MarketClub’s Trade Triangle and scoring technology have cranked out the best stocks for September 2019 based on their technical trend strength.

These stocks have strong short-term, intermediate-term, and long-term trends with the support to continue their upward trajectory.

Remember, the markets move fast and things may quickly change for these stocks.

Our MarketClub members have access to entry and exit signals so they’ll know when these trends start to reverse.

See exactly where these stocks rank on MarketClub’s free Top Stocks List.

Top Stocks to Buy for September 2019

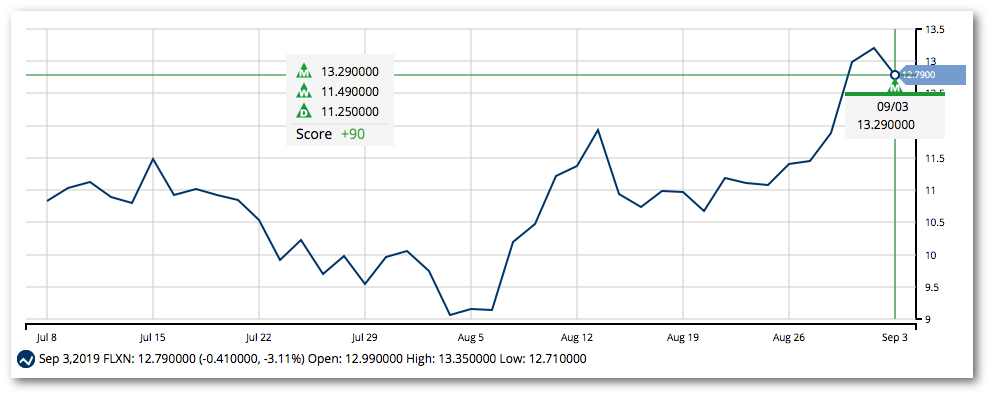

Flexion Therapeutics (FLXN)

Flexion Therapeutics, Inc., a biopharmaceutical company, focuses on the discovery, development, and commercialization of anti-inflammatory and analgesic therapies for the treatment of patients with musculoskeletal conditions.

Symbol: FLXN

Avg. Volume: 573,135

Market Cap: 487M

Monthly Green Trade Triangle: 9/3/19 @ $13.29

Smart Scan Score: +90

NRG Energy, Inc (NRG)

NRG Energy, Inc., together with its subsidiaries, operates as an energy company in the United States. The company is involved in the producing, selling, and delivering electricity and related products and services to 3.1 million residential, industrial, and commercial consumers. It generates electricity using natural gas, coal, oil, solar, nuclear, wind, fossil fuel, and nuclear sources.

Symbol: NRG

Avg. Volume: 3,216,006

Market Cap: 9.04B

Monthly Green Trade Triangle: 9/3/19 @ $36.53

Smart Scan Score: +100

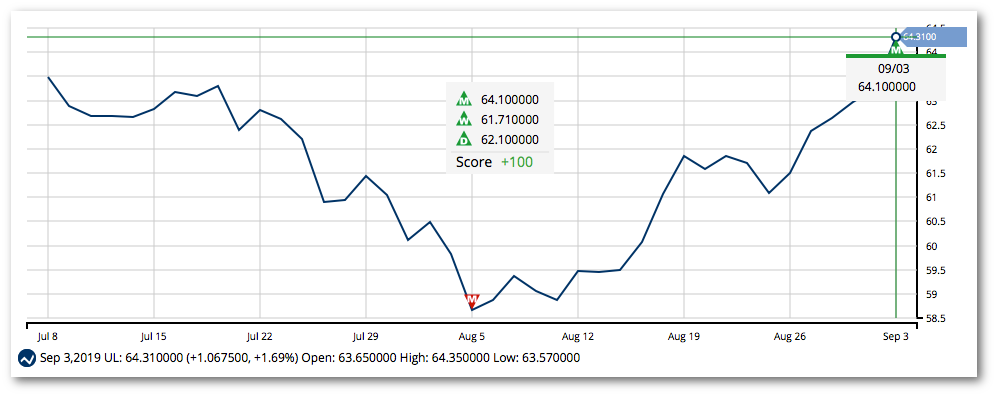

The Unilever Group (UL)

The Unilever Group, together with its subsidiaries, operates in the fast-moving consumer goods industry worldwide. It operates through three segments: Beauty & Personal Care, Foods & Refreshment, and Home Care. The Beauty & Personal Care segment offers skin care and hair care products, deodorants, and oral care products under the Axe, Dove, Lux, Rexona, and Sunsilk brands, as well as others, such as TRESemmé, Signal, Lifebuoy, and Vaseline brands.

Symbol: UL

Avg. Volume: 650,307

Market Cap: 168.7B

Monthly Green Trade Triangle: 9/3/19 @ $64.10

Smart Scan Score: +100

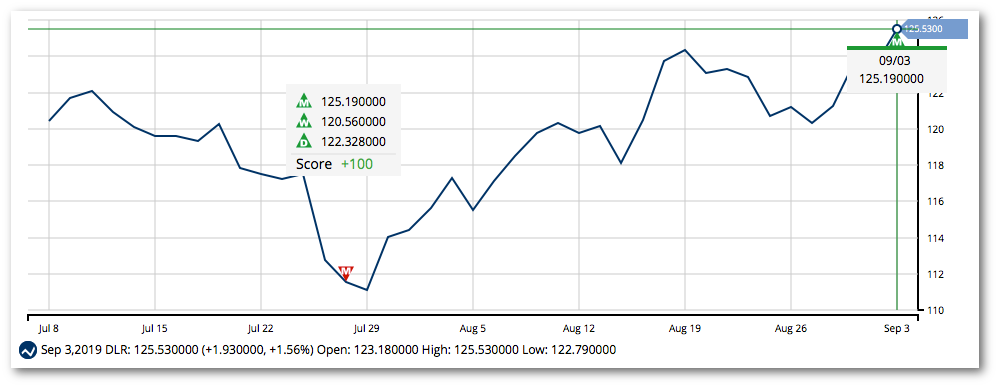

Digital Realty Trust, Inc. (DLR)

Digital Realty supports the data center, colocation and interconnection strategies of more than 2,000 firms across its secure, network-rich portfolio of data centers located throughout North America, Europe, Latin America, Asia, and Australia. Digital Realty’s clients include domestic and international companies of all sizes, ranging from cloud and information technology services, communications and social networking to financial services, manufacturing, energy, healthcare, and consumer products.

Symbol: DLR

Avg. Volume: 1,034,653

Market Cap: 26.1B

Monthly Green Trade Triangle: 9/3/19 @ $125.19

Smart Scan Score: +100

Medical Properties Trust, Inc. (MPW)

Medical Properties Trust, Inc. is a self-advised real estate investment trust formed to acquire and develop net-leased hospital facilities. The Company’s financing model facilitates acquisitions and recapitalizations and allows operators of hospitals to unlock the value of their real estate assets to fund facility improvements, technology upgrades and other investments in operations.

Symbol: MPW

Avg. Volume: 4,324,250

Market Cap: 8.39B

Monthly Green Trade Triangle: 9/3/19 @ $18.84

Smart Scan Score: +100

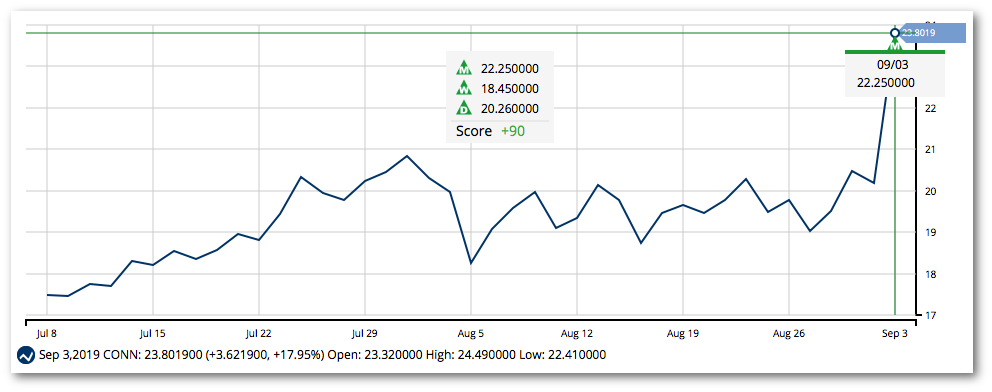

Conn’s Inc. (CONN)

Conn’s, Inc. operates as a specialty retailer of durable consumer goods and related services in the United States. It operates through two segments, Retail and Credit. The company’s stores offer furniture and mattress, including furniture and related accessories for the living room, dining room, and bedroom, as well as traditional and specialty mattresses; and home appliances, such as refrigerators, freezers, washers, dryers, dishwashers, and ranges.

Symbol: CONN

Avg. Volume: 536,656

Market Cap: 761.1M

Monthly Green Trade Triangle: 9/3/19 @ $22.25

Smart Scan Score: +90

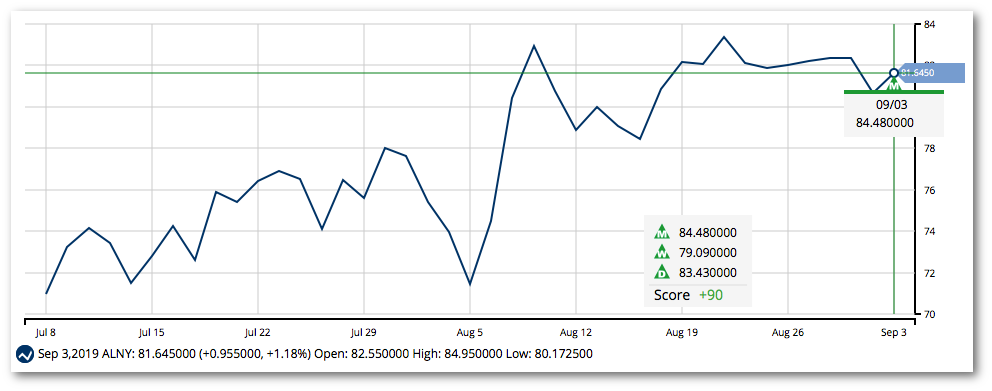

Alnylam Pharmaceuticals, Inc. (ALNY)

Alnylam Pharmaceuticals, Inc., a biopharmaceutical company, focuses on discovering, developing, and commercializing RNA interference (RNAi) therapeutics. The company’s pipeline of investigational RNAi therapeutics focus on genetic medicines, cardio-metabolic diseases, hepatic infectious diseases, and central nervous system/ocular diseases. It provides ONPATTRO (patisiran), a lipid complex injection for the treatment of the polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults.

Symbol: ALNY

Avg. Volume: 703,132

Market Cap: 9.09B

Monthly Green Trade Triangle: 9/3/19 @ $84.48

Smart Scan Score: +100

Let us send you the 50 top-ranked stocks every day.

Request the free Top Stocks List from MarketClub.