No matter the state of the economy, value investors are always on the lookout for bargain pickups.

Strong growth, weak growth, recession – there is always an underpriced or underappreciated market segment. While everyone else focuses on technology stocks and other big Wall Street favorites, the transportation sector has been stealthily growing stronger.

For one transportation company, a missed quarterly earnings report belies its underlying strengths, which give savvy investors a quality stock at a bargain price.

A Best-in-Class Transportation Company and Value Pick-Up

CSX Corporation (CSX) is a $76.6 billion freight railroad operating in the Eastern United States with more than 21,000 miles of railroad track. The company is headquartered in Jacksonville, FL.

The company reported an earnings miss for the first quarter of $0.93 per share compared to the analysts’ estimate of $0.95 per share. Revenues of $2.8 billion met expectations. However, annual EPS estimates remained largely unchanged.

Railroad companies are great economic indicators – a growing economy will have a busy freight rail business as goods and materials move across the map. The slight EPS miss for the first quarter does not imply that CSX isn’t doing well. If the company meets total annual estimates, even after the revision from the first quarter, it would translate into an 11% year-over-year gain in sales.

Despite the earnings miss, BMO Capital Markets upgraded its recommendation on the stock from “market perform” to “outperform” and raised the price target from $95 per share to $110 per share. The upgrade coming in right after the earnings report is a telling sign that CSX may not be a secret for much longer.

The Fundamental Basis

The stock trades at 28 times earnings compared to the railroad industry average of 30 times earnings.

Yet, it comes with a high long-term estimated EPS growth rate of 21%. That gives the stock a PEG ratio of less than 1.5 – a signal to investors that it may be trading in undervalued territory right now.

The stock also offers a 1.1% dividend yield, helping to protect investors against sustained downside movements while generating passive income.

The Technical Basis

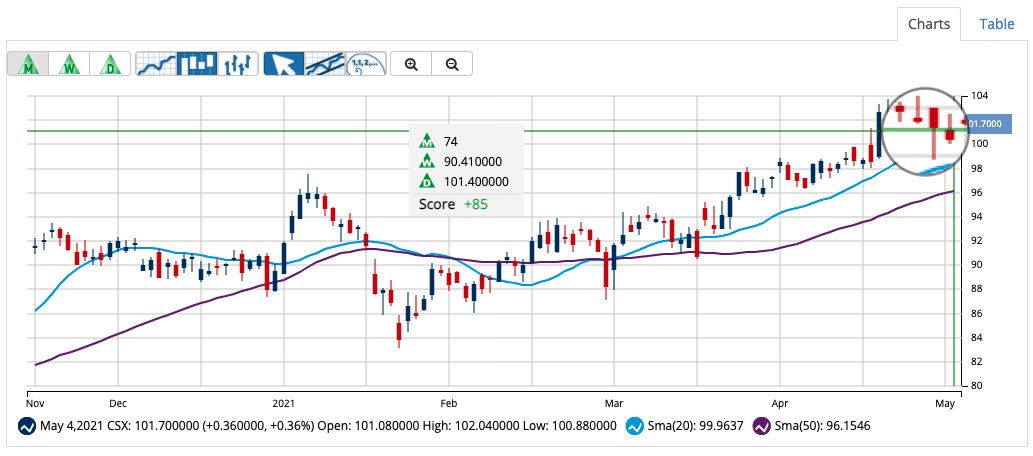

CSX’s stock chart reveals relatively muted volatility with a shallow but steady upward climb over several months.

The 20-day SMA crossed over the 50-day SMA in late February and has been forming a gap over time. It’s worth noting that a clear bullish hammer pattern in the candlesticks on April 29th – a strong signal that positive momentum is carrying the stock higher.

One potential red flag is the RSI reading of 61. Anything over 70 is considered an “overbought” signal, so investors will want to keep a close eye on the stock and buy on any pullbacks.

The Bottom Line

Based on CSX’s full-year EPS estimates, this stock should be fairly valued at around $110 per share. A move to this price would represent a gain of around 10% from its current price point.

For investors looking for high value with low risk, CSX is a great fit.

The above analysis of CSX was provided by financial writer Daniel Cross.

MarketClub’s Analysis of CSX

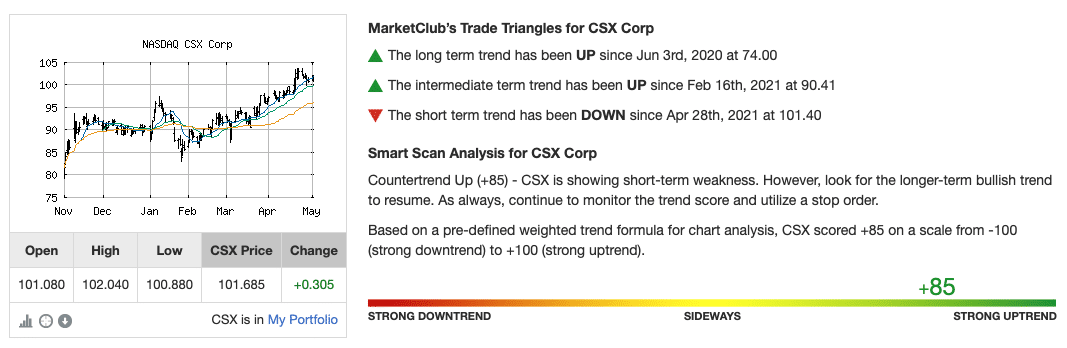

CSX is building strength to the upside based on MarketClub’s analysis.

A +85 Chart Analysis Score suggests that the stock is showing some short-term weakness. However, a long-term bullish trend is still in play for CSX.

MarketClub alerted members to a long-term trend on June 3, 2020, at $74. In a little less than a year, CSX climbed more than $27/share (37%).

Even better, the outlook remains strong for this transportation powerhouse.

If you’re not a MarketClub yet, start your 30-day trial and get daily updates on CSX and over 350,000 other markets!