The markets were very erratic last week with early (but not super reliable) signs of trouble.

Between trade war tensions, the 2-year Treasury yield moving above the 10-year Treasury, and an 800 point sell-off on August 14th, investors were left on the edge of their seats going into this week.

It’s not going to be a quiet week for Wall Street and here are the 5 things you should know.

#1 – Awaiting Earnings

Some of the most well-known stocks are scheduled to announce earnings this week.

A massive Chinese technology company, a high-end furniture company, and a do-it-yourself retailer – you’ll find reports from each end of the sector spectrum.

Monday, August 19, 2019

| Stock | Symbol | EPS Estimate | MarketClub Rating | Entry Signal Report |

| Baidu, Inc. | BIDU | $0.87 | -75 | Report For BIDU |

| Insys Therapeutics | INSY | -$0.15 | -90 | Report For INSY |

Tuesday, August 20, 2019

| Stock | Symbol | EPS Estimate | MarketClub Rating | Entry Signal Report |

| Kohls Corp | KSS | $1.53 | -75 | Report For KSS |

| Home Depot | HD | $3.08 | +55 | Report For HD |

Wednesday, August 21, 2019

| Stock | Symbol | EPS Estimate | MarketClub Rating | Entry Signal Report |

| Target Corp. | TGT | $1.62 | +75 | Report For TGT |

| Synopsys, Inc. | SNPS | $1.10 | +55 | Report For SNPS |

Thursday, August 22, 2019

| Stock | Symbol | EPS Estimate | MarketClub Rating | Entry Signal Report |

| 58.com | WUBA | $0.79 | -75 | Report For WUBA |

| Salesforce.com, Inc. | CRM | $0.47 | -75 | Report For CRM |

Friday, August 23, 2019

| Stock | Symbol | EPS Estimate | MarketClub Rating | Entry Signal Report |

| Williams-Sonoma, Inc. | WSM | $0.83 | +55 | Report For WSMA |

| Foot Locker Inc. | FL | $0.67 | -75 | Report For FL |

#2 – Major Signals Issued

Within the last 3 trading days, the major trends have shifted for a number of stocks, futures, forex, and mutual funds.

These reversals, spotted by our Trade Triangle technology, confirm strong-aligning trends with momentum.

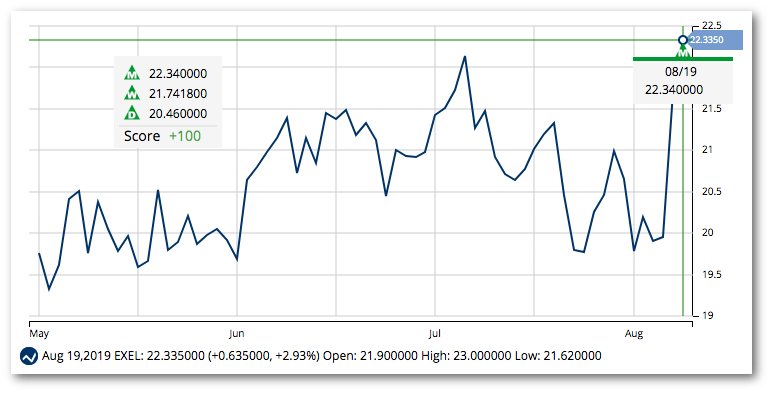

Exelixis, Inc.

A monthly Trade Triangle just confirmed a trend shift for Exelixis, Inc. (EXEL), an oncology-focused biotechnology company.

After hitting a 6-month high on March 14, 2019, at $24.76, EXEL fell below $19. Our system flagged a change in bullish trend shift at $22.34 on August 19, 2019.

DryShips Inc.

DryShips Inc. owns and operates ocean-going cargo vessels worldwide.

After our Trade Triangles spotted a bullish trend in March of 2019, DRYS continued to fall, hitting a 1-year low of $3.15 on June 10, 2019.

Our technology has been waiting for signs of a reversal for DRYS. That reversal was spotted on August 19, 2019, at $4.50 and a bullish signal was issued.

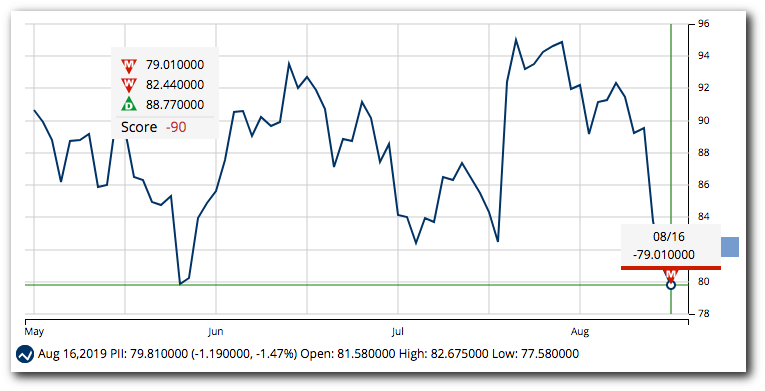

Polaris Industries, Inc.

Polaris, known for designing and engineering power sports vehicles, just shifted into a long-term bear market according to the Trade Triangle technology.

PII has been choppy in 2019, bouncing between support and resistance at the $79.60 and $93.96 levels respectively.

However, market action was flagged on August 16, 2019 and a new bullish signal was issued.

MarketClub members can find a list of stock, ETFs, mutual funds, or futures markets with new major trend signals anytime by using the Recent Trade Triangle scan – click here if you’re a member and we’ll take you to today’s list.

#3 – Big Events & Reports

| Report | Release Date & Time (ET) | See Report |

| Q2 Retail E-Commerce Sales | 8/19/19 – 10 AM | See Q2 2019 Report |

| Retail Economist/Goldman Stocks Weekly Chain Store Sales Index | 8/20/19 – 7:45 AM | Understanding The Store Sales Index |

| Johnson Redbook Retail Sales Index | 8/20/19 – 8:55 AM | Locate Redbook Report |

| MBA Weekly Mortgage Applications Survey | 8/21/19 – 7:00 AM | Mortgage Bankers Association Newsroom |

#4 – Notable Headlines

Weekly Mortgage Refis Spike 37%

A drop in interest rates for 30-year fixed-rate mortgages lead to a double-digit jump in refinance volume as homeowners raced to lower their monthly payments. Read More

London Stock Exchange Goes Dark

For more than 90 minutes on Friday, August 16, 2019, investors were unable to access stocks traded on the FTSE 100 or FTSE 200. This outage comes a little more than a year after the system was slow to start, delaying the trading day by one hour. Read More

Buffett Boosts Stake in Amazon (AMZN)

On Wednesday, August 14, 2019, Berkshire Hathaway increased its stake in Amazon. According to a regulatory note, Berkshire Hathaway’s total investment in AMZN exceeds $1 billion. Read More

#5 – Strongest Markets Trends Starting The Week

| Name | Symbol | MarketClub Rating |

| JD.com, Inc. | JD | +100 |

| Aramark | ARMK | +100 |

| DryShips, Inc. | DRYS | +100 |

| Roku, Inc. | ROKU | +100 |

| CVS Health Corp | CVS | +100 |

| Symantec Corp | SYME | +100 |

| Walmart, Inc. | WMT | +100 |

| Medtronics Plc | MDT | +100 |

| SPDR Select Sector Fund – Utilities | XLU | +100 |

| Vanguard Short-Term Bond ETF | BSV | +90 |

| iShares US Real Estate ETF | IYR | +100 |

| iShares Global REIT | REET | +100 |

| Invesco S&P 500 Low Volatility ETF | SPLV | +90 |

| Vanguard Short-Term Bond ETF | BSV | +100 |

| EURODOLLAR Nov 2019 | GE.X19 | +100 |

| 1 MONTH SOFR | SR1.Q19 | +90 |

What You Need To Know Every Day

MarketClub is the place for daily analysis, entry and exit signals, top market lists with the strongest opportunities, report calendars, headlines, and more.

Join MarketClub now to starting using our…

- Trade Triangles – Know when to buy, sell, or sit on the sidelines.

- Smart Scan – Quickly find winning trades in any market.

- Email Alerts – Never miss a move for any portfolio symbol.

- Portfolio Manager & Interactive Charts

- Plus More