The Trade Triangle technology just issued new buy signals for 3 high volume, well-known stocks.

Our technology has alerted members of these major trend shifts which propel these stocks into levels of great trend strength.

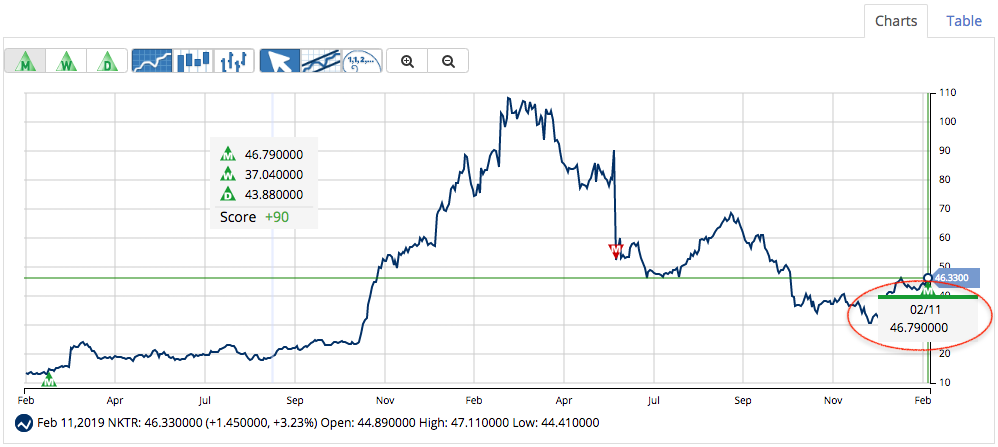

Buy Signal for Nektar Therapeutics (NASDAQ_NKTR)

Nektar Therapeutics, a research-based biopharmaceutical company, discovers and develops drug candidates for cancer, auto-immune disease, and chronic pain in the United States.

Symbol: NKTR

Avg. Volume: 2,130,163

Market Cap: 8.02B

2Y MarketClub Return*: $80.62/share (577%)

A new monthly Trade Triangle was issued for NKTR on 2/11/19 at $46.79 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. While the intra-day term is flopping around, the Smart Scan Scores sits at a +90 suggesting that this stock is in a firm uptrend.

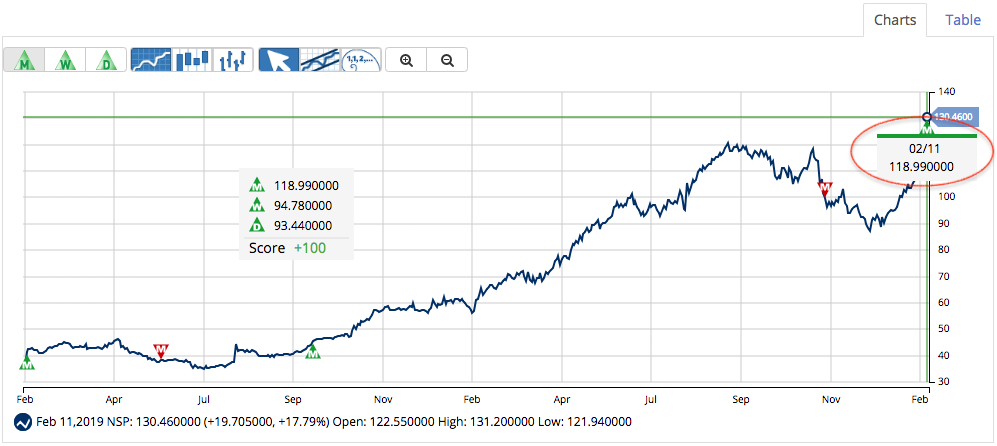

Buy Signal for Insperity, Inc. (NYSE_NSP)

Insperity, Inc. provides human resources (HR) and business solutions to enhance business performance for small and medium-sized businesses in the United States.

Symbol: NSP

Avg. Volume: 470,803

Market Cap: 5.48B

2Y MarketClub Return*: $19.6/share (50.48%)

A new monthly Trade Triangle was issued for NSP on 2/11/19 at $118.99 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. This stock remains in the confines of a strong long-term trend.

Buy Signal for Arrowhead Pharmaceuticals (NASDAQ_ARWR)

Arrowhead Pharmaceuticals, Inc. develops medicines for the treatment of intractable diseases in the United States.

Symbol: ARWR

Avg. Volume: 1,669,536

Market Cap: 1.59B

2Y MarketClub Return*: $6.37/share (312%)

A new monthly Trade Triangle was issued for ARWR on 2/11/19 at $16.09 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. This stock is rated as a +100 with all trends strongly moving in the same upward direction.

Join MarketClub to get up-to-date lists with new buy signals for stocks, ETFs, futures, Forex, and ETFs!

*Results calculated using the long-term method with both long and short positions.