Despite short-term volatility, many stocks are still making a strong run to all-time highs.

For example, this year alone, Costco Wholesale Corp. (COST) is up 21%, Innovative Industrial Properties (IIPR) is up 64%, and Pinterest, Inc. (PINS) is up a whopping 119%.

It’s easy to look at a chart’s price action and think you’ve missed the boat. After a 25% gain in 3 months, is there more? If a stock has positive price action for fifty consecutive trading days, isn’t a correction imminent?

It’s easy to walk away from strong movers thinking it’s too late.

However, the Trade Triangle technology spots when a stock pulls back, rebuilds momentum, and then moves back in the direction of its longer-term trend.

3 Stocks with New Entry Signals

A new weekly Trade Triangle has just triggered for these three stocks. While these stocks have made steady gains in 2020, a new signal reconfirms the bullish trend and the potential for further gains.

Depending on members’ trading strategy, these signals could be used as a bullish reentry signal.

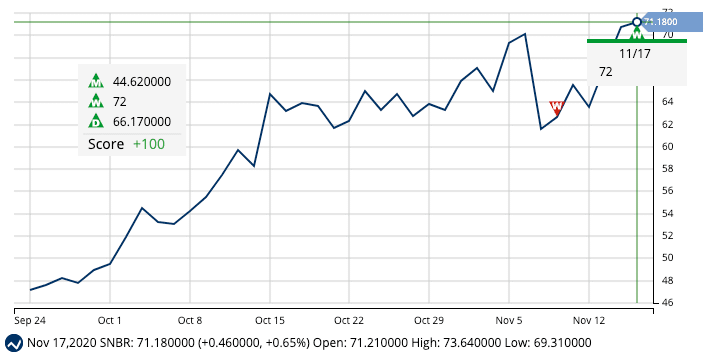

Sleep Number Corporation (SNBR)

Headquartered in Minnesota, this company provides sleep solutions and services in the United States. While known for its adjustable base system, the company also designs, manufactures, and sells beds, pillows, sheets, and other bedding products.

| Avg. Volume | 436,544 |

| Chart Analysis Score | +100 |

| Last Monthly Trade Triangle | 7/6/20 @ $44.62 |

| New Weekly Trade Triangle | 11/17/20 @ $72 |

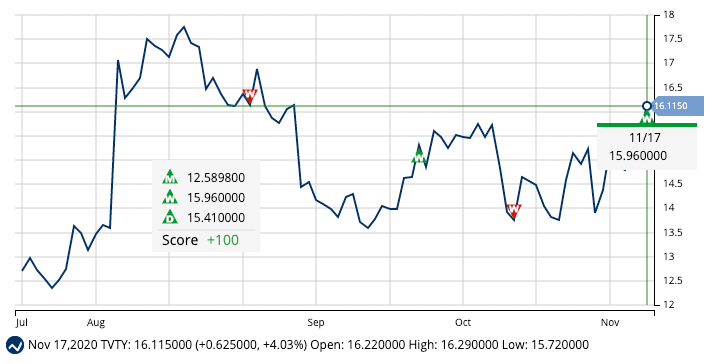

Tivity Health, Inc. (TVTY)

This company provides fitness, nutrition, and social connection solutions in the United States through two segments: healthcare and nutrition. The company was upgraded by Cantor Fitzgerald on November 17, 2020, from neutral or overweight.

| Avg. Volume | 540,823 |

| Chart Analysis Score | +100 |

| Last Monthly Trade Triangle | 7/15/20 @ $12.58 |

| New Weekly Trade Triangle | 11/17/20 @ $15.96 |

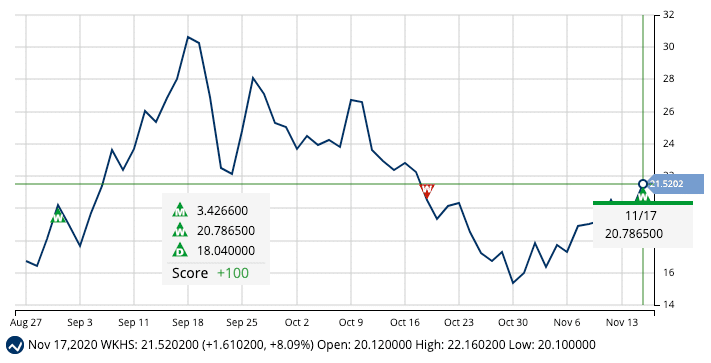

Workhorse Group Inc. (WKHS)

Workhorse is a technology company that designs, manufactures, builds, and sells electric vehicles in the United States. The company also provides performance monitoring systems for fleet vehicles to improve energy and route efficiency.

| Avg. Volume | 23,455,989 |

| Chart Analysis Score | +100 |

| Last Monthly Trade Triangle | 6/5/20 @ $3.42 |

| New Weekly Trade Triangle | 11/17/20 @ $20.78 |

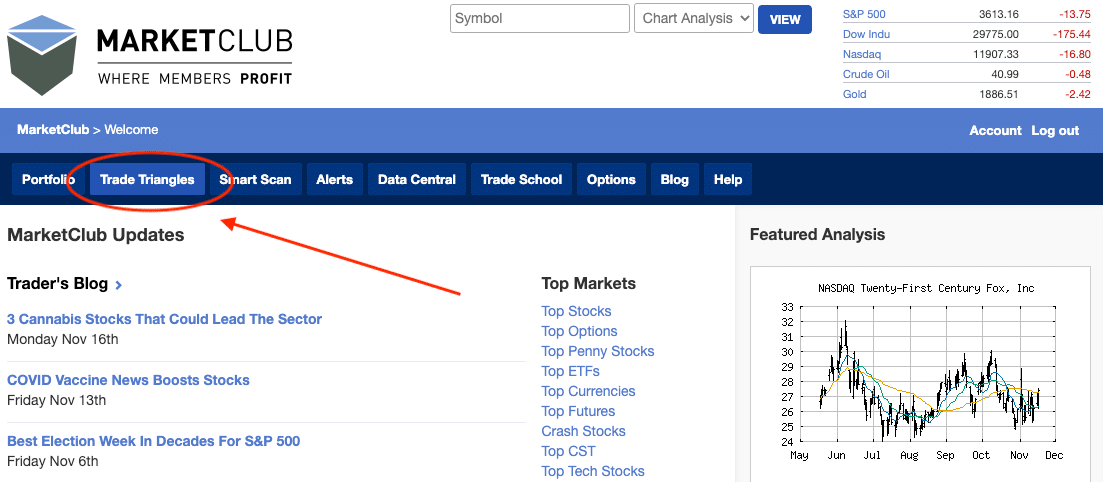

See The New List of New Weekly Trade Trade Triangles

Every minute of the day, MarketClub is detecting new trends.

Members can see an up-to-the-minute list of new weekly Trade Triangles by clicking the Trade Triangles button on the top menu.

Not a member and want instant access to this list?