Even the best trading strategy won’t work if you’re looking at the wrong stocks.

If you’re trading options, you need to avoid junk movers and focus on institutional-quality tickers. That means finding stocks with:

- a favorable trading history

- high liquidity

- strong-trending momentum

MarketClub’s Top Options List shows optionable stocks that met a threshold for volume, price, and momentum. And, this list is always changing as stock trends heat up or cool down. Get this daily Top Options List on us!

Today’s 10 Top Stocks for Trading Options

The following stocks were featured on our Top Options List on August 20, 2020.

These stocks met our criteria for liquidity, trend strength, and price. The stocks on this list may change quickly, so be sure to sign up for our daily list for regular updates.

Tesla, Inc. (TSLA)

Tesla focuses on sustainable energy by developing, manufacturing, and selling electric cars, solar panels, and energy generating and storage systems.

This California-based powerhouse has four consecutive earnings beats and is set to report its Q3 EPS towards the end of October. TSLA is trading at an all-time high and is carrying significant momentum and it rockets up the chart.

| Avg. Volume | 11,699,330 |

| Chart Analysis Score | +90 |

| Last Monthly Trade Triangle | 10/24/19 @ $266.07 |

Zoom Video Communications, Inc. (ZM)

Zoom is a video communications platform that allows people from around the world to connect. Users can join a meeting from various devices for a number of professional, personal, or educational purposes.

While the company was growing brand awareness through 2019, the coronavirus-related work-from-home shift was the catalyst that propelled the company over 200 million daily meeting participants.

ZM is trading at a new all-time high. The Chart Analysis Score of +100 indicates that the stock remains in a firm bullish trend.

| Avg. Volume | 13,186,605 |

| Chart Analysis Score | +100 |

| Last Monthly Trade Triangle | 1/16/20 @ $78.48 |

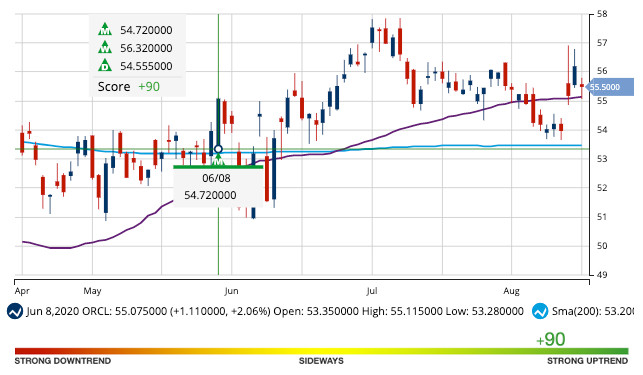

Oracle Corporation (ORCL)

Oracle is a technology company that provides cloud services and cloud-based applications to global customers. The applications help companies manage their supply chain, human capital management, and enterprise resource planning (ERP).

Oracle has three-consecutive earnings beats and has just been given the nod to pursue a buyout of TikTok’s U.S. business.

| Avg. Volume | 11,384,627 |

| Chart Analysis Score | +90 |

| Last Monthly Trade Triangle | 6/8/20 @ $54.72 |

eBay Inc. (EBAY)

Once a household name, eBay has made a quiet comeback in the world of marketplace platforms. Its platform allows sellers (individuals, distributors, or liquidators) to list, sell, and collect payment for individual buyers.

eBay is trading at an all-time high, jumping over the $50/share market in late June. The company is expected to grow 10.60% over the next year.

| Avg. Volume | 12,040,025 |

| Chart Analysis Score | +90 |

| Last Monthly Trade Triangle | 4/24/20 @ $39.25 |

Alcon Inc. (ALC)

Alcon is a healthcare company headquartered in Switzerland. This company researches, develops, manufactures, distributes, and sells eye care products to industry partners.

The company reported $0.14 EPS for Q2 2020, 50% below the analysts’ $0.21 estimate. While the company is projecting healthy growth over the next year, ALC’s trend points to a strong move lower.

| Avg. Volume | 1,532,177 |

| Chart Analysis Score | -100 |

| Last Monthly Trade Triangle | 3/11/20 @ $54.81 |

Elastic N.V. (ESTC)

Elastic N.V. is a California-based technology company that enables users to search through structured and unstructured data. The company offers a number of software products that analyze data to create visualizations for B2B and B2C consumption.

Elastic has consistently smashed earnings estimates and reported steady revenue growth, catching the eye of analysts from Citigroup, Bank of America, and Jefferies.

ESTC remains in the confines of a strong bullish trend.

| Avg. Volume | 1,999,068 |

| Chart Analysis Score | +100 |

| Last Monthly Trade Triangle | 5/21/20 @ $77.28 |

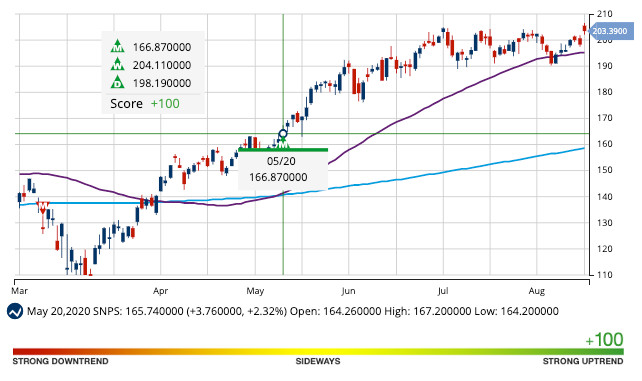

Synopsys, Inc. (SNPS)

This technology company provides software products used to design and test circuits.

Synopsys reported earnings this week and once again beat analysts’ estimates. SNPS is in a strong uptrend with a +100 Chart Analysis Score.

| Avg. Volume | 1,108,210 |

| Chart Analysis Score | +100 |

| Last Monthly Trade Triangle | 5/20/20 @ $166.87 |

Microchip Technology Inc. (MCHP)

Microchip Technology is a U.S.-based semiconductor company that develops, manufactures, and sells microcontrollers and microprocessors.

Microchip’s stock took a massive tumble in late-February, dropping more than 52% in 25 trading days. The stock has since rebounded back to the $100/share level and continues to hold bullish momentum.

| Avg. Volume | 4,081,247 |

| Chart Analysis Score | +90 |

| Last Monthly Trade Triangle | 6/3/20 @ $99.24 |

Consolidated Edison, Inc. (ED)

Consolidated Edison, Inc., founded more than 100 years ago, engages in regulated electric, gas, and steam delivery to customers in the United States.

Throughout 2020, ED’s price has fallen into the $70-75/share range. Strengthening bearish momentum, indicated by a -90 Chart Analysis Score, suggests that Consolidated Edison’s stock price may continue to drop.

| Avg. Volume | 1,962,502 |

| Chart Analysis Score | -90 |

| Last Monthly Trade Triangle | 2/27/20 @ $85.47 |

The Travelers Companies, Inc. (TRV)

Through subsidiaries, The Travelers Companies, Inc. provides a range of insurance products for commercial and personal property. The company operates through its business insurance, bond and specialty insurance, and personal insurance segments.

Travelers’ CFO Dan Frey reported on a conference call that the company does “expect to experience the impacts of economic disruption,” while the duration and severity of the impact are still unknown.

Investors saw a short run on TRV through May of 2020. However, the stock remains in a strong bearish trend and the price could continue to fall.

| Avg. Volume | 2,403,351 |

| Chart Analysis Score | -100 |

| Last Monthly Trade Triangle | 10/2/19 @ $142.79 |

Finding strong optionable stocks is easy with our Top Options List.

Our scanning tools look past the junk to find quality stocks with the volatility needed to produce meaningful options gains. Free access to this Top Option List is only a click away.