Sometimes investors don’t need to look very far to find a great deal on Wall Street. While value investors look for the bargains everyone else misses, growth investors prefer rising stars. Just because a stock is making waves, it doesn’t mean that it’s too late for you to ride it to higher returns.

One semiconductor company is hitting new highs and setting the stage for even more accelerated growth. This price momentum is a recipe for bigger profits for investors.

A Best-In-Breed Tech Company Hitting New Highs

Advanced Micro Devices (AMD) is a $35 billion semiconductor company that manufactures computer processors and other technical computer components. The company is the second-largest supplier of x86 microprocessors. AMD follows closely behind Intel and maintains a duopoly along with Nvidia for graphics processing units.

Get the entry and exit signals for AMD

The company reported a slight earnings beat for the first quarter at $0.06 per share compared to the analysts’ estimate of $0.05 per share. For the second quarter, scheduled to be released June 24th, analysts are anticipating EPS of $0.08 per share.

The company has been making headlines. Both Microsoft and Sony will be using AMD processors for both of its trademarked gaming consoles. The move should set AMD up as the premier gaming processor manufacturer. It could also propel the stock well above even higher end analyst estimates over the next 12 months.

The stock was upgraded by Morgan Stanley earlier this month from an “underweight” recommendation to “equal-weight” with a price target range of $17 to $28. Similarly, BofA/Merrill reiterated its recommendation of “buy” but with a much higher price range target of $35 to $40. Get the entry and exit signals for AMD.

The Fundamental Analysis of AMD

Like any fast-moving growth stock, Advanced Micro comes with a high multiple currently registering at 79 times earnings. The long-term EPS growth rate of 40% though means that the stock comes with a PEG ratio of less than 2 – a benchmark metric that is used to determine if the stock is overvalued or not.

The Technical Analysis of AMD

Bullish momentum is picking up steam fast in the stock, as evidenced by the new 52-week high and remarkable performance – up 80% year-to-date. The stock price is trading well above both the 20-day and 90-day SMA. This pull-away suggests an accelerating trend higher. With the RSI (relative strength index) spiking above 70 though, investors may want to keep a careful eye out for any pullbacks in the stock as buying pressure slows.

The Bottom Line

Based on Advanced Micro Devices’ full-year EPS estimates, this stock should be fairly valued at around $40 per share – a gain of more than 21% from its current price point. Growth-oriented investors will find AMD offers high performance and big possibilities for a stagnating portfolio.

The above analysis for AMD was provided by Daniel Cross, professional trader and financial writer.

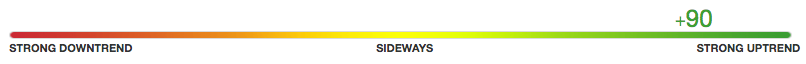

MarketClub’s Analysis for AMD

MarketClub agrees that AMD has trend strength and momentum pushing the stock into new highs.

With a +90 Chart Analysis Score and green Trade Triangles across the board, this stock has the technical backing to see a strong push higher.

AMD hit a new all-time high on June 10, 2019, at $34.30.

While the stock price saw a modest pullback, the short-term, intermediate-term, and long-term trends are still strong and suggesting there is more room to the upside for AMD.

MarketClub members following the monthly Trade Triangle strategy would have entered a long position for AMD on February 25, 2019, at $25.14.

As of June 11, 2019, members would be looking at unrealized gains of $7.29/share (28.9%).

Our members are the first to know when trends shift for any of the 350K stocks that we cover. With our alerts and signals, reversals for Advanced Micro Devices will never come as a surprise.

Not a member? Join MarketClub now to get signals and alerts for AMD as well as 350K more stocks, futures, ETFs, forex, or mutual funds markets.