This year has been one of the most tumultuous years in recent history thanks to the COVID-19 pandemic, political tensions, and civil unrest.

While most market forecasters are focused more on what might happen over the next several months, it might be a good time to look at a sustainable long-term investment play.

For one company, investing in the future is just business as usual. For investors, it means a long-term commitment to continued growth and steady profits.

An Aerospace Staple and Global Innovator

Lockheed Martin Corporation (LMT) is a $108 billion aerospace and defense company and the world’s largest defense contractor, with 78% of its revenues stemming from military sales (as of FY2013).

In addition to the U.S. Department of Defense, the company also has contracts with foreign governments, private contractors, the U.S. Department of Energy, and NASA.

The company reported an earnings beat for the second quarter of $5.79 per share compared to the analysts’ consensus of $5.72 per share. Net sales grew 12.5% for the quarter from $14.4 billion to $16.2 billion year-over-year. Cash flow from operations climbed to $2.2 billion from $1.7 billion.

Is LMT a good options play? See if Lockheed Martin Made Our Top Options List

When it comes to cutting edge technologies and innovative designs, Lockheed Martin is usually involved. Not only does the company have a recession-proof business with its military contracts, but it’s also involved in the space and energy industry. With Boeing, its joint venture United Launch Alliance is gearing up to be a launch provider for more private spacecraft launches.

If space technology wasn’t futuristic enough, the company is also working on a nuclear fusion reactor – once considered the stuff of science fiction – and could be ready for implementation by early 2025.

Morgan Stanley initiated coverage on the stock in early September, giving it an “overweight” recommendation and a price target of $509 per share.

The Fundamental Basis

The stock trades at 17 times earnings, just under the defense industry average of 19 times earnings. It also carries a long-term EPS growth rate estimate of 16%, giving the stock a PEG ratio close to 1. This ratio is a strong sign to investors that LMT may be undervalued.

The company isn’t just a defense contractor; it is also a defensive stock play. Lockheed Martin’s 2.70% dividend yield helps protect investors against sharp downside movements.

The Technical Basis

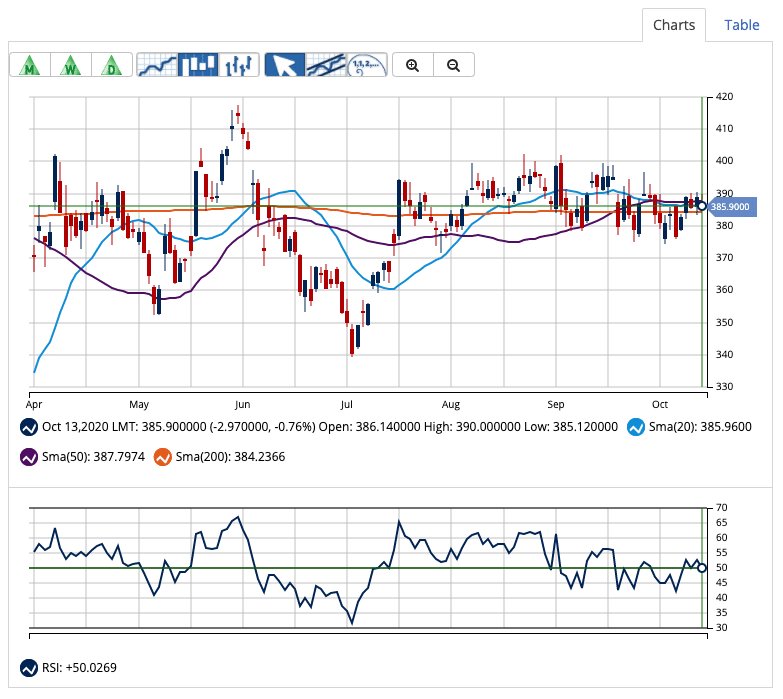

Lockheed Martin’s chart shows small ups and downs with a general sideways trend. This is even more apparent when we look at the simple moving averages (SMAs). The 20-day, 50-day, and 200-day SMAs are nearly overlapping with each other. The RSI is similarly right down the middle at around 52.

Does LMT have the technical qualities of a strong optionable stock? See our Top Options List

However, the candlesticks show recent bullish activity. LMT could see aggressive buying from investors, triggering a more sustained upwards trend.

The Bottom Line

Based on Lockheed Martin’s full-year EPS estimates, this stock should be fairly valued at around $435 per share – a gain of around 13% from its current trading price range.

As a company firmly rooted in innovation, LMT is a long-term play that could last more than a decade. Add in a healthy dividend and a recession-proof business, and investing in Lockheed Martin looks like a smart move for investors.

The above analysis of LMT was provided to MarketClub by Daniel Cross, professional trader and financial writer.

MarketClub’s Analysis of LMT

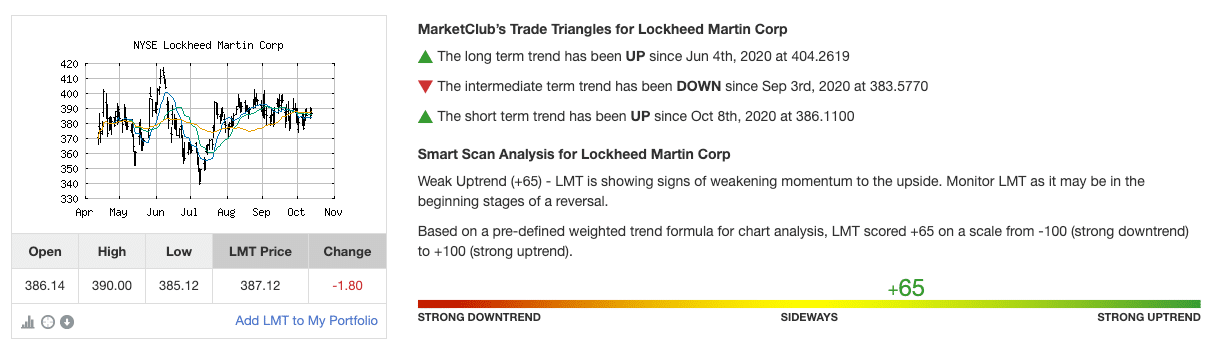

Members are sitting tight, waiting for LMT’s trend to strengthen in one direction or another.

With a Chart Analysis Score of +65, the stock’s price is moving in a sideways direction. The stock has been unable to break through the $400/share price since dropping down in early June.

MarketClub members looking to play a potential long-term swing would wait until the intermediate-term trend also turns bullish.

Learn more about how our technology spots trend changes and how our members ride price swings for over 350K stocks, futures, forex, ETF, and forex symbols.