Inflation is still a lingering worry for investors, but the global economic growth story is driving markets higher.

In addition, the recent spike in COVID infections put additional pressure on markets, but savvy investors can find a way to protect themselves and still profit from these market concerns.

A healthy dividend, attractive multiple, strong management, and an ability to leverage its brand to consumers make for a winning stock play for this drug retailer.

A Name-Brand Retailer and Healthcare Favorite

CVS Health Corporation (CVS) is a $112 billion healthcare and retail company known for its CVS pharmacy services. In addition to the pharmacy and retail store, the company also owns CVS Caremark, a pharmacy benefits manager, and Aetna, a health benefits provider.

The company reported a solid second-quarter earnings beat of $2.42 per share compared to the analysts’ expectations of about $2.06 per share. Revenues similarly beat estimates at $72.62 billion compared to $70.3 billion, while same-store sales climbed 12.3% from the same quarter last year. Following the earnings beat, management raised EPS expectations for FY2021.

Despite cost pressure, the company has managed to expand its retail segment, thanks in part to the fight against COVID. The company has been at the forefront of COVID vaccinations offering easy access for consumers. To date, they have administered 17 million vaccinations and performed over 6 million tests during the second quarter. The steady traffic also benefits CVS as consumers come in for their shots and take advantage of other available retail products that are available.

Since May, there hasn’t been any analyst coverage update, with Wells Fargo initiating coverage with an “equal weight” recommendation and an $89 price target.

The Fundamental Side

The stock trades relatively cheaply at just 11 times earnings compared to the average of 16 times of the drug retailers industry. The estimated long-term EPS growth rate of over 10% gives the stock a PEG ratio of close to 1 – a sign that it may be trading at undervalued prices.

Considering current low-interest rates, CVS’s dividend yield of 2.35% offers investors predictable income while also protecting against sustained downside movements.

The Technical Side

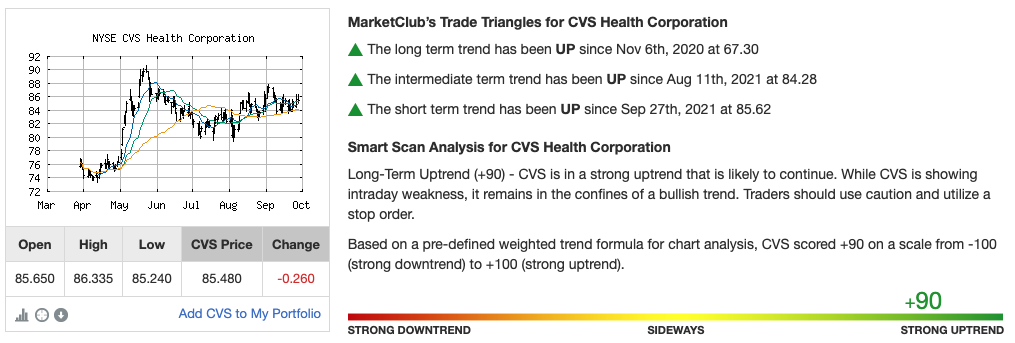

CVS’s stock chart shows some sideways trading over the past several weeks, but there are hints at future bullishness. The 20-day SMA is trending above the 50-day and 200-day SMAs, while the candlesticks show the early signs of strong positive investor activity.

The RSI of 54 isn’t close enough to an “overbought” signal just yet but has jumped up from 50 in just one trading day – another indication that the bulls are beginning to notice CVS.

The Bottom Line

Based on CVS’s full-year EPS estimates, this stock should be fairly valued at around $96 per share – a gain of roughly 13% from its current trading price.

Value and income-oriented investors will want to take a closer look at adding this stock to their portfolio as a defensive play with upside potential.

The above analysis of CVS Health Corporation (CVS) was provided by financial writer Daniel Cross.

Complete Technical Outlook for CVS

What’s the long-term outlook for CVS Health Corporation? Will the stock follow its overarching trend or make a quick reversal?

Get the next signal for CVS and analysis for over 350K markets with your MarketClub Trial.