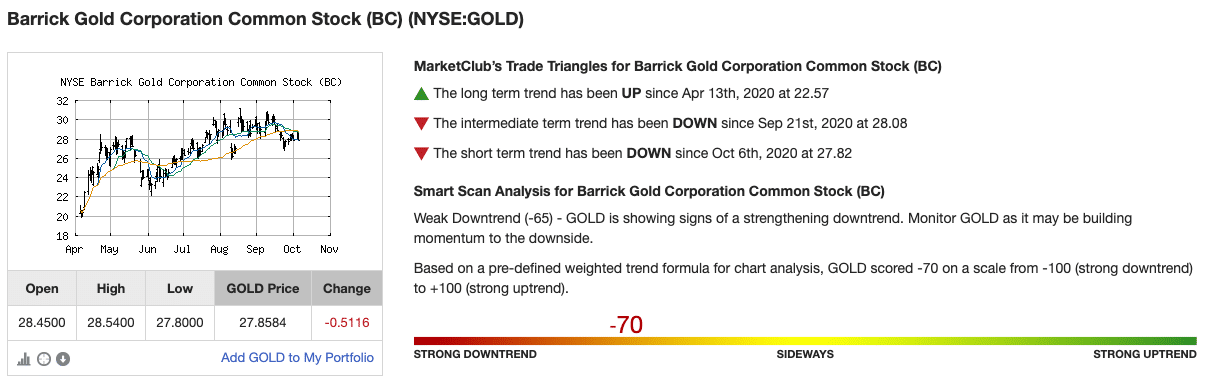

The technical outlook for Barrick Gold Corporation (GOLD) is mixed based on MarketClub’s analysis.

With a Chart Analysis Score of -70, GOLD is showing signs of a strengthening downtrend. Members would monitor GOLD (by putting it into their customizable watchlist) as it may be building momentum to the downside.

What’s next for GOLD?

If GOLD triggers a red monthly Trade Triangle, this stock would move into the confines of a strong downtrend and would likely continue falling.

However, if GOLD begins to build short or intermediate-term momentum, a strengthening Chart Analysis Score would alert members to a shift in the trend and a possible bull run.

Want a daily analysis of GOLD? Begin your 30-day trial to MarketClub and add GOLD to your watch list right now.