Interconnected relationships define the market. Rising inflation is usually associated with rising commodity prices and an inverse correlation with stock and bond prices.

The latest inflation data shows the inflation rate at 5.3%. The 10-year Treasury yield is struggling to keep pace at just 1.36%. But for savvy investors who know where to look, that news translates into big profits.

Inflation and rising commodity values mean bigger profits and a higher stock price for this company, giving investors a solid way to play market volatility.

A World-Class Base Metals Manufacturer and Portfolio Darling

Alcoa Corporation (AA) is a $9.2 billion aluminum mining and manufacturing company and the world’s eighth-largest aluminum producer.

The company operates in 10 countries and is involved in the mining, refining, smelting, fabricating, and recycling of aluminum and alumina.

The company reported a second-quarter earnings beat of $1.49 per share compared to the analysts’ consensus of $1.37 per share. Revenues similarly came in higher than expected at $2.83 billion – improving year-over-year from $2.15 billion.

The biggest catalyst for Alcoa moving forward is the global economic growth story. Demand for industrial base metals is soaring – the company’s stock price YTD gain of 110% is a testament to that. Alcoa also plans on reopening its Brazil plant to meet surging demand.

Argus upgraded the stock earlier this month, bumping from a “neutral” recommendation to a “buy.” The company also published a price target of $58 per share.

The Fundamental Basics

The stock trades seemingly high at 35 times earnings compared to the aluminum industry average of 21 times earnings. However, Alcoa’s past 5-year EPS growth rate of 28% gives the stock a PEG ratio of less than 2. This EPS growth rate is a sign that the stock may still be trading at undervalued prices.

The stock also has a fairly low price-to-book ratio of less than 2.40, giving additional credence to its value stock claim.

The Technical Framework

Alcoa’s stock chart shows a strong upwards trend, with the 20-day SMA trending above the 50-day SMA. The 50-day SMA is also running above the 200-day SMA.

Based on Alcoa’s full-year EPS estimates, this stock should be fairly valued at around $56 per share. A move to this price would represent a gain of roughly 15% from its current trading price range.

Investors looking for a strong inflation hedge and an opportunity to take advantage of higher commodity prices won’t want to ignore Alcoa.

The above analysis of Alcoa Corporation (AA) was provided by financial writer Daniel Cross.

What’s Next for Alcoa (AA)?

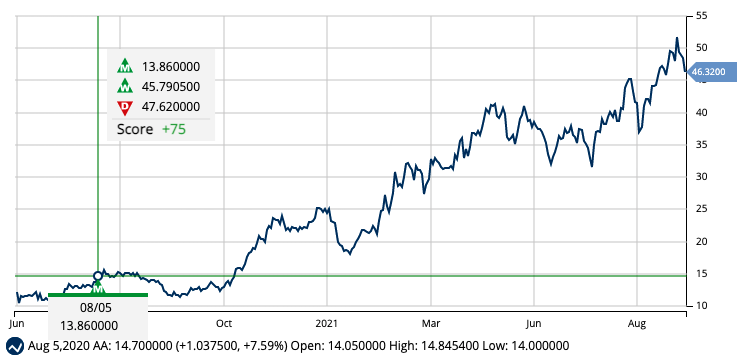

Alcoa has been on a run since MarketClub members received a green monthly Trade Triangle on August 5, 2020, at $13.86. The stock is up more than $32.14/share (231%).

The stock is experiencing short-term weakness, however AA is still in a bullish trend. With a Chart Analysis Score of +75, Alcoa could continue its upward trajectory.

What’s next for this base metals giant?

Join MarketClub to get the next signal for Alcoa (AA) and over 350K other stocks, ETFs, commodity, and mutual fund tickers.