COVID-19 has reshaped what global business looks like and how everyday consumers live. Work-from-home transitions and online shopping have become the new norm. Companies have had to learn how to adapt quickly to stay profitable.

But some businesses had begun a shift to an online format even before the coronavirus outbreak. For these innovators, forward-thinking gives them the ability to meet the surge of online demand.

As consumers begin to adjust to buying their groceries and other household essentials online, one retail conglomerate, in particular, is set to prosper.

A Neighborhood Brand Name and Retail Superstar

Target Corporation (TGT) is a $55 billion retail and discount store conglomerate and the 8th largest retailer in the US. It operates more than 1,868 stores across the United States.

The company reported a fourth-quarter earnings beat of $1.69 per share compared to the analysts’ consensus estimate of $1.66 per share. While in-store sales have declined, the company saw a massive spike in its e-commerce segment, with online sales climbing 275% year-over-year as of mid-April.

|

Discover Warren Buffett’s Secret Trading Tool Buffett quietly uses this trading tool to make billions on the side of his value-investing technique. Learn this secret trading tool and a strategy to place similar low-risk, high-profit potential trades. |

When the topic of online retailing comes to mind, most investors think of Amazon. The traditional brick-and-mortar stores like Target have largely been ignored. However, Target is well-positioned to meet the new online demand from consumers, and the growth coming from the e-commerce segment could be the key to this stock breaking out higher.

BMO Capital Markets upgraded its recommendation on the stock in April from “market perform” to “outperform” along with a price target bump from $115 per share to $125 per share.

Taking Stock in the Fundamentals

The stock trades cheaply at just 17 times earnings compared to the whopping 65 times earnings for diversified retailers and almost half of the S&P 500’s 31 times earnings multiple.

The low beta of just 0.73 means that the stock should help lower portfolio volatility. The stock carries a healthy 2.45% dividend yield, giving investors additional returns while providing some protection against sharp downside movements.

The Technical Target

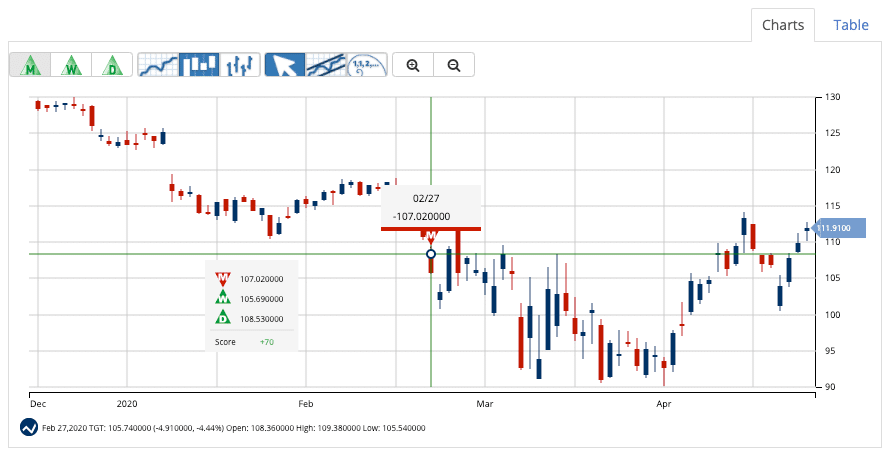

The stock chart for Target shows some erratic behavior with several identifiable peaks and valleys over the past several months. The 20-day SMA is currently trending below both the 50-day and 200-day SMA but is closing the gap quickly.

Investors should watch for key crossovers in the next week or two to signal further bullishness. In the past few days, the stock has seen aggressive buying accompanied by an uptick in the price – another strong bullish signal that momentum is building.

The Bottom Line

Based on Target’s full-year EPS estimates, this stock should be fairly valued at around $125 per share – representing a gain of about 16% from its current trade price.

Investors looking for a retail play outside of the tech space should see Target as a value buy to hold for the long term.

The above analysis of TGT was provided to MarketClub by Daniel Cross, a professional trader and financial writer.

What Does MarketClub Say?

Currently, Target Corporation (TGT) has a Chart Analysis rating of +70.

The short-term and intermediate-term trends are strong, but TGT has yet to develop a strong long-term bullish trend. Our system will review every data tick and will alert members if TGT continues to increase in technical strength.

If you’re a MarketClub member and a longer-term trader, you can add TGT to your watch list and set your monthly Trade Triangle alert. You’ll be the first to know when TGT shifts into a bullish trend with significant support.

Not a member? Start your 30-day trial and get the next signal for Target (TGT).