One of the most attractive features of a utility stock is its defensive capabilities. Consistent earnings regardless of economic conditions and low beta ratios make for an ideal safe-haven asset. When you can find a stock that meets that criteria, but comes with the additional bonus of positive momentum, it’s worth taking a closer look.

A Best-In-Breed Utility for Your Portfolio

For one utility company, a new 52-week high and strong EPS growth expectations make for a defensive play that’s hard to pass up for any investor.

American Water Works Company (AWK) is an $18.5 billion water utility company that provides water and waste-water services within the US and Canada.

The company met 4th quarter EPS estimates reporting $0.69 per share which fell in line with analysts’ expectations. Management reiterated guidance for 2019 with EPS estimates between $3.54 to $3.64 while simultaneously planning to invest around $8.0 billion to $8.6 billion over the next five years.

The company added 25,000 new customers through its acquisition of Pivotal Home Solutions in 2018, and management is looking for even more opportunities in 2019. The stock was upgraded in December by Robert W. Baird from “neutral” to “outperform” suggesting that Wall Street isn’t dismissing American Water Work’s potential either. Investors can take advantage of both growth and defense all in one stock play.

Fundamentally Solid

The stock trades in line with the industry average but comes with a much higher long term EPS growth rate of more than 15%. This uncommon growth estimate also coincides with a low beta ratio of just 0.24 making it resistant to large swings in market volatility – a trademark of defensive stocks.

AWK – Free Technical Analysis Report from MarketClub

The stock carries a decent dividend for investors which is currently yielding 1.8%. Possessing a dividend payout ratio of just 56% means that the company can increase its dividend down the road as well.

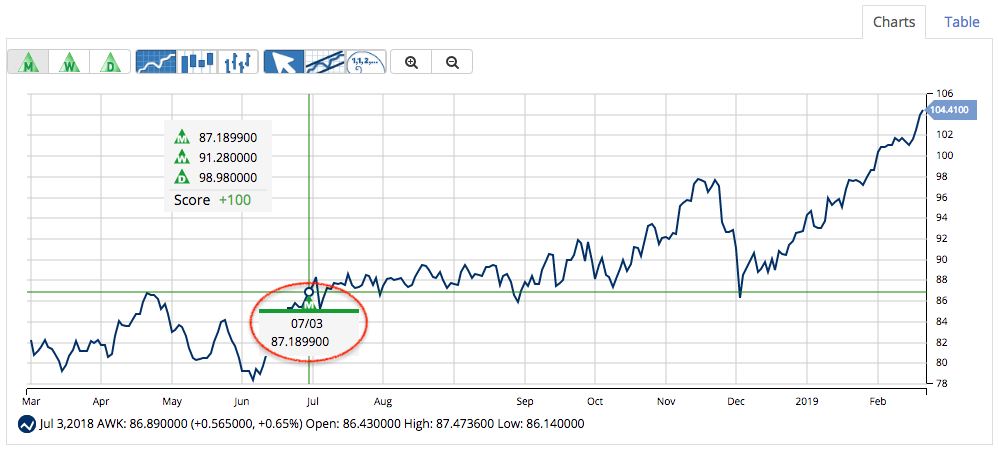

Technical Movement

American Water Works hit a new 52-week high last week revealing to investors a building level of positive momentum in the stock price. The 20-day SMA crossed over the longer 90-day SMA back in January, and the gap between the two has been steadily increasing since. The rise has been accompanied by normal trading volumes as well, letting investors know that this momentum could be a lasting phenomenon.

The Bottom Line

Based on American Water Work’s full-year EPS estimates, this stock should be fairly valued at around $108 per share – a modest gain of less than 8% with the dividend reinvested. But like most utilities, American Water Works’ true value to investors is one of wealth preservation. For investors, a safe-haven asset undergoing strong bullish momentum is a rare opportunity that shouldn’t be overlooked.

The above analysis provided by Daniel Cross, professional trader and financial writer.

What Does MarketClub Say?

MarketClub’s agrees that American Water Works Co, Inc. (AWK) is in a strong uptrend with a chart analysis score of +100.

Long-term traders would have entered into a long position after following a new monthly Trade Triangle on July 3, 2018, at $87.18. As of the close on March 13, 2019, AWK is up about 20.3%.

Members, you can add AWK to your watchlist and set your alert so you’ll know the second our technology detects any weakness for this stock.