Yesterday, the Dow Jones Industrial Average (DJI) fell more than 700 points on trade war tensions.

The majority of stocks mirrored the broader market dip, with some of the more heavily-traded stocks like Apple, Inc. (AAPL), Intl Business Machines Corp (IBM), and Visa, Inc. (V) each falling more than 4%.

Yesterday was not the first sign of weakness as a number of exit signals were issued for hundreds of stocks last week.

MarketClub’s Trade Triangle signals find members well-supported technical trades AND they also protect members’ profits and save them from sharp drops.

Signals that Saved Members

* Results based on our Intermediate-Term Trading Strategy

Astronomics Corp (ATRO)

Astronics Corporation, through its subsidiaries, designs and manufactures products for the aerospace, defense, and electronic industries in the United States, North America, Asia, Europe, South America, and internationally. It operates in two segments, Aerospace and Test Systems.

| Date | Signal | Long/Short/Exit | Price | Return ($) | Return (%) |

| 2/11/19 | Monthly Green | Long | $33.18 | ||

| 3/6/19 | Weekly Red | Exit | $32.40 | $0.78 | 2.3% |

| 4/1/19 | Weekly Green | Long | $32.79 | ||

| 6/14/19 | Red Weekly | Exit | $40.24 | $7.45 | 22.72% |

| TOTAL | $6.67 | 20.1% |

The 6/14/19 signal saved members before ATRO dropped more than 30% from 6/14/19 to 8/5/19.

Woodward, Inc. (WWD)

Woodward, Inc. designs, manufactures, and services control solutions for the aerospace and industrial markets worldwide. The company’s Aerospace segment offers fuel pumps, metering units, actuators, air valves, specialty valves, fuel nozzles, and thrust reverser actuation systems for turbine engines and nacelles; and flight deck controls, actuators, servo controls, and motors.

| Date | Signal | Long/Short/Exit | Price | Return ($) | Return (%) |

| 1/29/19 | Monthly Green | Long | $88.50 | ||

| 3/11/19 | Weekly Red | Exit | $92.25 | $3.75 | 4.23% |

| 3/21/19 | Weekly Green | Long | $97.32 | ||

| 7/31/19 | Weekly Red | Exit | $111.90 | $14.58 | 14.9% |

| TOTAL | $18.33 | 20.7% |

The 7/31/19 signal saved members before WWD dropped 4.9% from 7/31/19 to 8/5/19.

DENTSPLY SIRONA Inc. (XRAY)

DENTSPLY SIRONA Inc. designs, develops, manufactures, and markets various dental and oral health products, and other consumable healthcare products primarily for the professional dental market worldwide. The company operates in two segments, Technologies & Equipment and Consumables.

| Date | Signal | Long/Short/Exit | Price | Return ($) | Return (%) |

| 1/4/19 | Monthly Green | Long | $38.90 | ||

| 2/26/19 | Weekly Red | Exit | $41.50 | $2.60 | 6.6% |

| 3/4/19 | Weekly Green | Long | $49.45 | ||

| 4/17/19 | Weekly Red | Exit | $48.74 | $0.71 | 1.4% |

| 5/2/19 | Weekly Green | Long | $51.50 | ||

| 7/16/19 | Weekly Red | Exit | $56.61 | $5.11 | 9.9% |

| TOTAL | $7.00 | 17.9% |

The 7/16/19 signal saved members before XRAY dropped more than 11% from 7/16/19 to 8/5/19.

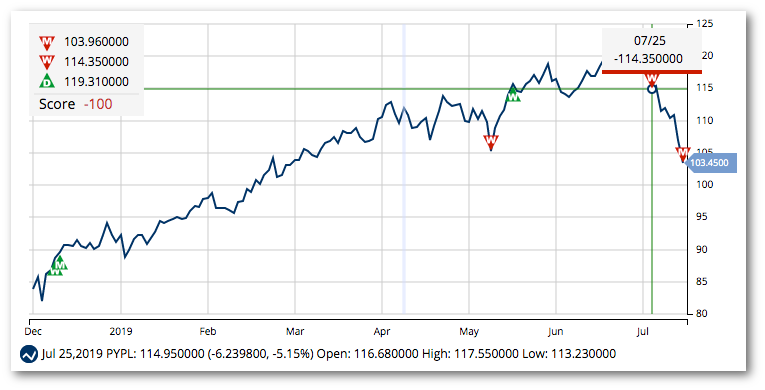

Paypal Holdings Corp, Inc. (PYPL)

PayPal Holdings, Inc. operates as a technology platform and digital payments company that enables digital and mobile payments on behalf of consumers and merchants worldwide. Its payment solutions include PayPal, PayPal Credit, Braintree, Venmo, Xoom, and iZettle products.

| Date | Signal | Long/Short/Exit | Price | Return ($) | Return (%) |

| 1/9/19 | Monthly Green | Long | $89.06 | ||

| 6/3/19 | Weekly Red | Exit | $106.52 | $17.46 | 19.6% |

| 6/10/19 | Weekly Green | Long | $115.14 | ||

| 7/25/19 | Weekly Red | Exit | $114.35 | $0.79 | 0.68% |

| TOTAL | $16.67 | 18.7% |

The 7/25/19 signal saved members before PYPL dropped more than 9% from 7/25/19 to 8/5/19.

Charter Communications, Inc. (CHTR)

Charter Communications, Inc., through its subsidiaries, provides cable services to residential and commercial customers in the United States. It offers subscription-based video services, including video on demand, high definition television, digital video recorder, pay-per-view, and spectrum mobile and spectrum guide services, as well as ad-supported free online video products.

| Date | Signal | Long/Short/Exit | Price | Return ($) | Return (%) |

| 1/31/19 | Monthly Green | Long | $334.76 | ||

| 7/26/19 | Weekly Red | Exit | $395.30 | $60.54 | 18.0% |

| TOTAL | $60.54 | 18.0% |

The 7/26/19 signal saved members before PYPL dropped more than 3.5% from 7/26/19 to 8/5/19.

These are just a few examples of how the Trade Triangles not only find optimal entry points for members, but also protect from big drops.

Join MarketClub right now to test our signals and also see the stocks that are flagged for strong downward price moves.