The summer months have begun and investors are carefully monitoring the growing inflation concerns that have cropped up in the markets. Rising inflation means diminishing profits for most companies. Conversely, some companies absorb inflationary impacts without a second glance.

Defensive industries tend to do well with little to no revenue reduction when inflation rears its ugly head. Industries like consumer staples, utilities, and healthcare have a relatively constant demand and give investors an ideal hunting ground for picking up winning stocks.

For one healthcare giant, inflationary concerns are of little impact on its ability to grow and generate bigger profits for investors.

A Growth Stock and Defensive Company Rolled Into One

Agilent Technologies (A) is a $41 billion healthcare diagnostics and research company that manufactures and sells analytical instruments, software, services, and more for laboratory workflow processes.

The company reported a solid second-quarter earnings beat of $0.97 per share compared to the analysts’ estimates of $0.83 per share. Revenues beat estimates as well, coming in at $1.53 billion. Following the report, analysts raised annual guidance for the stock.

The main catalyst for Agilent is the need by healthcare companies to maintain medical equipment and optimize its workflow. As the COVID management efforts continue to increase, Agilent is in a position to provide the best tools and software to help providers.

Citigroup most recently upgraded the stock from a “neutral” recommendation to “buy” rating. In addition, analysts bumped the price target from $135 per share to $150 per share.

The Fundamental Angle

The stock trades in line with the S&P 500 average at 36 times earnings. However, this comes in well below the medical equipment industry average of 46 times earnings.

The long-term estimated EPS growth rate of 15% gives the stock a PEG ratio of around 2 – a sign that the stock may be trading at undervalued prices. Agilent offers a small 0.57% dividend yield, which helps protect the stock from sustained selling pressure.

The Technical Angle

Agilent’s stock chart shows a slow but steady increase in the stock’s price over time. The 20-day SMA is trending above the 50-day SMA, giving investors some indication of bullish momentum building up.

The relatively high RSI of 62 could mean that the stock is nearing “overbought” territory, but it could also reflect the increased buying pressure brought about by more significant bullishness from investors.

The Bottom Line

Based on Agilent’s full-year EPS estimates, this stock should be fairly valued at around $155 per share – a gain of more than 12% from its current trading price.

Investors looking to keep a defensive strategy and a strong growth stock with building bullish momentum will want to take a good hard look at adding Agilent to their portfolio.

The above analysis of Agilent was provided by financial writer Daniel Cross.

MarketClub’s Analysis for Agilent Technologies, Inc. (A)

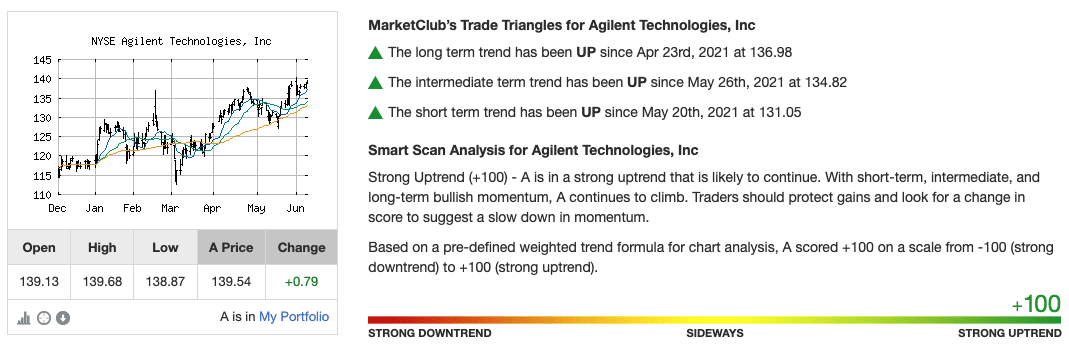

Based on MarketClub’s analysis, Agilent is in a strong bullish trend with a Chart Analysis Score of +100.

In May of 2020, MarketClub members received a Trade Triangle at $86.08 suggesting a new bullish long-term trend.

The stock continued to run for 10 months before triggering a red monthly Trade Triangle at $113.16, more than a $27.08/share (31.4%) gain since the May 2020 signal.

Members received a new monthly green Trade Triangle on April 23, 2021, at $136.98. As of today, the trend remains strong to the upside.

What’s next for Agilent Technologies (A)?

Get a free daily analysis that will show you any new Trade Triangles or signs of weakness.