There’s a misconception among newer investors that the best stock play is the hot new Wall Street darling or tech IPO. But experienced investors will tell you that some of their best money-making picks have been in well-known companies with a history. There are numerous opportunities in familiar companies that can generate bigger returns than any of Wall Street’s “fad” stock picks.

One recognizable brand is trading at prices too low to ignore, allowing savvy investors to pick up a winner at a considerable discount.

A Best-In-Class Niche Company and Stealthy Value Stock Addition

The Estée Lauder Companies, Inc. (EL) is a $110 billion household and personal products company best known for its beauty care products. It manufactures and markets makeup, skincare, haircare, fragrances, and more, with operations in more than 150 countries.

The company reported a third-quarter earnings beat of $1.62 per share compared to the analysts’ consensus of $1.32 per share. Revenues came in slightly under expectations at $3.9 billion, but an improved outlook for consumer product demand could result in more upside earnings surprises ahead.

Estée Lauder has focused on growing its skincare segment, recently increasing its stake in the Canadian-based DECIEM Beauty Group. Double-digit growth also occurred in its overseas operations – specifically in mainland China. For the third quarter, its skincare segment oversaw a sales increase of 31% year-over-year.

There have been several analyst upgrades so far this year, the latest being Wells Fargo back in late March. It changed its recommendation on Estée Lauder from “equal-weight” to “overweight” and bumped the price target up from $290 per share to $340 per share.

The Fundamental Foundation

The stock trades at a seemingly high 55 times earnings until you compare it to the cosmetics industry average of 77 times earnings. However, the high 30% EPS growth rate estimate gives the stock a PEG ratio of around 2. This ratio is a good sign for investors that EL may still be trading at discounted prices.

The stock carries a small 0.70% dividend yield. This yield helps to prop the stock up during bearish markets. The relatively low dividend payout ratio of just 40% means that the company has plenty of room to keep paying or even raise the dividend in the future as well.

The Technical Buildup

Estée Lauder’s chart reveals a pattern of steady climbing followed by a drop-off before repeating the cycle. Overall, the trend is bullish, with each new peak coming in higher than the previous one.

While both the 50-day SMA and 200-day SMA are slowly rising, the 20-day SMA appears more volatile – investors will want to keep an eye on any potential bearish crossovers in the coming week.

The Bottom Line

Based on Estée Lauder’s full-year EPS estimates, this stock should be fairly valued at around $335 per share. A move to this price would represent a gain of roughly 11% from its current trading price.

Value investors looking for an out-of-the-box play in a trusted brand need look no further than this stellar stock pick.

The above analysis of EL was provided by financial writer Daniel Cross.

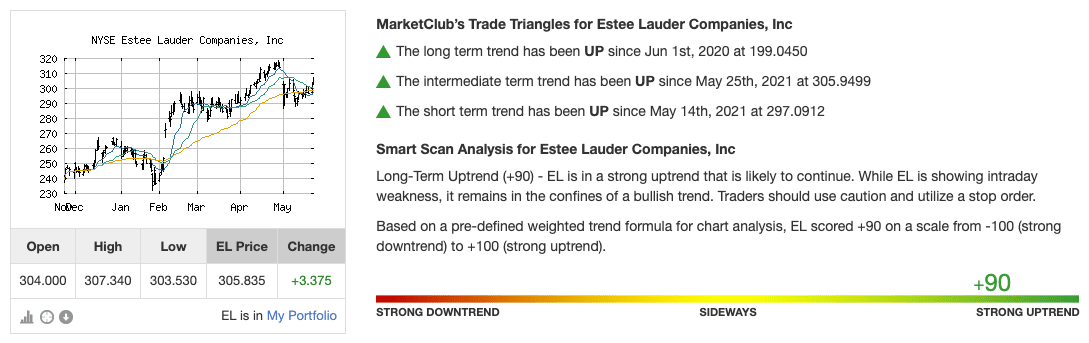

MarketClub’s Analysis for EL

MarketClub detects a strong uptrend for EL. This bullish trend is likely to continue based on the short, intermediate, and long-term momentum.

Want a warning when the trend for Estée Lauder begins to weaken? Sign up for a free Trend Analysis for EL or any other U.S. or Canadian stock.