There’s an old saying investors like to use – “when everyone is digging for gold, be the one selling shovels.” In other words, don’t buy into the fad but pay attention to the businesses critical to supporting it.

As the economy recovers and businesses resume their normal day-to-day operations, it means that the supply chain and transportation industry should be ready for a steady recovery.

For one transportation company, a return to business as usual could mean a big return for investors.

A Critical Supply Chain Component and Undervalued Stock

Old Dominion Freight Line (ODFL) is a $22.15 billion trucking and transportation company with regional, inter-regional, and national LTL services. It also provides logistics services, supply chain consulting, truck-load brokerage, and more. The company currently operates 5,800 semi-tractor trucks and more than 22,500 trailers.

The company reported a second-quarter earnings beat of $1.25 per share compared to the analysts’ estimates of $1.08 per share. It represents a 15.5% drop year-over-year. With the coronavirus pandemic, management expected this drop in revenue. Despite the news, the company was upbeat regarding the third and fourth quarter expectations citing improved efficiencies.

As the global economy begins to get back on track following the COVID-19 pandemic, Old Dominion anticipates renewed demand for LTL services. Relatively low fuel prices have also been a positive note for the company, reducing operating expenses and even allowing it to pay out a small dividend to investors.

Cowen reiterated its “market perform” recommendation in early September but bumped the price target up from $168 per share to $184 per share. Wells Fargo initiated coverage on the stock, giving it an “equal-weight” recommendation and a $192 per share price target.

The Fundamental Basics

The stock trades at 37 times earnings – slightly higher than the trucking industry average of 30 times earnings. However, the stock comes with an estimated long-term EPS growth rate of around 23% compared to the industry average of just 10%. That gives the stock a PEG ratio of less than 2 and signals to investors that the stock may still be undervalued.

The Technical Basis

Looking at Old Dominion’s stock chart, investors will notice a dip over the past couple of weeks, although the 20-day SMA is still trending above both the 50-day and 200-day SMA.

The candlestick chart shows a clear uptrend of positive trading days throughout last week, while the RSI rating of about 40 indicates that the stock still has plenty of upside potential as we head into the latter half of 2020.

The Bottom Line

Based on Old Dominion’s full-year EPS estimates, this stock should be fairly valued at around $205 per share. A move to $205 would mean a gain of more than 12% from its current trading price.

For investors wanting to take advantage of economic growth going into 2021, Old Dominion looks like a significant opportunity.

The above analysis of ODLF was provided to MarketClub by Daniel Cross, professional trader and financial writer.

MarketClub’s Analysis of ODFL

The recent pullback for ODLF has thrown the stock out of the strong bullish trend that it establish in May of 2020.

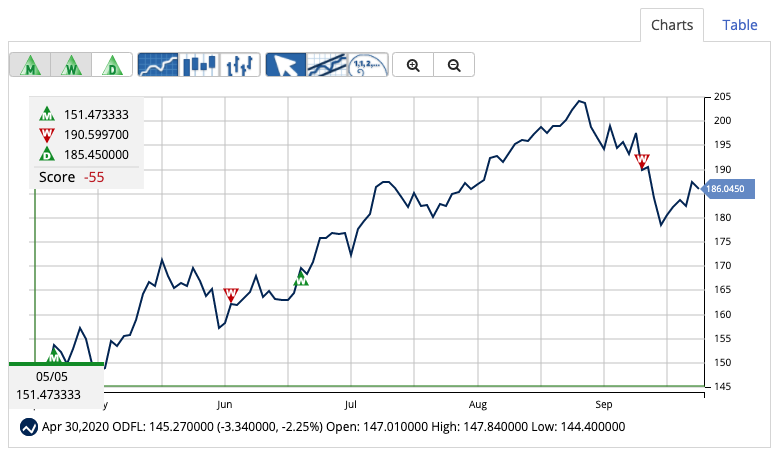

MarketClub members following the long-term signals may still be in a long position. A new monthly Trade Triangle hit on the chart on May 5, 2020, at $151.47 and the stock is up 22% since.

ODFL will need to build a bit more momentum before the stock moves into strong-trending standing once again.

MarketClub members will look for a new weekly Trade Triangle if they want to take positions that match the long-term trend.

Want the next weekly Trade Triangle?

Start your 30-day trial to get this signal and signals for over 350K stocks, ETFs, futures, and forex symbols.