Updated January 21, 2020

Many companies that pay strong and reliable dividends are powerful performers able to offer extra cash to investors.

This cash or stock offer sweetens the deal for the investors that are able to find only the strong-trending stocks with the highest dividend yields.

With MarketClub’s scanning technology, members can quickly confirm that high-dividend payers also have stable upward trajectories.

Here are the 3 highest dividend-paying stocks with the strongest MarketClub rating…

Johnson & Johnson (JNJ)

Johnson & Johnson researches, develops, manufactures, and sells health care products under three segments: consumer, pharmaceutical, and medical devices.

Forward Dividend Yield: $3.80 (2.55%)

Avg. Volume: 6,596,072

Market Cap: 393B

Last Monthly Green Trade Triangle: 11/22/19 @ $137.49

Unrealized Gain/Loss Since Triangle: $11.98 (8.7%)

Smart Scan Score: +100

See Member-Only Signal for JNJ

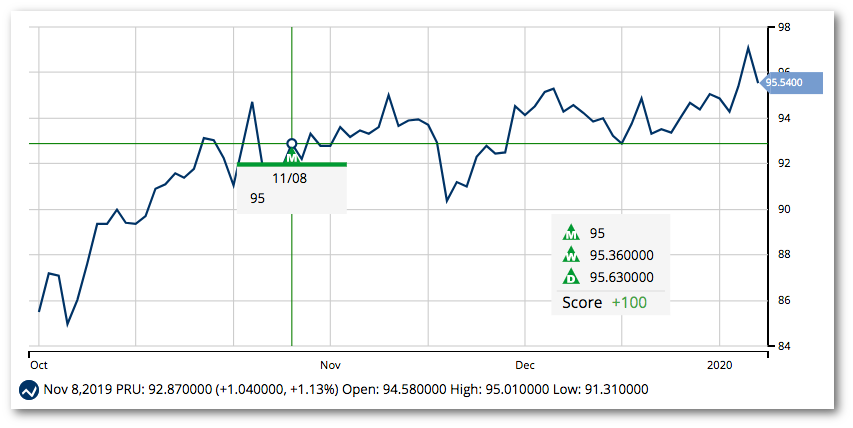

Prudential Financial, Inc. (PRU)

Prudential Financial, Inc. provides insurance, investment management, and other financial products.

Forward Dividend Yield: $4.00 (4.12%)

Avg. Volume: 2,040,267

Market Cap: 37.9B

Last Monthly Green Trade Triangle: 11/8/19 @ $95

Unrealized Gain/Loss Since Triangle: $0.54 (0.56%)

Smart Scan Score: +100

See Member-Only Signal for PRU

Medifast, Inc. (MED)

Medifast manufactures and distributes weight loss, healthy living products, and consumable nutritional items. Medifast’s products can be purchased online, through call centers and health advisors, and through direct consumer marketing.

Future Dividend Yield: $4.52 (3.91%)

Avg. Volume: 404,548

Market Cap: 1.3B

Last Monthly Green Trade Triangle: 1/14/20 @ $113.62

Unrealized Gain/Loss Since Triangle: $1.50 (1.3%)

Smart Scan Score: +100

See Member-Only Signal for MED

The market is always moving, creating opportunities at every moment.

With MarketClub, members employ solid analysis on big-dividend payers to find trades with promising payouts.

Begin Your 30-Day Trial to MarketClub

Gain access to powerful scans and analysis to confirm the trends of more these high-paying dividend stocks and over 350K additional markets.