For newbies, foreign exchange (forex or fx) trading can be fairly intimidating. There are many things that traders need to understand about the forex markets before even thinking about buying into them.

Terminology is one of the simplest and most important places to start.

5 Important Forex Trading Terms

Today we’ll cover five essential terms that any budding forex trader needs to know. These terms are important both inside and outside of forex.

#1 – Margin Trading

The term “margin” refers to the practice of margin trading.

In its most basic form, margin trading is a type of lending. Margin trading means that a forex trader uses their broker’s money to trade currency pairs for a hopeful profit.

Brokers lend the money without requiring the trader, in most cases, to deposit the loaned amount into their brokerage account. Margin trading is a prevalent practice, but traders should treat it as a double-edged sword. Margin trading can increase potential gains but also expose the trader to significant amounts of losses.

#2 – Leverage

Leverage is connected to margin trading.

Each broker has a different leverage ratio, which determines how much money a broker will boost your trading position. For example, a broker could offer a trader a leverage ratio of 50:1. In this case, if the trader enters a trade worth $5 (USD), then the broker will leverage that amount to be $250 ($5 x 50).

Leverage is a valuable tool for traders that don’t have large amounts of capital. In the same vein as margin trading, using leverage can augment profits and expose the trader to significant losses.

#3 – Pair

In forex trading, everything is traded in pairs. It’s impossible to trade only a single currency.

There are eight major currencies in the market that are considered standard currencies.

US Dollar (USD)

Japanese Yen (JPY)

Great British Pounds (GBP)

European Euro (EUR)

Australian Dollar (AUD)

Canadian Dollar (CAD)

Swiss Franc (CHF)

New Zealand Dollar (NZD)

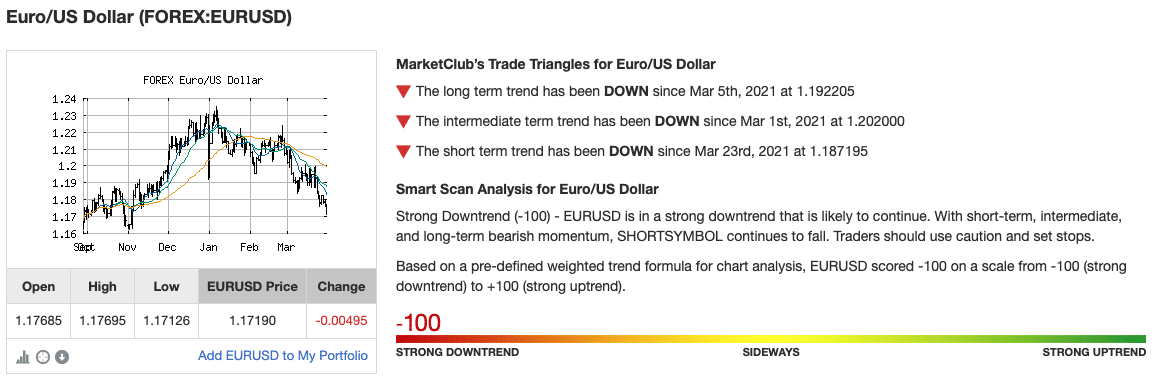

The standard currencies are traded by almost any forex broker and come in pairs. If you own Euros (EUD) and want to trade into U.S. Dollars, the pair to trade would be EUR/USD.

Of course, dozens of other currencies in the world and hundreds of potential pair combinations make the selection of pairs to trade an important and challenging task.

#4 – Base & Quote Currency

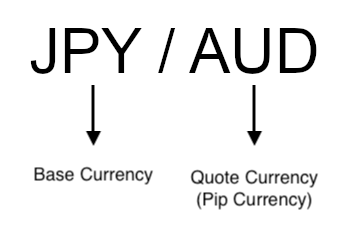

The base currency is the first one listed in a pair.

In the case of JPY/AUD, the Japanese Yen would be the base currency.

The quote currency, the second one in a pair, is the one being traded against. In some cases, it is also referred to as the pip currency.

#5 – Pips

Pips are units of measurement. In the forex context, a pip is the smallest unit of currency. The size of a pip is determined by the type of currency.

For example, in EUR/USD, a pip would be 0.0001 of either currency.

However, for the Japanese Yen, which has higher denominations than EUR/USD, a pip size would be 0.01.

Understanding how to read pips is vital as they’re often the size of price fluctuations you can see in the market. Pip-sized movements can be profitable despite being so small, especially when using margins or leverage.

These great forex tips were brought to you by our friends at Trading 101.

Want a free daily analysis of the top-trending currency pairs?

Tell us where to email our free list!