Trading activity in Gamestop (GME) took national headlines last week when a Redditor called for investors to buy stock in the company to create a “short-squeeze.”

Because the stock was heavily shorted by hedge funds and other institutional fund management, the sudden uptick in the stock’s price instigated a rush to cover their short positions sending the stock skyrocketing upwards.

For investors, betting on a short-squeeze isn’t enough to justify a stock purchase. But finding a stock that offers solid fundamentals along with the possibility of a short-squeeze means more opportunities to profit as we head deeper into the year.

A Short-Squeeze Play Worth Holding Onto

Blue Apron Holdings (APRN) is a $168 million internet retail company known for its mail-order ingredient and recipe products that allow customers to cook custom meals at home.

The company reported a third-quarter earnings beat of -$0.96 per share compared to the analyst expectations of -$1.25 per share. Management gave some positive guidance and a statement that said that business was better than expected.

One of the biggest catalysts for the stock is the continuation of social distancing protocols and food delivery services. The company’s meal-by-mail services fits well into the new paradigm of cooking at home and shopping from home.

The stock hasn’t had much analyst coverage over the past year. The most recent coverage was an upgrade in July by Canaccord Genuity from “hold” to “buy” and given a price target of $18 per share.

The Fundamental Case

Since the stock currently has negative earnings, standard P/E ratio analysis can’t be used. Instead, we can look at the stock’s estimated EPS growth rate of nearly 40% to see that it is putting up solid growth numbers.

The stock has a rather large short float of 21%. This ratio creates a constant bearish pressure that makes strong jumps higher difficult. For investors, the possibility that enough buying activity could trigger a short-squeeze makes it an interesting stock to watch over the next few months.

The Technical Case

The chart for Blue Apron shows the stock leaping higher to kick off the year on higher-than-average trading volumes. Generally, this is a strong bullish sign that a positive trend will continue.

But the real story here is the high RSI of 65. A stock is usually considered “overbought” at around 70. In a stock that has been heavily shorted, a large influx of buyers could trigger a “short-squeeze” scenario.

The Bottom Line

Based on Blue Apron’s full-year EPS estimates, this stock should be fairly valued at about $12.50 per share. A move to this price would represent a gain of nearly 40% from its current trading price.

Investors looking to speculate on short-squeeze opportunities but don’t want to take on too much risk should consider adding this stock to their portfolio. Even if the short squeeze never happens, this stock has solid fundamentals that should drive it higher over the long term.

The above analysis of APRN was provided by financial writer Daniel Cross.

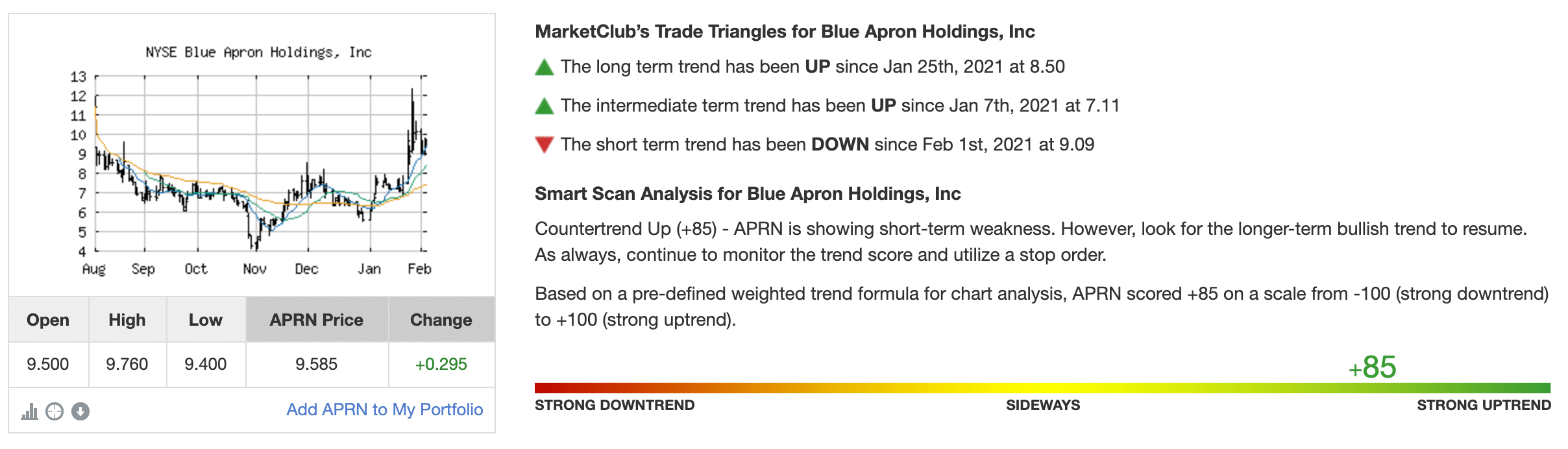

MarketClub’s Analysis of APRN

While APRN is experiencing some short-term weakness, the long-term trend still points towards a move higher.

The long-term trend was detected on January 25, 2021, at $8.50. The stock has since moved $1.08/share (12.7%) in less than 10 trading sessions.

While the short-term red Trade Triangle should prompt caution, Blue Apron’s stock still remains in an uptrend.

Want to know when APRN moves back into a strong uptrend (+100 Chart Analysis Score)? Add APRN to your watchlist for notifications.

Not a MarketClub member? Not a problem!