Experienced investors know that the companies you are most familiar with often tend to generate the biggest gains in your portfolio.

The hottest new tech company all the Wall Street pundits are talking about might seem like an exciting opportunity. Still, it’s nothing more than a gamble if you aren’t familiar with what the company does or understand how they generate profits.

One specialty retail chain has the right management team and ideal economic environment to generate outsized earnings and profits for investors.

A Best-In-Class Niche Retailer With Room to Run

Ulta Beauty, Inc. (ULTA) is a $19.6 billion specialty retailer known for its selection of cosmetics, fragrances, haircare and skincare products, and other related accessories. The company carries over 25,000 products from more than 600 beauty brands through brick-and-mortar stores, online sites, and mobile applications.

The company reported a phenomenal third-quarter earnings beat of $3.94 per share versus the $2.46 per share analysts had expected. Revenues soared 29% up to $2 billion, while management upped guidance for the third time following the earnings report. Full-year EPS has jumped from the initial quote of $10 per share to $17.10 per share.

The biggest catalyst for Ulta is the higher expected sales growth and increased foot traffic in its physical store locations. The company has managed to bounce back quickly from the impact of the COVID pandemic and sales have been impressively high each quarter.

In December, a slew of analysts reiterated their coverage of the stock with 9 “outperform” or “buy” recommendations and 5 “hold” or “neutral” recommendations. Despite the stock’s lagging year-to-date performance, all expectations moving forward appear to be overall positive.

The Fundamental Base

The stock trades at 22 times earnings, slightly higher than the specialty retailers industry average of 17 times earnings. However, the long-term projected EPS growth rate of 28% gives the stock a PEG ratio of less than 1 – a sign that it may be trading at undervalued prices right now.

Ulta currently has cash holdings of $1.05 billion, while current liabilities amount to just $1.34 billion. This cash gives the company plenty of room for capital investments or future acquisitions.

The Technical Details

Ulta’s chart is signaling a sideways trend at the moment but could soon break out higher. While the 50-day SMA is currently above the 20-day SMA, the trending arc upwards should make it cross over that marker within the next week.

The stock has been seeing both up and down days accompanied by higher-than-average volumes lately, suggesting that investors have mixed thoughts on the stock’s direction.

However, the RSI reading of 40 is a good sign that ULTA is closer to being oversold rather than overbought – an opportunity to pick up the stock at a discount.

The Bottom Line

Based on Ulta’s full-year EPS estimates, this stock should be fairly valued at around $445 per share. A move to this price would represent a gain of more than 21% from its current trading price.

This stock delivers for investors looking to add a niche retail play with great long-term potential.

The above analysis of Ulta Beauty, Inc. (ULTA) was provided by financial writer Daniel Cross.

Long-Term Outlook for Ulta Beauty, Inc. (ULTA)

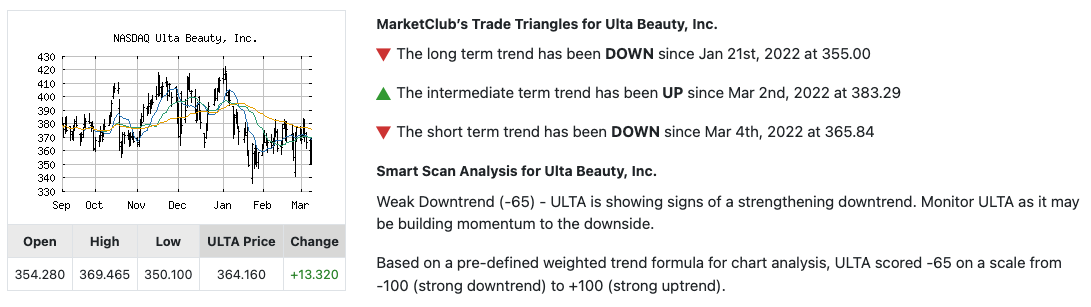

New price action points to a weak downtrend for ULTA. It will be important to monitor the stock for downside momentum.

This is not to say that the stock can’t turn around with hot short-term action.

While our last green monthly Trade Triangle caught a 38% move from November of 2020 to January 2021, the long-term signal issued on January 21, 2022, suggested that the swing had ended.

Be the first to know when ULTA’s trend turns upwards or when a new signal is triggered. Start your trial and add ULTA to your watchlist.