President Biden’s $1.9 trillion economic injection should help boost market liquidity and send markets higher.

And while the general sentiment is positive, there are still a few sectors that stand to gain more than others – sectors like information technology.

For one IT services company, the positive market sentiment and healthier economic direction mean more significant profits for both the company and savvy investors.

A Brand Name Company and Value Pick-Up

Accenture Plc (ACN) is a $163 billion information technology services company based in Ireland that sells consulting and processing services.

The company reported a first-quarter earnings beat of $2.17 per share, compared to the analyst consensus of $2.05 per share.

With second-quarter earnings set to be released later this month, investors are optimistic about its results.

The most significant catalyst for the company is the new paradigm of increased online business practices.

Businesses are preferential to having their needs met virtually or online. From cybersecurity to cloud computing services, Accenture is the ideal company to meet the growing digital needs of the global economy.

One of the other catalysts that could send Accenture soaring even higher is the implementation of artificial intelligence (AI) software.

This innovative technology is still in its infancy and, when fully implemented, could be a harbinger of bigger profits for technology companies.

Susquehanna upgraded ACN in March from a “neutral” to a “positive” recommendation and boosted the price target from $267 to $290 per share.

The Fundamental Case

The stock trades at 31 times earnings, coming in slightly lower than the professional business support industry average of 40 times earnings.

The 15% long-term EPS growth rate gives it a PEG ratio of about 2 – a sign that the stock may currently be trading at undervalued prices.

It comes with a small dividend yield of 1.40%, which gives investors some measure of downside protection. And the 40% dividend payout ratio ensures that investors are getting a safe dividend that will likely increase down the road.

The Technical Case

Accenture’s chart shows some degree of recent volatility and a general sideways trend. However, there are some positive highlights to note.

The 20-day SMA is now running parallel to the 50-day SMA and should cross over later this week. That could signal a more substantial and sustained rally in the stock. With the RSI at around 45, the stock is closer to being oversold right now, which could add even more momentum in the future.

The Bottom Line

Based on Accenture’s full-year EPS estimates, this stock should be fairly valued at around $280 per share – a gain of about 12% from its current trading price range.

Investors looking to take advantage of the online trend in business practices will want to take a closer look at this under-appreciated value stock.

The above analysis of ACN was provided by financial writer Daniel Cross.

MarketClub’s Analysis of ACN

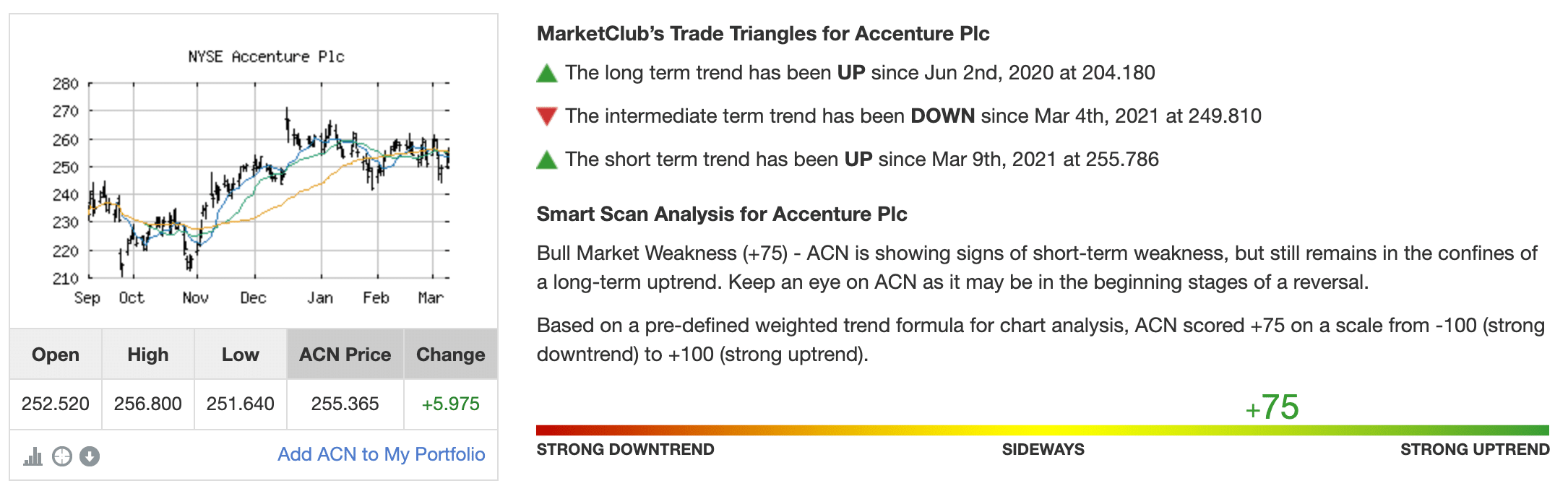

The recent price action for ACN suggests that the stock is experiencing bull market weakness. With a +75 Chart Analysis Score, the stock is showing signs of short-term weakness, but the stock remains in the confines of a long-term uptrend.

ACN has moved more than 25% since members received a long-term, monthly Trade Triangle on June 2, 2020, at $204.80.

However, MarketClub’s analysis indicates that ACN could be in the beginning stages of a reversal. Members will want to watch the Chart Analysis Score or set an alert for a trend shift warning.

Not a member and want to see the signals, alerts, and trend momentum score for ACN?

Join MarketClub and test our tools for thousands of U.S. and Canadian stocks, futures, forex, ETFs, and mutual fund markets.