It doesn’t matter if you have been trading for 20 minutes or 20 years – having a trading plan is crucial to your success.

A trading plan allows you to make decisions in a pre-planned, non-emotional manner. Not only does creating a trading plan set the tone for your strategy, but it also holds you accountable.

Traders tend to jump into the markets based on emotion – “This could be the start of a big move. I should get in quick so that I don’t miss out.”

If you decide on a trade based on emotion, investment show idea, or rumor, you will likely make a bad decision. This is one of the worst possible ways to trade and one of the quickest ways to lose money.

By setting your trading plan, you prepare yourself to emotionally handle anything that happens in the market. With your plan in hand, you agree to follow a set of your own rules based on your unique risk tolerance, preferences, or goals.

Creating a trading plan is a virtal step, and it doesn’t have to take hours to prepare.

What is the point of a trading plan?

Where do most entrepreneurs start when creating a new business? They start with a business plan, a road map that tests feasibility, guides the business towards a goal, and prepares for bumps in the path.

Traders and investors should start in the same place.

A trading plan is a step-by-step guide to help traders move towards success and rationally navigate around potholes created by the markets or by emotions.

No matter how hard we try, money triggers emotions. Money is more than just the dollars and cents in brokerage accounts; it’s spending time with our children, taking our spouse on a trip around the world, or retiring early.

As a whole, traders are greedy when trades are performing and fearful when they are not.

When you trade with a solid plan, you ignore fear and greed – you follow your rules before you follow your emotions. You get out of trades before they sour, and you allow trades to develop before we bail.

What should I include?

Every plan is different because every trader is different. From a simple set of rules to a complex web of decisions, trading plans eliminate emotional trading and use learned lessons to improve performance.

In the simplest terms, a trading plan defines:

- what we want to accomplish

- how we’ll accomplish our mission

- when we’ll use our backup plan (if needed)

- why we want to make the trade

Again, some traders may choose to document every decision needed to find, execute, manage, and close a trade.

Their plan may include a lengthy checklist of criteria that must be met before even considering investing and then another list that verifies their brokerage account setup.

Other traders may use a simple go/no-go model to make decisions.

The key is to use a trading plan that works best for you, considering your strength, weaknesses, and goals.

Free Trading Plan Template

At MarketClub, we believe that success and discipline go hand in hand. Truly successful traders (not just ones chasing outrageous claims and silly picks) create a plan and stick with it.

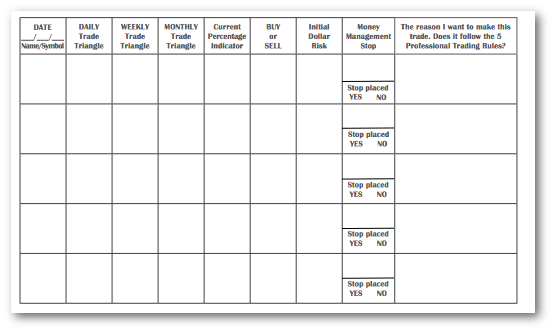

We’ve created a simple trading plan template that you can download and start using right now.

This trading plan will help you consider your trading style, set your goals, and follow your plan.

How To Create Your Trading Plan

- STEP 1: Jot down your reasons for buying or selling a particular market.

- STEP 2: Record your entry points for the market you’re about to trade.

- STEP 3: Next, write down when you are going to exit this market. This can be with a stop, a new exit signal, or when a market reaches a predetermined target zone.

- STEP 4: Make these decisions when the market isn’t going wild.

- STEP 5: Finally, review your game plan every day to see whether things are going according to what you expect. This allows you to adjust your money management stops and your target zones in a non-emotional way.

Download your free template from MarketClub, print it, and stick with it!

Use your trading plan along with MarketClub to reduce emotion and listen only to the markets.

This post was updated July 13, 2021.