What is it about penny stocks that drive traders wild and how can you find the best plays?

While they are far riskier than their bluechip counterparts, penny stocks allow traders to purchase large blocks of shares with minimal funds. If a stock musters up the momentum and moves only a few cents, the payoff could be significant.

While traders will want to approach penny stocks with caution, it doesn’t mean that big profits aren’t waiting on the other side of a penny stock trade.

These speculative favorites can offer big returns for traders that know what to look for.

What Is a Penny Stock Anyway?

According to the Securities and Exchange Commission (SEC), a penny stock is a share of a company with a current price under $5.

These stocks tend to have low liquidity, high volatility, and most trade to the side of the major exchanges (like on the pink sheets or over-the-counter bulletin board).

The term penny stock does not consider the market capitalization, just the current market price of the outstanding share. Many people associate a penny stock with a micro-cap stock. However, the term micro-cap considers the company’s market capitalization, not necessarily the share price.

Stocks that trade aside the major exchanges like the NYSE and NASDAQ are exempt from filing with the Securities and Exchange Commission (SEC) and are not closely investigated like their Wall Street friends.

How to Analyze Penny Stocks

Since pink sheet and OTC companies are not required to report to the SEC, it may be impractical to rely on fundamental analysis to make decisions.

Even if you look at traditional fundamental figures like annual sales or earnings per share, it doesn’t mean they are accurate or that the information will be readily available. On top of this, penny stocks are susceptible to fraud and pump and dumpers who push press releases and campaigns to jack up the share price before the big players sell off shares.

Many traders use technical analysis to trade penny stocks in place of a fundamental approach.

Technical analysis uses statistical trends to forecast future price direction by evaluating changes and patterns in price and volume. This type of analysis values the stock price’s movement itself and not the company’s quantitative or qualitative qualities.

How to Find Strong Penny Plays

The word “best” may carry different meanings from one penny stock trader to the next.

Maybe best means the company with the best potential to graduate to a major exchange. But at MarketClub, we think the best penny stock is one with the most technical potential to increase in price, rewarding shareholders.

High-quality penny stocks should have strengthening momentum, substantial volume, and price changes that point to climbing price.

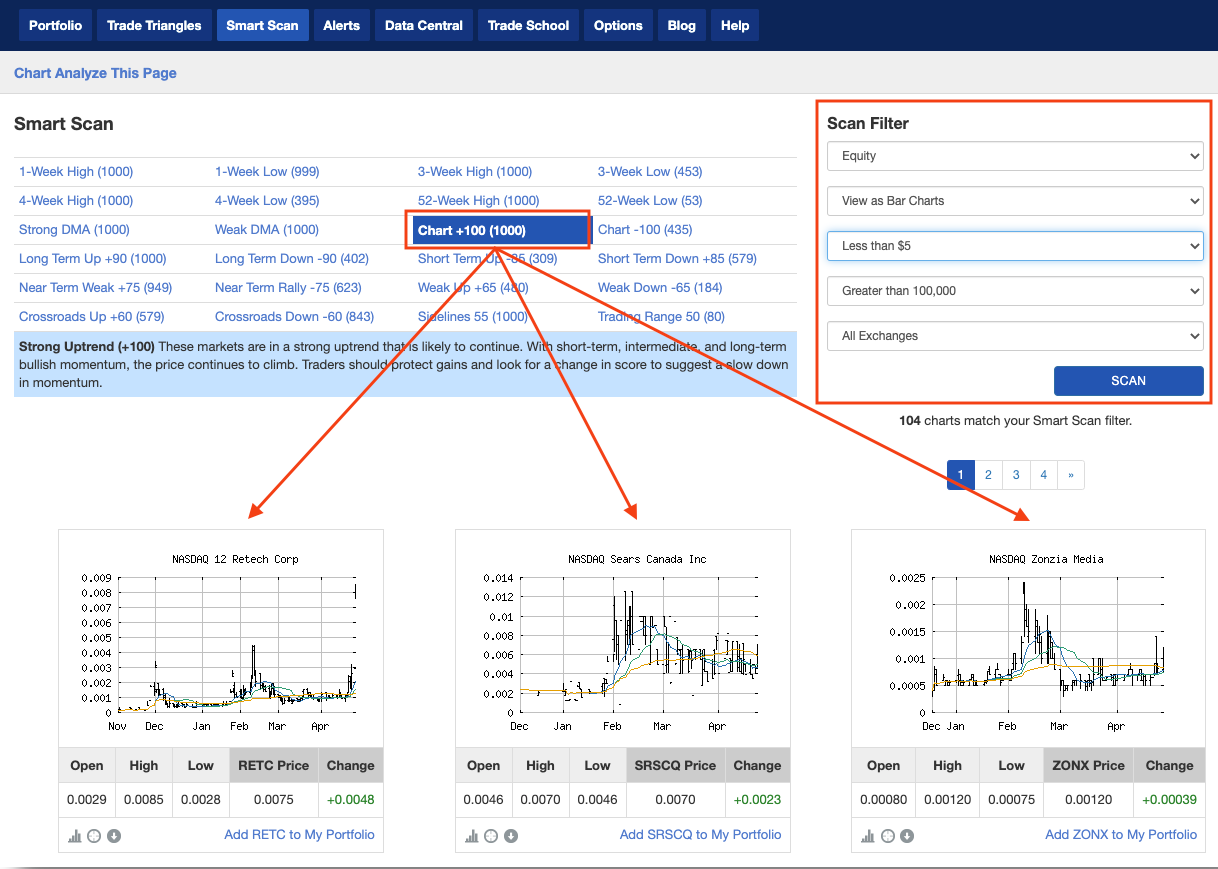

MarketClub members can use the Chart +100 Smart Scan to identify the strongest penny stocks at any moment.

When used with the penny stock filters, this powerful scan will return the stocks under $5 with the short-term, intermediate, and long-term bullish momentum.

Suggested Filters for +100 Chart Analysis Scan – Top Penny Stocks

- Select “Chart +100” from the scan list.

- Set Filters

- Equity

- View as Line Chart

- Price Less Than $5

- Volume Greater Than 100,000

- U.S. Exchanges

- Hit SCAN

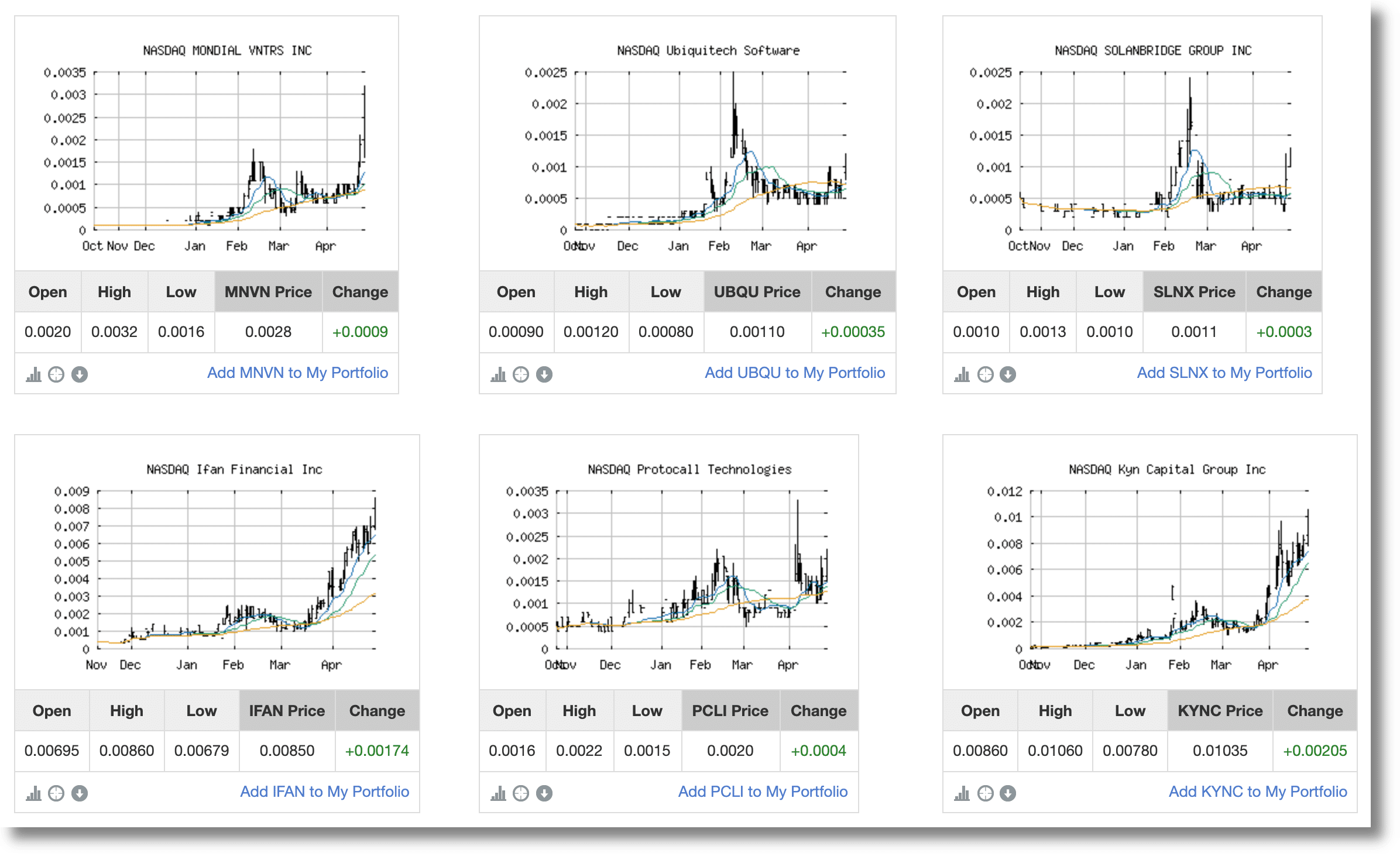

MarketClub’s Smart Scan will crank out a condensed list of the strongest penny stocks with charts that match bullish technical trends.

Once you peek at these charts, add them to your watch list. Then, set an alert to receive a message when a new Trade Triangle is issued or when the trend begins to reverse.

Our powerful screen quickly reviews thousands of penny stocks every moment to find the most robust trading opportunities.

From the strongest penny stocks to new finds, we make technical analysis quick and easy!

Join MarketClub to get an updated list of the best penny stocks by technical strength.