When you think of a defensive stock, a technology company is probably the last place you’d go. Traditionally, the technology sector has been home to aggressive growth stocks with high earnings, and large swings in volatility. But as technology becomes more essential for everyday business, tech companies start to change into a more defensive economic…

Buy Alert for JELD-WEN Holdings (JELD)

Our Trade Triangle technology just issued a new buy alert for JELD-WEN Holding, Inc. (NYSE_JELD) today, February 19, 2019. JELD-WEN Holding, Inc. manufactures and sells doors and windows primarily in North America, Europe, and Australia. Our last long-term signal suggested that members short JELD on 2/21/18 at $34.05. Today’s monthly Trade Triangle would signal members to…

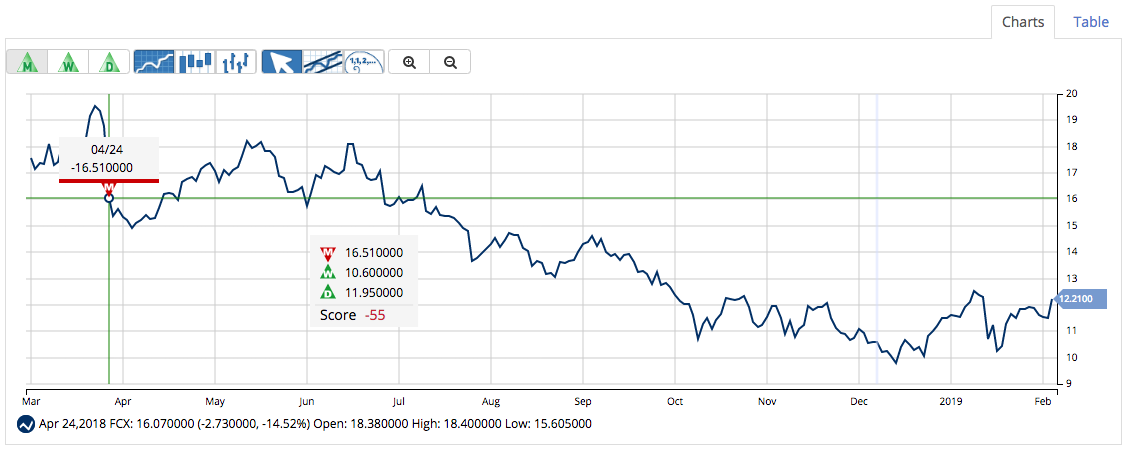

Mining Giant Is Too Cheap to Ignore

It may be counter-intuitive to declare a stock near its 52-week low as an opportunity, but some of the best value stocks are found this way. But having a low stock price alone isn’t enough of a reason to buy – it needs to have the right combination of technical and fundamental signals to tell…

New Buy Signals for NKTR, NSP, and ARWR

The Trade Triangle technology just issued new buy signals for 3 high volume, well-known stocks. Our technology has alerted members of these major trend shifts which propel these stocks into levels of great trend strength. Buy Signal for Nektar Therapeutics (NASDAQ_NKTR) Nektar Therapeutics, a research-based biopharmaceutical company, discovers and develops drug candidates for cancer, auto-immune…

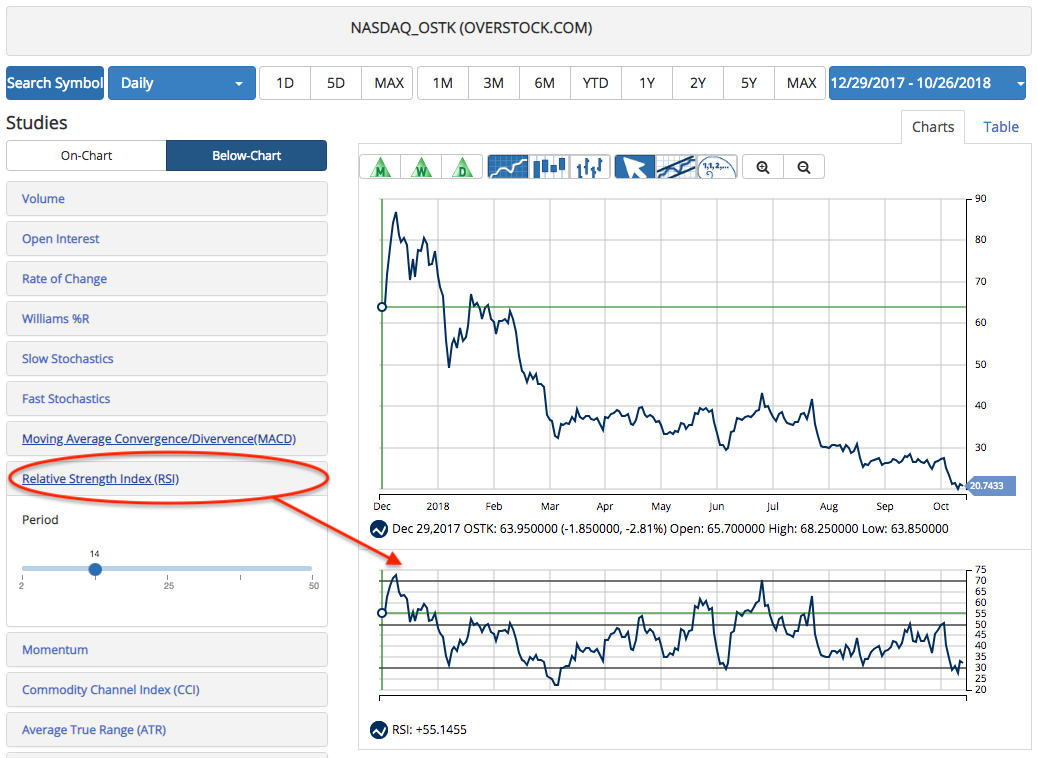

Beginner’s Guide to RSI

Relative Strength Index (RSI) is widely-used momentum oscillator measures the strength and speed of a market’s price movement by comparing the current price of the security against its past performance. Developed by J. Welles Wilder in the 1970s, the RSI can be used to identify overbought and oversold areas, support and resistance levels, and potential…

Large-Cap Pharma Stock Ready For Breakout

In general, large-cap stocks don’t experience a lot of movement over a relatively short period. They are too big to be easily impacted by changes in the economic cycle. As such, investors usually see them as somewhat defensive regardless of their sector. Momentum, whether positive or negative, is a powerful thing. The larger the company,…

10 Hot Stocks for February

MarketClub’s Trade Triangle and scoring technology have cranked out the strongest stocks for February 2019. Our technology has verified that these stocks have strong short-term, intermediate, and long-term trends with the support to continue their upward trajectory. Remember, the markets move fast and things may quickly change for these stocks. Our MarketClub members have access…

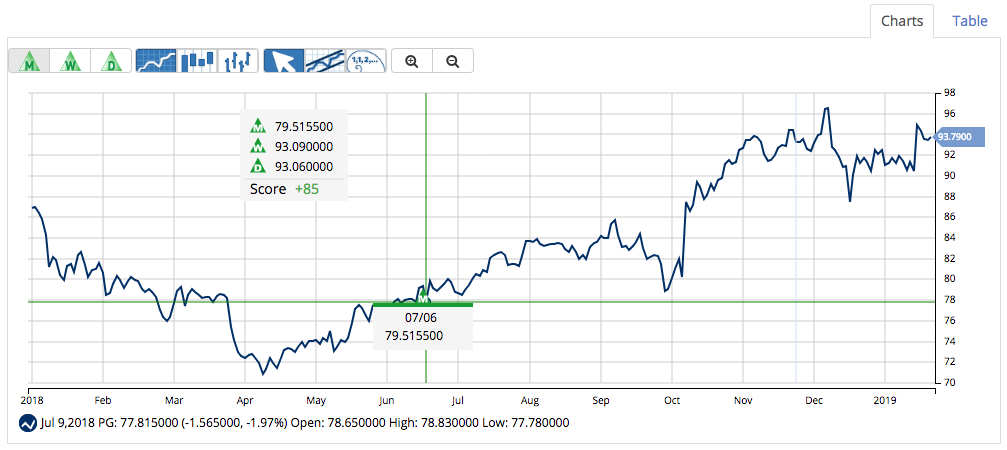

This Portfolio Staple is Building Momentum

Investors are looking anywhere and everywhere for the markets to give them some kind of clear signal… Should they go back to being bullish, or hedge against a bear market taking over this year? Guessing which direction the economy will head towards right now could lead investors around in circles with no more certainty than…

It’s All About Market Patience

One of my all-time favorite sayings is “money saved is money earned.” After such a volatile end to 2018, many of our MarketClub members were stopped out of trades by the Trade Triangles. While many traders dislike being on the sidelines (me included), they were very happy to exit before their year’s gains were wiped…

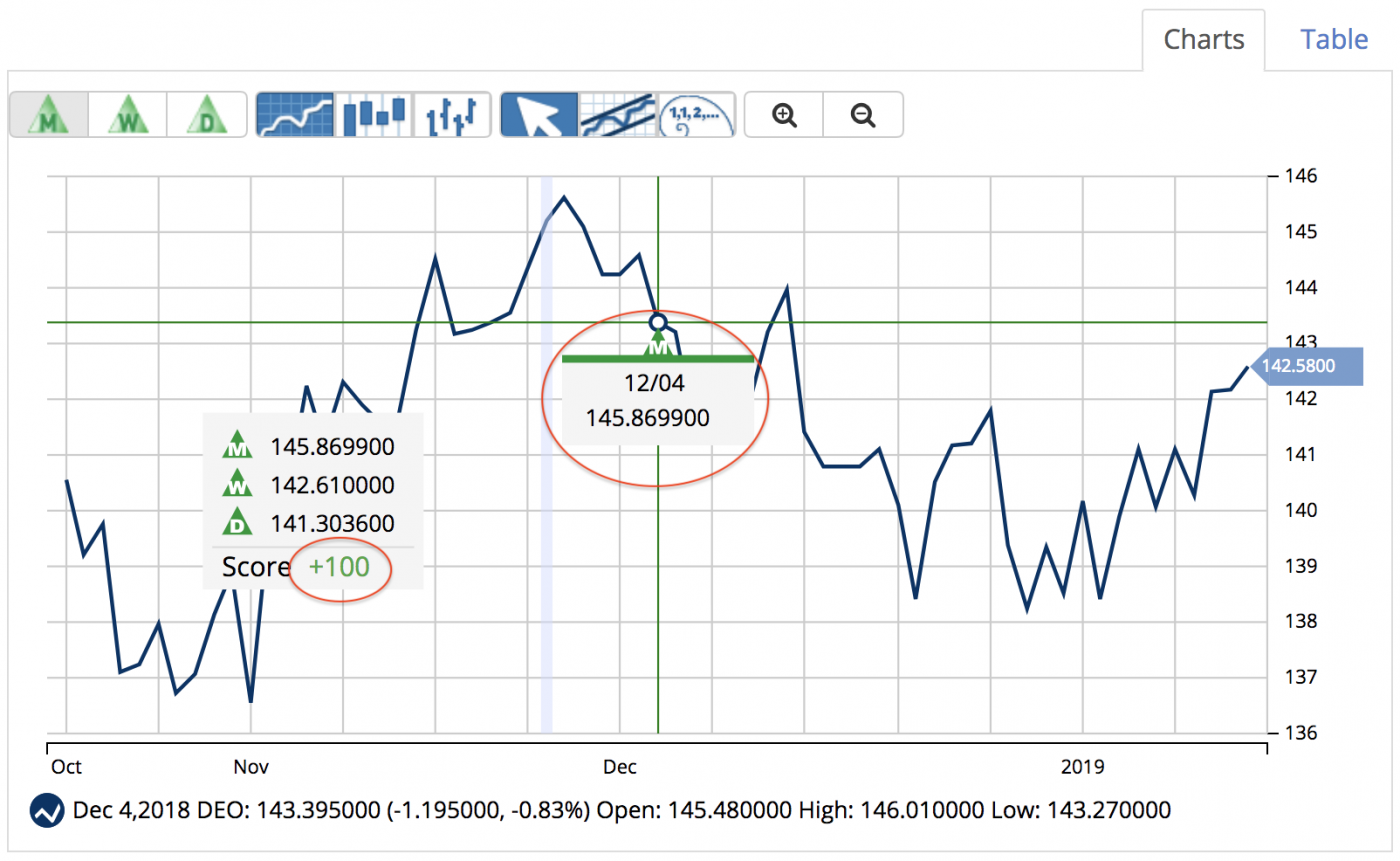

Sin Stock with a Buy Signal

Defensive stocks are the first thing most investors turn to when market uncertainty begins to climb. While sectors like utilities, healthcare, and consumer staples may top the list of choices, there’s another industry that can go unnoticed – ‘sin’ stocks. ‘Sin’ stocks are named such due to the nature of their business – generally casinos…