One of the most attractive features of investing in value stocks is the tendency for it to have the bad news already priced into it. That leaves a lot of unrealized upside potential just sitting in the stock, ready to move as soon as a catalyst sets it off.

In the case of one manufacturing company, a fallen stock price belies the booming market potential that could drive it much higher giving value investors a bargain buy.

A Best-In-Breed Manufacturer And Classic Value Stock Pick-Up

Magna International Inc. (MGA) is a $16.7 billion auto parts manufacturer specializing in mobility technology based out of Canada. It has more than 400 operational centers in 27 countries around the globe.

The company reported a solid first quarter earnings beat of $1.28 per share compared to the analysts consensus of $1.10 per share.

Sponsor Message

10 hot stocks with massive upside potential

America’s #1 Pattern Trader has found a way to squeeze profits out of Wall Street’s biggest names – giving folks the chance to make 25%, 75%, even 100+% on any given trade within a few days’ time. Today he’s lined up 10 stock patterns, including the stock names, how much they could increase, and when he believes it’ll happen.

Net sales beat estimates as well at $8.88 billion but production challenges due to the global chip shortage caused management to trim total 2022 guidance down to a range of $37.3 billion to $38.9 billion.

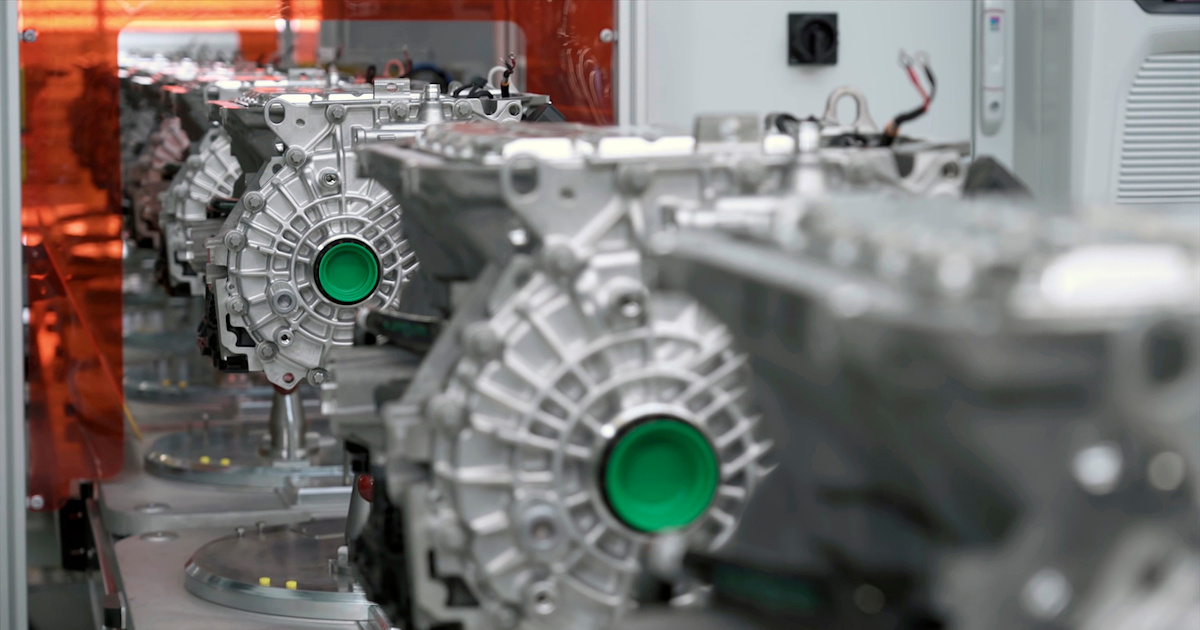

One of the biggest catalysts for Magna moving forward is the current boom in EV technologies.

The company has several deals working in its favor: the deal with Fisker to manufacture EV cars slated to start at the end of 2022, and a joint venture with LG Electronics to manufacture the LG Magna e-Powertrain.

Adding to this scenario is a push in US automakers to develop EV trucks which also rely on Magna’s e-powertrains and components.

While the semiconductor chip shortage has impacted the company’s production line, the bad news has already been priced into the stock. Right now, there is little downside risk and far more upside potential for investors.

Exane BNP Paribas initiated coverage on the stock in April giving it an “underperform” recommendation but did not cite a price target.

Despite the less-than-stellar review, contrarians should take this analysis as a note that this stock is underappreciated by Wall Street right now.

Fundamental Strength

The stock trades fairly cheaply at just 13 times earnings compared to the auto parts industry average of 19 times earnings.

It comes with a projected long term EPS growth rate of nearly 10% giving it a PEG ratio of less than 2 – a good sign that the stock is undervalued at the moment.

It carries a beefy 2.97% dividend yield giving investors some downside protection while also providing steady income along the way.

Technical Attraction

Magna’s stock chart shows a steep drop off in early March as the chip shortage and war in Ukraine caused metal prices to spike.

See the Full Technical Analysis Report for MGA

However, the 20-day SMA is near to crossing over the 50-day SMA which could initiate a bullish reversal over the next week or so.

Despite the decline, the RSI of 47 is solidly in the middle of the pack which means neither bears nor bulls currently hold sway over the stock’s direction.

The Bottom Line

Based on Magna’s full year EPS estimates, this stock should be fairly valued at around $80 per share – a significant gain of more than 32% from its current trading price range.

Contrarian investors and value investors alike should consider adding this stealthy pick-up to their portfolio for outsized returns.

The above analysis of Magna International Inc. (MGA) was provided by financial writer Daniel Cross.

Is MGA on our List of Top Stocks?

Does MGA rank in our list of the day’s top 50 stocks with the strongest technical momentum?

See the list and the stocks that could see significant breakouts in the days and weeks to come.