New vaccines developed by biotechnology and pharmaceutical companies have helped boost the economic recovery. Many drug manufacturing stocks saw a quick spike on COVID vaccine announcements. However, one strong sector player has yet to see a stock price jump.

With long-term growth opportunities, this pharmaceutical company is one to watch as we head into the new year.

A Best-in-Class Pharmaceutical Giant With Room to Run

Gilead Sciences (GILD) is a $72 billion pharmaceutical company and drug manufacturer primarily focused on antiviral treatments used for HIV, hepatitis, influenza, and more.

The company reported a third-quarter earnings beat of $2.11 per share compared to the analysts’ estimates of $1.90 per share. Sales grew 18% year-over-year to $6.49 billion while EPS jumped 29% year-over-year.

Like many of the big drug companies, Gilead has developed its own COVID-19 vaccine – Veklury. As the first FDA-approved drug to combat COVID-19, it’s already putting up big numbers with sales of $873 million per quarter.

Biktarvy, a drug that proved to be more than 90% effective at suppressing HIV infection, is also a large part of its portfolio, with revenue gains of $300 million in the segment year-over-year.

The company has an additional catalyst working in its favor. The company recently closed on a $21 billion acquisition of Immunomedics and gained access to its breast cancer treatment drug, Trodelvy. Gilead is tracking positive gains from the deal already.

Gilead Sciences also announced plans to acquire the German-based MYR Pharmaceuticals for $1.5 billion euros. The acquisition will likely be a large part of the company’s plans going into 2021.

Morgan Stanley resumed its coverage of Gilead in November with an “equal-weight” recommendation and a price target of $67 per share. Despite the recent activity in biotech stocks, there hasn’t been much analyst coverage on Gilead Sciences. But value pick-ups can often be found where Wall Street isn’t looking.

The Fundamental Core

The stock trades cheaply at just nine times earnings compared to the pharmaceuticals industry average of 29 times earnings.

GILD comes with a hefty 4.75% dividend yield, giving investors an impressive income-generating play as well. This healthy dividend helps protect against sustained downside movements.

The Technical Structure

On first impression, Gilead’s chart doesn’t inspire much, given its steady down-sloping trend over the past five months.

The 20-day and 50-day SMAs are trending together with no hint of which one might overtake the other either. However, the low RSI reading of 32 indicates that the stock is likely oversold at the moment and should be due for a bullish turnaround sometime in the next trading week.

The Bottom Line

Based on Gilead’s full-year EPS estimates, this stock should be fairly valued at around $70 per share. A move to this fair value would represent a gain of more than 22% from its current trading price.

For investors looking to cash in on the drug manufacturing boom, this stock provides outsized growth opportunities along with an impressive high-yield dividend play.

The above analysis of GILD was provided by Daniel Cross, professional trader and financial writer.

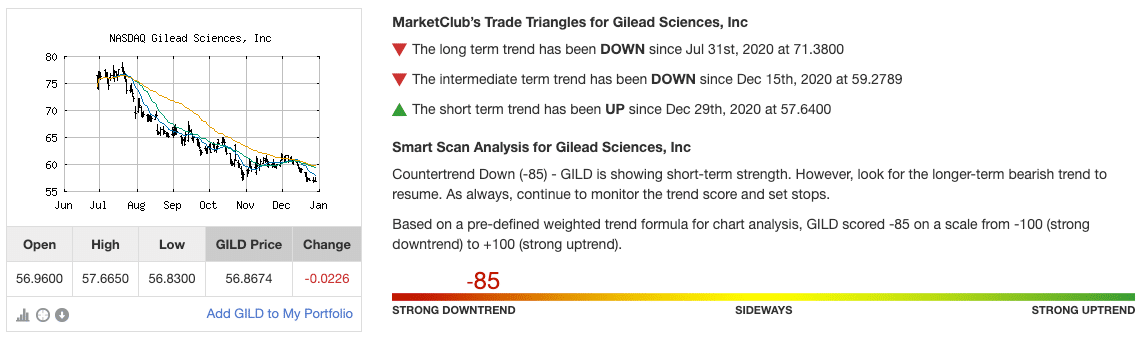

MarketClub’s Analysis of GILD

There is a fairly strong bearish trend for GILD according to MarketClub’s technical chart analysis.

With a -85 score, GILD’s price is likely to continue to the downside, unless market action can disrupt the trend.

A red Trade Triangle was last triggered on July 31, 2020, at $71.38. The stock has since fallen $14.49/share (20.2%).

MarketClub members following the long-term strategy will continue to wait on the sidelines or ride GILD to new intermediate-term lows.

MarketClub will continue to monitor every price tick for GILD, ready to detect if and when the bearish trend begins to turn.

Join MarketClub now to get the signals, daily analysis, and trend score for GILD.