A growing global economy means a steady demand for industrial materials and products required for construction and manufacturing.

And when it comes to bleeding edge manufacturing technology, there’s nothing like the robotics industry.

In the case of one industrial electronics manufacturer, the current economic environment is the perfect place to find new opportunities and boost its bottom line.

A Classic Industrial Stock Priced To Buy

ABB Ltd (ABB) is a $67.9 billion specialty international industrial machinery conglomerate operating out of Switzerland. It specializes in robotics, power, heavy electrical equipment, and automation. It is the largest industrial employer in Switzerland, and its stock is listed on the SIX Swiss Exchange, Nasdaq Stockholm, and the NYSE.

The company missed fourth-quarter earnings estimates at $0.33 per share compared to the $0.41 per share that analysts had expected. However, revenues beat estimates at $7.57 billion while total 2021 revenues climbed 11% year-over-year. The number of order placements jumped by an even more significant degree, beating out last year’s order count by 18%.

One of the biggest catalysts working in ABB’s favor is the market growth for electronic vehicles, automation processes, and robotic components. The company is quickly expanding, as evidenced by the recent $80 million deal in Spain for traction and battery solutions for e-trains. ABB’s focus on global EV solutions could be the path for earnings beats later on this year as well.

The most recent coverage of the stock was an upgrade in January by RBC Capital Markets from a “sector perform” recommendation to an “outperform” recommendation which means investors still have a chance to pick up this winner before Wall Street catches on.

The Fundamental Angle

The stock trades roughly in line with the electrical components industry average of 20 times earnings but comes with an estimated long-term EPS growth rate of 14%. A PEG ratio of less than 2 is typically a good sign that the stock may be undervalued.

ABB also comes with a solid 2.70% dividend yield helping to protect investors against downside movements while providing a stable income stream to reduce portfolio volatility.

The Technical Take

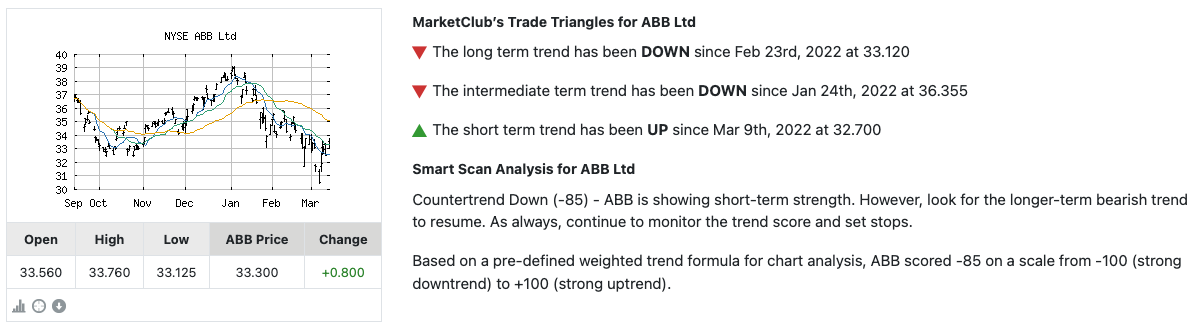

ABB’s chart appears to be negative at first glance. The 20-day SMA is the lowest trend line with the 50-day and 200-day both above it. But if we look at the past week or two of trading, we can see some bullish signs.

See the Full Technical Analysis Report for ABB

There have also been a couple of hammer patterns on up days accompanied by higher-than-average volumes, while lower-than-average volumes accompany down days.

The Bottom Line

Based on ABB’s full-year EPS estimates, this stock should be fairly valued at around $40 per share. A move to this price would represent a gain of more than 17% from its current trading range.

Value investors looking for a stealthy play with long-term growth prospects will want to take a second look at this bargain pick-up.

The above analysis of ABB Ltd (ABB) was provided by financial writer Daniel Cross.

Long-Term Outlook for ABB Ltd (ABB)

MarketClub agrees that ABB does not look promising at first glance.

With a -85 Chart Analysis Score, ABB is in a down countertrend. While the stock is showing short-term strength, the long-term bearish trend could continue.

MarketClub members can add ABB to their watchlist to monitor the Chart Analysis Score and jump on the stock when the time is right.

Get the next signal for ABB and see signals for over 350K symbols.