The markets rebounded in a big way on Monday, with the DJIA up 1.76% and the S&P 500 up 1.40%. Last week’s sell-off, triggered by over-hyped headwinds, has seemingly vanished with the bulls back in the driver’s seat. But the sell-off could mean big opportunities for value investors looking for strong companies at lower prices.

Solid fundamentals, a dip in the stock price, and a jump in consumer demand mean big profits for investors for one recreational manufacturer.

A Recreational Superstar and Stealthy Value Stock Pick Up

Thor Industries (THO) is a $6 billion recreational vehicles manufacturer specializing in RV brands such as Airstream, Heartland RV, Jayco, and more. The company also has a model line in Europe – the Erwin Hymer Group.

The company reported a phenomenal third-quarter earnings beat of $3.29 per share compared to the analysts’ estimates of $2.34 per share. Revenues were even more impressive, coming in at a whopping 105.7% higher than the previous year. With backlog increases in all market segments, management expects high growth continuing well into 2022.

The company has seen an upside to the COVID outbreak, with an increase in sales as consumers elect to take socially distant vacations in RVs. An article by the Boston Herald noted that consumer interest in RVs soared 162% during the coronavirus pandemic. The emergence of a vaccine is expected to boost interest in travel. The RV Industry Association projects a 33.8% year-over-year increase in RV shipping for 2021.

Exane BNP Paribas initiated coverage on the stock in June, giving it a “neutral” recommendation and a $128 per share price target. Northcoast downgraded its recommendation from “buy” to “neutral.” However, investors should note that analyst reports typically lag other market indicators. This can often be a good contrarian play for value investors.

The Fundamental Side

The stock trades rather cheaply at just 10 times earnings. This is far less than the recreational vehicles and boat’s industry average of 27 times earnings.

The long-term projected EPS growth rate of about 13% gives the stock a PEG ratio of less than 1. This ratio is a strong sign that the stock is currently trading at undervalued prices. It comes with a 1.5% dividend yield, giving investors a bit of downside protection from sustained downturns while helping to generate stable income as well.

The Technical Side

Thor’s stock chart shows a clear downturn in the price that has occurred over the past month. The 20-day SMA has sunk below the 50-day SMA but is still above the 200-day SMA for now.

However, according to the candlesticks, bullish activity appears to be winning out over the past three trading sessions. The RSI of 33 clearly indicates that the stock is in deep “oversold” territory, with momentum shifting back to the bulls.

Investors will want to watch for growing strength in the upcoming weeks.

The Bottom Line

Based on Thor’s full-year EPS estimates, this stock should be fairly valued at around $140 per share – a gain of nearly 30% from its current trading price.

If you’re looking for a value stock pick that could return outsized gains over the next 12 months, Thor Industries is one that you can’t miss.

The above analysis of Thor Industries (THO) was provided by financial writer Daniel Cross.

MarketClub’s Analysis of Thor Industries (THO)

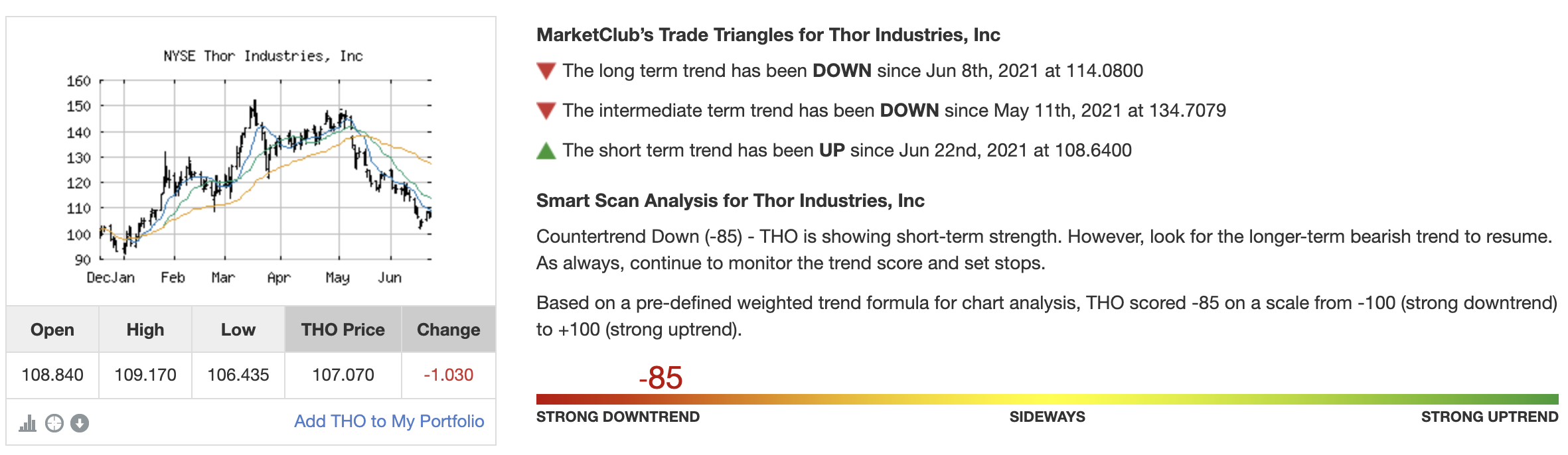

MarketClub detects a countertrend for THO and a -85 Chart Analysis Score.

While recent price action has created short-term strength, the long-term trend remains bullish.

MarketClub members will look for THO to gain strength before entering into a long position.

Want an alert when Thor Industries gains bullish momentum? Join MarketClub today and get analysis and updates on more than 350K stock, ETFs, mutual funds, and more.